Xoom vs Paysera: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-16 09:50:07.0 12

Introduction

Cross-border money transfers are essential for millions of people worldwide, but users often face high fees, unfavorable exchange rates, and slow delivery times. Choosing the right platform can make a real difference in how much recipients get and how fast they receive it.

Xoom and Paysera are two popular services in this space. Xoom is known for its integration with PayPal and extensive global reach, while Paysera stands out for its competitive fees and multi-currency accounts.

A strong alternative is Panda Remit, which offers high exchange rates and a smooth digital experience for users looking for flexibility and value.

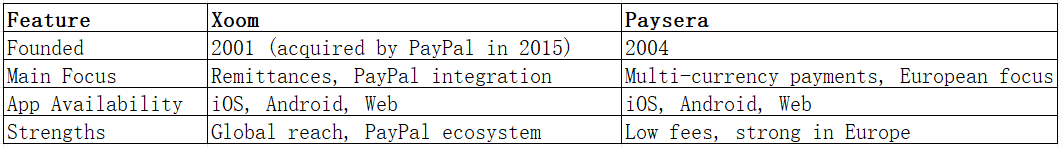

Xoom vs Paysera – Overview

Xoom was founded in 2001 and acquired by PayPal in 2015. It focuses on fast international transfers to bank accounts, cash pickup locations, and mobile wallets. Its global presence makes it a reliable choice for many users.

Paysera, established in 2004 in Lithuania, offers international transfers, a multicurrency e-wallet, and payment processing services. It has grown significantly in Europe, appealing to both individuals and businesses.

Similarities

-

Both provide international money transfers through apps and web platforms.

-

Support multiple currencies.

-

Offer user-friendly mobile apps.

Differences

-

Xoom is heavily integrated with PayPal, while Paysera provides more multi-currency account options.

-

Paysera typically offers lower fees than Xoom, especially for intra-European transfers.

-

Xoom supports wider global coverage, while Paysera is stronger within Europe.

Panda Remit is another option for those seeking competitive exchange rates and flexible digital transfer solutions.

Xoom vs Paysera: Fees and Costs

Fees are one of the first things users compare.

-

Xoom charges fees depending on the payment method (bank, card, or PayPal balance) and destination country. It may apply extra charges for card-funded transfers.

-

Paysera typically offers low or zero fees for transfers within the EU, though fees may apply for non-EU destinations.

According to NerdWallet, Xoom’s fees can be higher compared to competitors, especially for credit card transactions.

Panda Remit is often considered a cost-effective alternative for international transfers thanks to its competitive fee structure.

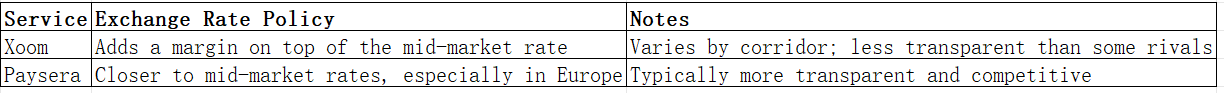

Xoom vs Paysera: Exchange Rates

Exchange rate policies significantly impact how much recipients receive.

Xoom often applies a markup to the mid-market rate, which can reduce the final amount received. Paysera tends to offer better rates for Euro transfers.

Panda Remit is also known for providing high exchange rates, which can be advantageous for users prioritizing value.

Xoom vs Paysera: Speed and Convenience

Speed can be crucial, especially for urgent remittances.

-

Xoom transfers can be instant to a few hours, depending on the country and payout method.

-

Paysera usually delivers same-day or next-day transfers within Europe, though international transfers may take longer.

Their apps offer clear tracking features and support multiple payout methods.

According to Remittance Prices Worldwide, digital services are consistently faster than traditional banks. Panda Remit is also recognized as a fast digital alternative.

Xoom vs Paysera: Safety and Security

Both platforms are regulated and licensed.

-

Xoom is regulated in the US and operates under PayPal’s strict compliance standards.

-

Paysera is licensed as an electronic money institution in Lithuania and regulated under EU financial directives.

Both use encryption, fraud detection, and buyer protection policies. Panda Remit is also a licensed and secure platform, adhering to strict compliance standards.

Xoom vs Paysera: Global Coverage

-

Xoom supports transfers to 100+ countries, including bank deposits, cash pickup, and mobile wallet options.

-

Paysera is strongest in Europe and supports transfers to various international destinations but has a more regional focus.

The World Bank provides useful data on remittance flows and coverage for different regions.

Xoom vs Paysera: Which One is Better?

Both Xoom and Paysera bring unique strengths.

-

Xoom excels in global coverage and PayPal integration, making it suitable for users sending money to a wide range of destinations.

-

Paysera stands out for low fees and strong Eurozone performance, making it attractive for European users.

For some users, Panda Remit may offer even better exchange rates, speed, and a seamless digital experience.

Conclusion

In the Xoom vs Paysera comparison, the right choice depends on your priorities:

-

If you need global coverage and PayPal integration, Xoom is a solid choice.

-

If you're in Europe and want low fees with competitive rates, Paysera is highly appealing.

For those seeking high exchange rates, low fees, and fast transfers, Panda Remit is worth exploring. It supports flexible payment methods such as POLi, PayID, bank card, and e-transfer, and covers over 40 currencies through a fully online process.

For additional guidance on choosing the right platform, refer to Investopedia’s money transfer guide.