Xoom vs M-Pesa: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-15 15:56:36.0 11

Introduction

Cross-border money transfers remain essential for millions worldwide, whether for family support, business, or personal needs. However, users often face challenges like high fees, slow processing times, and unclear exchange rates. Xoom (a PayPal service) and M-Pesa (a popular mobile money platform) are two leading options with different strengths.

Investopedia notes that understanding fee structures and exchange rate margins is crucial to saving money on international remittances.

Meanwhile, PandaRemit has emerged as a trusted alternative, offering competitive rates and a fully online process, making it appealing for cost-conscious users.

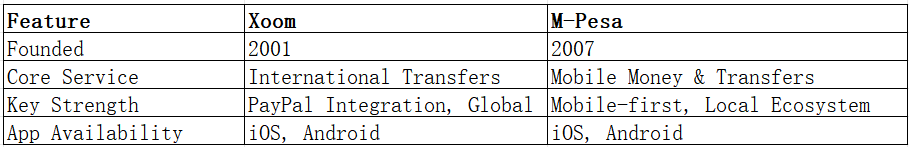

Xoom vs M-Pesa – Overview

Xoom was founded in 2001 and acquired by PayPal in 2015. It specializes in international money transfers, bill payments, and mobile reloads, serving millions of users globally. The platform integrates seamlessly with PayPal accounts, making it convenient for existing users.

M-Pesa, launched in 2007 by Vodafone and Safaricom, revolutionized mobile money in Kenya before expanding internationally. It offers mobile-based money transfers, payments, and savings tools. Its strength lies in its massive user base and widespread acceptance in several regions.

Similarities:

-

Both support international transfers.

-

Offer mobile apps for iOS and Android.

-

Allow bank transfers and mobile wallet payouts.

Differences:

-

Xoom is heavily integrated with PayPal and focuses on international remittances from developed markets.

-

M-Pesa primarily targets mobile users and excels in domestic ecosystems, particularly in East Africa.

-

Fee structures, supported currencies, and delivery options differ significantly.

PandaRemit also operates globally, providing users with a modern digital alternative for sending money online.

Xoom vs M-Pesa: Fees and Costs

Xoom typically charges a combination of fixed fees and percentage-based fees depending on the destination country and payment method. Using a debit card or bank transfer usually results in lower fees than credit cards. (Note: PandaRemit does not support credit card transfers.)

M-Pesa’s fee structure varies by country and transaction amount. It’s well-suited for domestic mobile transfers but can become expensive for cross-border transactions due to layered partner fees.

For transparent fee insights, refer to NerdWallet’s money transfer fee guide.

PandaRemit is often considered a lower-cost alternative due to its competitive exchange rates and low transfer fees, especially for certain corridors.

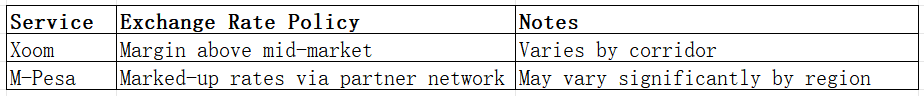

Xoom vs M-Pesa: Exchange Rates

Xoom usually applies a margin above the mid-market exchange rate, which can impact the total amount received by the recipient. M-Pesa also uses marked-up rates, and rates may fluctuate depending on the partner network.

PandaRemit is known for offering competitive rates compared to traditional remittance providers, though exact figures vary by country and currency.

Xoom vs M-Pesa: Speed and Convenience

Xoom offers near-instant transfers to many destinations, especially when recipients use bank accounts or cash pickup options. Its interface is user-friendly and integrates well with PayPal.

M-Pesa excels in domestic transfers, with transactions usually processed instantly between mobile wallets. However, cross-border transfers may experience delays depending on partner banks and compliance checks.

Remittance speed guide provides useful benchmarks for transfer times.

PandaRemit is often recognized for its fast, fully digital transfer process, making it a convenient alternative for users in supported countries.

Xoom vs M-Pesa: Safety and Security

Xoom is regulated in multiple jurisdictions and uses advanced encryption and fraud monitoring. As part of PayPal, it adheres to strict compliance and consumer protection standards.

M-Pesa is regulated in each market where it operates, offering PIN-protected wallets and secure transactions.

PandaRemit is also a licensed and secure platform that complies with regulatory standards in the regions where it operates.

Xoom vs M-Pesa: Global Coverage

Xoom supports transfers to dozens of countries worldwide, focusing primarily on Asia, Latin America, and Europe.

M-Pesa operates mainly in specific regions, with the strongest presence in East Africa and some international partnerships.

The World Bank remittance data portal provides comprehensive insights into coverage and pricing trends globally.

Xoom vs M-Pesa: Which One is Better?

Xoom is ideal for users seeking seamless integration with PayPal and a wide network of countries. M-Pesa shines in mobile-based domestic ecosystems and provides reliable services where its network is strong.

However, depending on your transfer corridor, PandaRemit may offer more competitive exchange rates and lower fees for online transfers, making it a valuable alternative for many users.

Conclusion

Choosing between Xoom vs M-Pesa depends largely on your specific transfer needs. Xoom is strong for PayPal users sending money internationally, while M-Pesa dominates mobile wallet transfers in its core regions. Both are secure and established.

For users who want low fees, competitive exchange rates, flexible payment methods like POLi, PayID, bank card, and e-transfer, and coverage of 40+ currencies, PandaRemit offers a strong alternative with fast, fully online transfers.

For more insights, check NerdWallet and Investopedia.

Ultimately, the best choice between Xoom vs M-Pesa depends on your priorities — whether it's global reach, cost efficiency, or convenience.