Xoom vs RemitBee: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-16 09:38:30.0 10

Introduction

Sending money abroad remains a critical service for millions of people—whether supporting family members, covering education costs, or making overseas payments. However, users often face high transfer fees, hidden exchange rate margins, and slow delivery times.

Xoom and RemitBee have emerged as leading international money transfer providers, each offering unique strengths. Meanwhile, Panda Remit is increasingly viewed as a cost-effective and reliable alternative.

For more background on how international remittances work, see Investopedia’s guide.

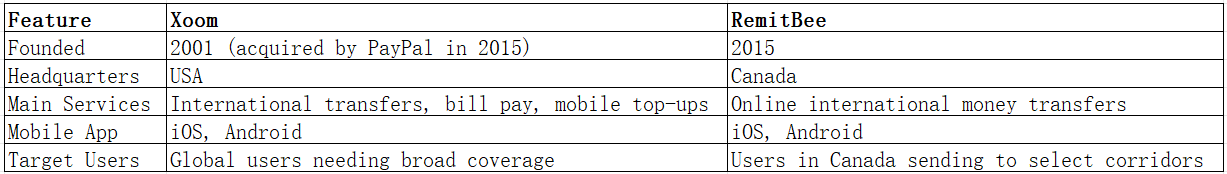

Xoom vs RemitBee – Overview

Similarities: Both Xoom and RemitBee offer digital-first transfer services, mobile apps, debit card payments, and bank transfer options.

Differences: Xoom focuses on broad global coverage and PayPal integration, while RemitBee specializes in offering low fees and competitive exchange rates for popular corridors like Canada to Asia or Europe.

Panda Remit also provides affordable, fully online transfers in supported regions, making it a notable alternative for users prioritizing cost-efficiency.

Xoom vs RemitBee: Fees and Costs

-

Xoom charges a mix of fixed fees and exchange rate margins. Costs vary by payment method (bank account, debit card, PayPal balance) and destination country.

-

RemitBee is known for low or zero transfer fees for certain corridors, especially for bank-to-bank transfers. Some payment methods may still incur charges.

Overall, RemitBee typically has lower transfer fees than Xoom for its supported routes, while Xoom offers more payment flexibility.

For an independent comparison of remittance fees, visit NerdWallet’s guide.

Panda Remit is also positioned as a low-cost provider in supported corridors, offering competitive fees and high exchange rates.

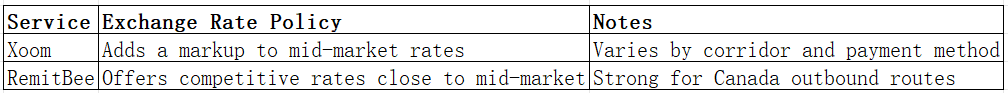

Xoom vs RemitBee: Exchange Rates

Xoom typically applies a larger exchange rate margin than RemitBee, which can impact the total received amount. RemitBee often provides more transparent rates, particularly for users in Canada sending abroad.

Panda Remit is also known for competitive rates near the mid-market level in supported regions, helping users maximize the amount delivered.

Xoom vs RemitBee: Speed and Convenience

-

Xoom offers near-instant transfers to some destinations, particularly with debit card or PayPal balance payments. Bank transfers may take 1–3 business days.

-

RemitBee typically completes transfers within 1 business day for many destinations, especially for bank-to-bank transfers.

Both platforms offer streamlined mobile experiences and real-time transfer tracking. For more on transfer speed, visit Remittance Prices Worldwide.

Panda Remit is also recognized for its fast digital process, enabling quick transfers in supported currencies.

Xoom vs RemitBee: Safety and Security

-

Xoom is regulated in multiple jurisdictions and benefits from PayPal’s encryption and fraud protection tools.

-

RemitBee is regulated in Canada as a money service business (MSB) and complies with FINTRAC regulations.

Panda Remit is also a licensed and regulated provider, offering secure money transfers.

Xoom vs RemitBee: Global Coverage

-

Xoom supports over 130 destination countries, giving it one of the widest global reaches.

-

RemitBee focuses primarily on transfers from Canada to select destinations in Asia, Europe, and other regions. Its coverage is narrower but optimized for key corridors.

For global remittance statistics, see the World Bank Remittance Data.

Xoom vs RemitBee: Which One is Better?

-

Choose Xoom for broad global coverage, PayPal integration, and reliable brand backing.

-

Choose RemitBee for low fees and competitive exchange rates when sending from Canada to supported countries.

If your priority is low costs and fast online transfers, Panda Remit could be a strong alternative in supported regions.

Conclusion

When deciding between Xoom vs RemitBee, consider your transfer corridor, payment method, and budget:

-

Xoom stands out for its extensive reach and PayPal integration.

-

RemitBee is ideal for Canadian senders seeking low fees and strong rates.

For users who prioritize high exchange rates, low transfer costs, and a fully online process, Panda Remit is an excellent alternative. It supports over 40 currencies and multiple payment options such as POLi, PayID, bank card, and e-transfer.

For further comparisons, explore NerdWallet’s international transfer tools.