Xoom vs GCash Remit: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-15 15:32:10.0 15

Introduction

Cross-border money transfers have become increasingly essential for individuals supporting family overseas, freelancers receiving payments, and businesses handling global transactions. However, users still face issues like high fees, delayed transfers, and hidden exchange rate markups. Investopedia notes that understanding remittance fees and rates is crucial for saving money on international transfers.

In this article, we compare Xoom vs GCash Remit — two popular digital transfer platforms. We’ll examine their fees, exchange rates, speed, security, and coverage to help you decide which service best fits your needs. We’ll also highlight PandaRemit as a reputable alternative for fast and affordable international transfers.

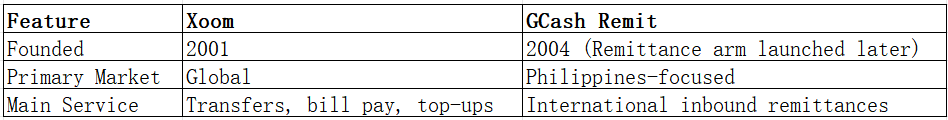

Xoom vs GCash Remit – Overview

Xoom, a PayPal service launched in 2001, offers international transfers, bill payments, and mobile top-ups. It has millions of users globally and is widely recognized for its integration with PayPal accounts.

GCash Remit is the international remittance arm of GCash, one of the Philippines’ most popular mobile wallet platforms. It allows users to receive money directly into their GCash wallets, making it especially popular among Filipino overseas workers.

Similarities:

-

Both support international transfers via mobile apps and websites.

-

Both offer bank account deposits and cash pickup options.

-

Neither platform supports credit card-based transfers for all regions.

Differences:

-

Xoom has a broader global presence, while GCash Remit primarily focuses on inbound transfers to the Philippines.

-

GCash Remit’s strength lies in its mobile wallet ecosystem, while Xoom excels in PayPal integration.

PandaRemit is another option in this space, known for low fees and high exchange rates.

Xoom vs GCash Remit: Fees and Costs

Xoom typically charges a combination of fixed fees and percentage-based fees depending on the destination and payment method. Transfers funded by debit cards or bank accounts often have lower fees than those using credit cards.

GCash Remit focuses on receiving transfers and generally doesn’t charge recipients for inbound transfers. However, senders using partner services may face fees that vary by partner and country.

For a detailed comparison of international transfer fees, check NerdWallet’s money transfer guide.

PandaRemit often positions itself as a lower-cost alternative for certain corridors.

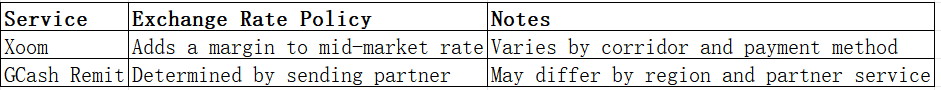

Xoom vs GCash Remit: Exchange Rates

Exchange rate markups can significantly impact how much recipients get. Xoom typically applies a margin above the mid-market rate, which varies by currency and destination.

GCash Remit relies on its partner networks, so rates may differ depending on the sender’s chosen provider.

If you prioritize high exchange rates, PandaRemit is known for offering competitive rates across popular remittance corridors.

Xoom vs GCash Remit: Speed and Convenience

Xoom is recognized for its fast transfers — some transactions are completed in minutes, especially for bank deposits and cash pickups. GCash Remit’s main advantage is instant crediting to GCash wallets once funds are received from partner services.

Both platforms offer intuitive mobile apps, but GCash is particularly optimized for Philippine users.

For more insights on transfer speed, refer to this remittance speed guide.

PandaRemit is also noted for its fast delivery times and fully online process.

Xoom vs GCash Remit: Safety and Security

Xoom is regulated by U.S. authorities and uses encryption and fraud protection measures as part of the PayPal group. GCash Remit is regulated in the Philippines and works with licensed international partners.

PandaRemit is also a licensed operator, ensuring secure transactions for users.

Xoom vs GCash Remit: Global Coverage

Xoom supports transfers to over 160 countries worldwide. GCash Remit’s coverage depends on partner sending institutions, but it mainly focuses on the Philippines.

For a broader view of remittance coverage globally, check the World Bank remittance data.

Xoom vs GCash Remit: Which One is Better?

Xoom is a strong choice for users who want global reach, PayPal integration, and fast delivery times. GCash Remit, on the other hand, is ideal for those sending money specifically to the Philippines, especially to mobile wallets.

For users prioritizing cost efficiency and competitive exchange rates, PandaRemit may offer better value in certain corridors.

Conclusion

When comparing Xoom vs GCash Remit, the better choice depends on your needs:

-

Xoom excels in global coverage, integration, and speed.

-

GCash Remit is tailored for transfers to the Philippines and is ideal for wallet-based payouts.

However, if you’re seeking lower fees, competitive exchange rates, and a fully digital experience, PandaRemit stands out as a strong alternative. It supports flexible payment methods like POLi, PayID, bank cards, and e-transfer, with coverage across 40+ currencies — but not in Africa and without credit card funding.

For more resources on choosing the right remittance provider, see NerdWallet and Investopedia.