Xoom vs Currencies Direct: Which International Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-15 14:44:03.0 10

Introduction

Cross-border money transfers are essential in today’s global economy, but users often face high fees, slow delivery, hidden charges, and complicated processes. Xoom and Currencies Direct are popular platforms offering international transfers via mobile apps and multiple payment options. PandaRemit is another reputable alternative, providing fast and flexible online transfers. For more information on international transfers, see NerdWallet's international money transfer guide.

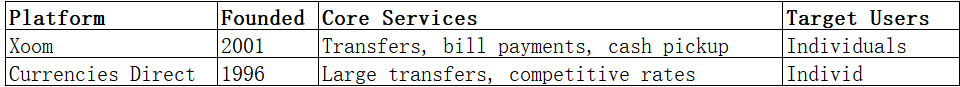

Xoom vs Currencies Direct – Overview

Xoom

-

Founded: 2001

-

Services: International money transfers, bill payments, cash pickups

-

User Base: Millions globally, covering 100+ countries

Currencies Direct

-

Founded: 1996

-

Services: Large personal and business transfers, competitive exchange rates

-

User Base: Individuals and businesses, particularly for larger payments

Similarities

-

Both offer international money transfer services

-

Mobile apps available

-

Bank account integration supported

Differences

-

Fees: Xoom is better for small personal transfers; Currencies Direct offers competitive rates for larger transfers

-

Features: Xoom supports cash pickup and bill payments; Currencies Direct focuses on online transfers and currency management

-

Target Audience: Xoom for individuals; Currencies Direct for businesses and high-value personal transfers

PandaRemit offers an additional flexible online transfer option.

Xoom vs Currencies Direct: Fees and Costs

-

Xoom: Fixed fees for small transfers, occasional promotions

-

Currencies Direct: Very competitive for large transfers, less cost-effective for small amounts

-

Account Types: Xoom does not require subscription; Currencies Direct accounts can access better rates for verified users

Reference for fees: Investopedia Money Transfer Fees.

PandaRemit provides a low-cost alternative.

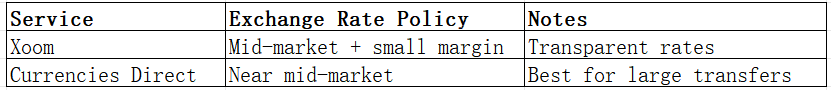

Xoom vs Currencies Direct: Exchange Rates

-

Xoom: Mid-market rates with a small markup

-

Currencies Direct: Competitive rates, particularly for large payments

PandaRemit offers competitive rates without specific numbers.

Xoom vs Currencies Direct: Speed and Convenience

-

Xoom: Instant delivery in some countries, easy-to-use app, cash pickup available

-

Currencies Direct: Typically 1-2 business days, online bank-to-bank transfers

Transfer speed guide: WorldRemit Transfer Speed Guide.

PandaRemit provides fast, fully online transfers.

Xoom vs Currencies Direct: Safety and Security

-

Xoom: Regulated in the U.S., with encryption and fraud protection

-

Currencies Direct: Regulated in the UK and internationally, secure online transfers

PandaRemit is a licensed and secure option.

Xoom vs Currencies Direct: Global Coverage

-

Xoom: 100+ countries, multiple payout options including cash and bank

-

Currencies Direct: Supports numerous countries for bank transfers

Coverage reference: World Bank Remittance Coverage Report.

Xoom vs Currencies Direct: Which One is Better?

-

Xoom Advantages: Ideal for small personal transfers, fast delivery, versatile features

-

Currencies Direct Advantages: Best for large or business transfers, competitive rates, secure

PandaRemit can provide better value for users seeking fast, low-cost, and flexible online transfers.

Conclusion

Xoom and Currencies Direct each have unique advantages: Xoom suits individual small transfers, while Currencies Direct excels for larger or business transactions. PandaRemit is a strong alternative, offering competitive exchange rates, low fees, flexible payment methods (POLi, PayID, bank transfer, e-transfer, etc.), coverage of 40+ currencies, and fast, fully online transfers. For more details, visit the PandaRemit official site or check the Investopedia money transfer guide. Choosing the right platform depends on user needs, and PandaRemit provides a convenient, high-value solution.