Xoom vs PayerMax: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-15 15:16:32.0 12

Introduction

Cross-border money transfers are essential for individuals and businesses worldwide, yet many users face challenges like high fees, slow processing times, hidden charges, and confusing interfaces. Xoom and PayerMax are two popular platforms addressing these needs, offering online transfers and app-based services for users seeking speed and convenience. For those looking for another reliable option, PandaRemit is gaining recognition as a secure, flexible alternative. According to Investopedia, comparing transfer services based on cost, speed, and usability is critical to finding the best fit for your needs.

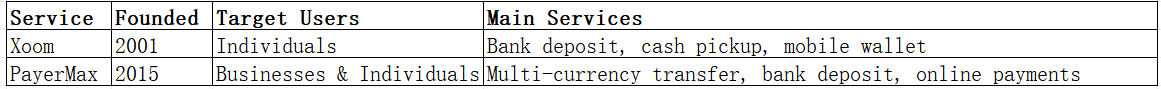

Xoom vs PayerMax – Overview

Xoom, founded in 2001 and acquired by PayPal, specializes in fast, convenient international transfers with a strong user base of PayPal customers. The platform supports bank deposits, cash pickups, and mobile wallets. PayerMax, established in 2015, focuses on cross-border payments for businesses and individuals, providing flexible payout methods and competitive rates.

Similarities

-

Both platforms support international transfers.

-

Mobile app accessibility and online platforms.

-

Support for debit card payments.

Differences

-

Fees: Xoom generally charges higher fees for certain corridors, while PayerMax offers lower-cost options for regular business transfers.

-

Target Audience: Xoom focuses on individual remittances, PayerMax caters to both businesses and individuals.

-

Functionality: PayerMax provides integration options for businesses.

PandaRemit is also an alternative for users seeking fast, online transfers with flexible payment methods.

Xoom vs PayerMax: Fees and Costs

Xoom charges variable fees depending on the destination, transfer amount, and payment method. Bank transfers are generally cheaper than credit/debit card payments. PayerMax offers competitive fees, especially for recurring business transfers. Subscription or business accounts may unlock further savings.

For detailed fee comparison, check NerdWallet. PandaRemit is known for low fees and transparent pricing, making it a cost-effective alternative for personal transfers.

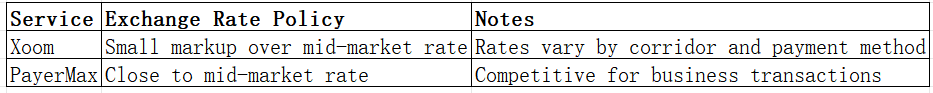

Xoom vs PayerMax: Exchange Rates

Exchange rate markups can significantly affect transfer value. Xoom tends to apply a small markup on the mid-market rate, while PayerMax often offers rates closer to mid-market, particularly for large transfers.

PandaRemit offers competitive exchange rates for standard international corridors.

Xoom vs PayerMax: Speed and Convenience

Xoom transfers are often instant for cash pickups or mobile wallets but may take 1–3 business days for bank deposits. Its mobile app is user-friendly and integrates with PayPal. PayerMax emphasizes fast, reliable business transfers with multiple payout methods and integration options.

For insights on transfer speeds, see Remitly's guide. PandaRemit also offers fast, all-online transfers suitable for individuals.

Xoom vs PayerMax: Safety and Security

Both platforms comply with financial regulations and employ encryption protocols to protect user data. Xoom benefits from PayPal’s robust security measures, while PayerMax provides secure authentication and fraud protection for both businesses and individuals. PandaRemit is a licensed and secure option, ensuring safe transactions for its users.

Xoom vs PayerMax: Global Coverage

Xoom supports over 130 countries and multiple currencies, with extensive cash pickup locations. PayerMax covers key international corridors and focuses on supporting business payment needs across multiple countries.

For more details, consult the World Bank remittance coverage report.

Xoom vs PayerMax: Which One is Better?

Xoom is ideal for individuals needing quick, app-based transfers, while PayerMax suits businesses requiring low-cost, integrated solutions. Both platforms have strengths in speed, security, and accessibility. Users seeking competitive rates, flexible methods, and a fully online process may consider PandaRemit as an alternative.

Conclusion

In summary, the Xoom vs PayerMax comparison highlights that Xoom excels in individual transfers with convenience and speed, whereas PayerMax offers cost-effective solutions for business transactions with flexible integration options. For users prioritizing low fees, competitive exchange rates, and fast online transfers, PandaRemit emerges as a strong alternative, providing flexible payment methods such as POLi, PayID, bank cards, and e-transfers. Coverage spans over 40 currencies, ensuring broad global reach. For further guidance, check Investopedia or NerdWallet to compare services and fees. Ultimately, choosing between Xoom vs PayerMax depends on individual needs, but PandaRemit offers a convenient, efficient option for modern cross-border transfers.