Xoom vs PaySend: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-15 11:54:47.0 11

Introduction

Cross-border money transfers can involve high fees, slow delivery, hidden charges, and complex user experiences. Users need a secure, fast, and cost-effective solution. Xoom and PaySend are two popular services, each with specific advantages. For users seeking lower fees and convenience, Panda Remit is a reputable alternative. More details on international money transfers can be found at Investopedia international money transfer guide.

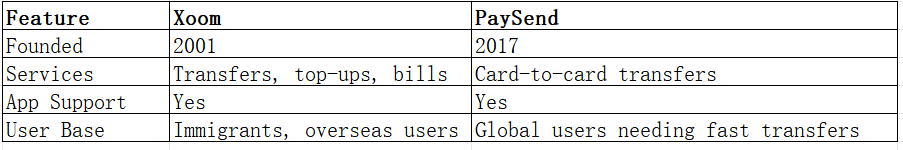

Xoom vs PaySend – Overview

Xoom

-

Founded: 2001

-

Services: International transfers, mobile top-ups, bill payments

-

User base: Millions worldwide, especially U.S. immigrants and overseas communities

PaySend

-

Founded: 2017

-

Services: Digital transfers, card-to-card payments

-

User base: Global users needing fast card-based transfers

Similarities

-

Provide international money transfer services

-

Support mobile app usage

-

Offer bank or card-based transfers

Differences

-

Fees: Xoom charges higher fees for small transfers; PaySend uses low fixed fees for card-to-card transfers

-

User experience: Xoom offers full online operations; PaySend focuses on fast, simple card payments

-

Target users: Xoom targets tech-savvy and regular remitters; PaySend suits users needing instant card-based transfers

Another option is Panda Remit, providing convenient and cost-effective transfers.

Xoom vs PaySend: Fees and Costs

Xoom fees vary based on transfer amount, destination, and payment method, with debit card payments usually costing more. PaySend offers low, fixed fees for card-to-card transfers.

Account Types & Promotions

-

Xoom offers first-time user promotions; PaySend focuses on simplicity and predictable fees.

Detailed fee comparisons can be found at NerdWallet money transfer fee guide.

Panda Remit is also a lower-cost alternative.

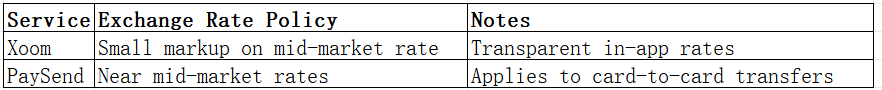

Xoom vs PaySend: Exchange Rates

Exchange rates impact transfer costs. Xoom applies a small markup on the mid-market rate, while PaySend uses near mid-market rates for card-based transfers.

Panda Remit also provides competitive rates.

Xoom vs PaySend: Speed and Convenience

Xoom

-

Delivery time: Minutes to hours

-

App: Fully online

-

Payout: Bank deposits, cash pickups, mobile wallets

PaySend

-

Delivery time: Instant card-to-card transfers

-

App: Simple, fast digital payments

-

Payout: Card-to-card only

More on remittance speed: World Bank remittance guide.

Panda Remit provides fast and convenient online transfers.

Xoom vs PaySend: Safety and Security

Both Xoom and PaySend are licensed and regulated, with encryption and fraud protection to ensure safe transactions. Panda Remit is also a licensed and secure option.

Xoom vs PaySend: Global Coverage

Xoom supports over 130 countries and multiple currencies. PaySend covers card-based transfers globally, primarily in Europe and the Americas. Both provide flexible payment methods.

Coverage details: World Bank remittance coverage report.

Xoom vs PaySend: Which One is Better?

Xoom excels in speed and full online operations, while PaySend focuses on instant card-to-card transfers. Fees and exchange rates vary by destination.

For users seeking low-cost, fast, and convenient alternatives, Panda Remit is a strong option.

Conclusion

Comparing Xoom vs PaySend, Xoom suits users prioritizing fast online operations and varied payout options, while PaySend is ideal for instant card-based transfers. Depending on costs and exchange rates, some users may prefer alternative services.

Panda Remit advantages:

-

High exchange rates & low fees

-

Flexible payment methods (POLi, PayID, bank transfer, e-transfer)

-

Coverage of 40+ currencies

-

Fast, fully online transfers

Learn more at Investopedia and NerdWallet, or try Panda Remit for fast, low-cost transfer solutions.