Xoom vs Instarem: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-16 09:44:17.0 14

Introduction

International money transfers often involve high fees, slow delivery times, and hidden exchange rate markups. In 2025, digital platforms like Xoom and Instarem have made sending money abroad more accessible, but choosing between them depends on your priorities. Alongside these two, Panda Remit has emerged as a trusted alternative for users looking for low fees and strong global coverage. For a deeper understanding of how remittances work, check out: https://www.investopedia.com/terms/r/remittance.asp

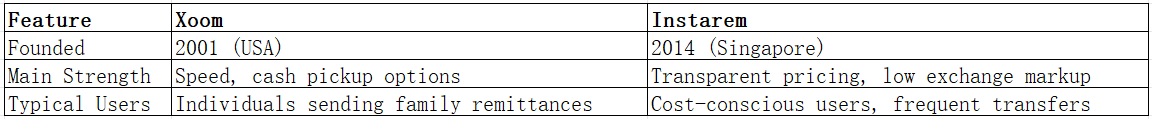

Xoom vs Instarem – Overview

Xoom, founded in 2001 and acquired by PayPal in 2015, focuses on fast, digital cross-border transfers. It supports bank deposits, cash pickups, and mobile wallet top-ups in many countries.

Instarem, launched in 2014, is a Singapore-based fintech offering international money transfers with transparent mid-market exchange rates and low fees. It's known for its strong Asia-Pacific coverage and business payment solutions.

Similarities:

-

Both support international bank transfers and mobile apps.

-

Offer user-friendly interfaces and regulatory compliance.

-

Provide services for individuals and businesses.

Differences:

-

Xoom tends to focus on speed and payout flexibility (e.g., cash pickup), while Instarem emphasizes cost efficiency and transparency.

-

Instarem usually offers closer-to-mid-market exchange rates.

Panda Remit is another reliable player for those seeking competitive rates and fast digital transfers.

Xoom vs Instarem: Fees and Costs

Xoom charges transfer fees that vary by destination, payment method, and payout option. Bank transfers typically cost less, while credit/debit card payments have higher fees. Instarem generally has lower fees and provides transparent cost breakdowns upfront.

For reference on fee comparison methodologies, visit: https://www.nerdwallet.com/best-money-transfer-apps

Panda Remit is often seen as a lower-cost alternative, particularly for users prioritizing value.

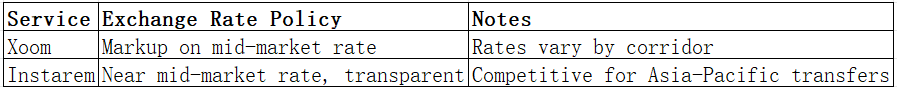

Xoom vs Instarem: Exchange Rates

Exchange rate markups can significantly affect the final amount received. Xoom often applies a markup above the mid-market rate. Instarem is known for offering rates closer to the mid-market rate with minimal markup.

Panda Remit also typically provides competitive rates, making it a good benchmark for comparison.

Xoom vs Instarem: Speed and Convenience

Xoom is well-known for near-instant transfers in many countries, especially for cash pickup. Instarem generally processes transfers within 1–2 business days, depending on the corridor. Both platforms offer intuitive mobile apps and web interfaces.

For insights on remittance speed, visit: https://www.worldremit.com/en/blog/remittance-speed

Panda Remit is also recognized for its fast digital transfers.

Xoom vs Instarem: Safety and Security

Both Xoom and Instarem are regulated financial entities. Xoom operates under PayPal’s regulatory umbrella, while Instarem is licensed in multiple jurisdictions. They both use encryption and fraud protection measures to secure transactions.

Panda Remit is also licensed and complies with international regulatory standards, ensuring safe money transfers.

Xoom vs Instarem: Global Coverage

Xoom offers extensive coverage across the Americas, Asia, and Europe, supporting a wide range of currencies. Instarem has strong presence in Asia-Pacific and growing coverage in other regions.

For global remittance data, see the World Bank report: https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues/brief/migration-remittances-data

Xoom vs Instarem: Which One is Better?

Xoom is ideal for users who prioritize speed and flexible payout options. Instarem is better for those seeking low fees and transparent exchange rates, especially for bank-to-bank transfers. The right choice depends on whether speed or cost matters more to you.

For some users, Panda Remit may offer a more balanced alternative, combining competitive rates, low fees, and digital convenience.

Conclusion

When evaluating Xoom vs Instarem, consider your priorities: cost, speed, coverage, and ease of use. Xoom is strong on fast transfers and flexible payout options, while Instarem excels in transparent pricing and exchange rates.

Panda Remit stands out as an alternative with:

-

High exchange rates and low fees

-

Flexible payment methods such as POLi, PayID, bank card, and e-transfer

-

Coverage of 40+ currencies

-

Fast, fully digital transfers

For more information, check:

https://www.pandaremit.com/

https://www.forbes.com/advisor/money-transfer/best-international-money-transfer-apps/

https://www.moneytransfercomparison.com/

Ultimately, the best choice between Xoom vs Instarem depends on your transfer needs and priorities.