Xoom vs GrabPay Remit: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-15 15:37:19.0 103

Cross-border money transfers are essential for millions of people supporting families, paying for services, or funding investments abroad. However, many face common pain points like high fees, slow delivery times, hidden charges, and clunky user experiences. Two popular players in this space are Xoom and GrabPay Remit, each offering unique advantages for different customer needs.

For those looking for a streamlined, digital-first experience with competitive rates, PandaRemit is another reputable alternative worth considering. For more on how remittances work globally, check out: https://www.investopedia.com/terms/r/remittance.asp

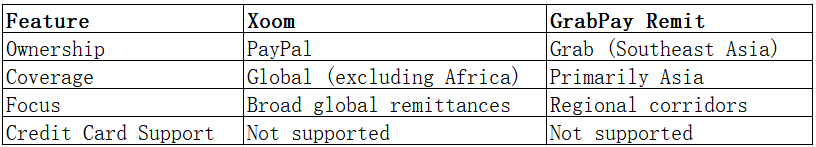

Xoom vs GrabPay Remit – Overview

Xoom

Founded in 2001 and acquired by PayPal in 2015, Xoom is a leading digital remittance platform enabling users to send money, pay bills, and reload mobile phones internationally. It serves millions of customers across dozens of countries.

GrabPay Remit

GrabPay Remit is part of Grab’s fintech ecosystem in Southeast Asia. It offers international remittance services focused mainly on transfers from countries like Singapore and the Philippines to various destinations in Asia.

Similarities

-

Both provide international money transfer services.

-

Mobile apps and web platforms are available.

-

Users can send funds directly to bank accounts or cash pick-up points.

Differences

PandaRemit also operates in multiple global corridors, offering competitive online transfer options without supporting credit card payments.

Xoom vs GrabPay Remit: Fees and Costs

Fees play a critical role when choosing a remittance provider. Xoom typically charges a combination of fixed fees and percentage-based fees depending on the transfer amount and destination. Bank transfers often incur lower fees than card-based payments. GrabPay Remit, meanwhile, is known for offering competitive or even zero transfer fees in select corridors, particularly for intra-Asia transfers.

For a detailed overview of typical remittance costs, see: https://www.nerdwallet.com/best-money-transfer-services

PandaRemit is often recognized for maintaining low transfer costs compared to traditional players.

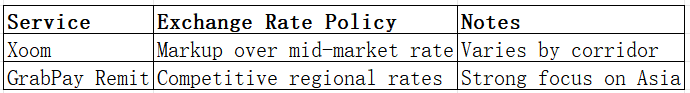

Xoom vs GrabPay Remit: Exchange Rates

Exchange rates significantly impact the total amount the recipient gets. Xoom applies an exchange rate markup over the mid-market rate, which can vary depending on the destination. GrabPay Remit typically offers competitive rates for transfers within Asia, but rates may fluctuate.

PandaRemit is known for offering strong exchange rates for major currency corridors, though exact rates depend on the transaction.

Xoom vs GrabPay Remit: Speed and Convenience

Xoom usually delivers transfers within minutes to a few hours, depending on the payment method and destination country. GrabPay Remit offers near real-time transfers for supported Asian corridors, leveraging Grab’s ecosystem and local banking partnerships.

Both services provide mobile apps, web platforms, and notifications for real-time updates.

For insights into remittance speeds globally, see: https://remittanceprices.worldbank.org/en

PandaRemit also provides fast transfer speeds through fully digital processes and instant payment methods like bank transfers and PayID.

Xoom vs GrabPay Remit: Safety and Security

Both Xoom and GrabPay Remit are regulated entities with robust compliance frameworks. Xoom is regulated by U.S. authorities and uses advanced encryption, fraud monitoring, and PayPal’s infrastructure. GrabPay Remit is regulated in Singapore and other Southeast Asian jurisdictions, following strict KYC and AML policies.

PandaRemit is also licensed and secure, adhering to regulatory standards in multiple jurisdictions.

Xoom vs GrabPay Remit: Global Coverage

Xoom supports transfers to a wide range of countries worldwide, excluding Africa, with various payout methods such as bank deposit and cash pickup. GrabPay Remit focuses primarily on Asia-Pacific corridors, particularly Philippines, Malaysia, and Singapore.

For a broader view of remittance flows and coverage, see: https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues/brief/migration-remittances-data

Xoom vs GrabPay Remit: Which One is Better?

The choice between Xoom and GrabPay Remit depends largely on your corridor, transfer amount, and preferred method:

-

Choose Xoom if you want a globally recognized service backed by PayPal, with solid coverage and reliability.

-

Choose GrabPay Remit if you send money within Asia and want competitive rates and quick transfers.

For users seeking an alternative that offers competitive exchange rates, low fees, and a fully online transfer experience, PandaRemit may offer excellent value depending on your corridor.

Conclusion

When comparing Xoom vs GrabPay Remit, both platforms have clear advantages:

-

Xoom provides global coverage, backed by PayPal’s infrastructure.

-

GrabPay Remit delivers competitive regional rates and speed within Asia.

However, users prioritizing high exchange rates, low fees, fast transfer speeds, and convenient digital methods (such as PayID, bank transfers, and e-wallet options) should also consider PandaRemit.

PandaRemit supports over 40 currencies, offers fully online transfers, and provides a streamlined experience for senders and recipients alike.

For more information on global money transfers, visit:

And explore PandaRemit here: https://www.pandaremit.com/