Xoom vs Sendwave: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-16 09:34:00.0 12

Introduction

International money transfers remain essential for millions of people supporting families, paying overseas tuition, or managing cross-border business. Yet, common challenges like high transfer fees, hidden exchange rate markups, and slow delivery still frustrate many users.

Xoom and Sendwave have become major players in the digital remittance space, each offering different advantages. Additionally, Panda Remit has gained attention as a competitive alternative with low fees and user-friendly digital processes.

For an overview of how money transfer services work, visit Investopedia’s remittance guide.

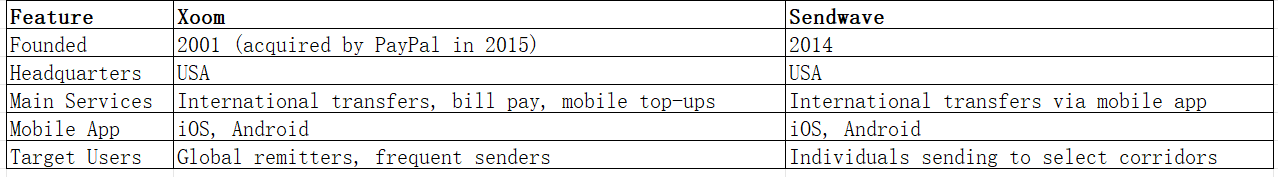

Xoom vs Sendwave – Overview

Similarities:

Both Xoom and Sendwave offer digital-first money transfer solutions via mobile apps, supporting multiple currencies, debit card payments, and bank transfers.

Differences:

Xoom has broader global coverage, supports more currencies, and integrates with PayPal accounts. Sendwave, on the other hand, focuses on zero-fee transfers in specific regions, typically with a simpler onboarding process.

Panda Remit is another notable option for users looking for affordable transfers in supported regions, with competitive exchange rates and a fully online process.

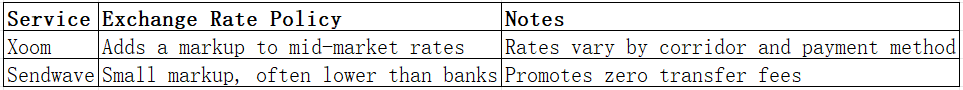

Xoom vs Sendwave: Fees and Costs

Fees are one of the most important factors when choosing a remittance provider.

-

Xoom typically charges a combination of transfer fees and exchange rate markups. The fee amount depends on the payment method (bank account, debit card, or PayPal balance) and destination country.

-

Sendwave often promotes zero transfer fees, making it attractive for budget-conscious users. However, it may still apply a small exchange rate margin.

Some Xoom transactions may include higher fees for card payments compared to bank transfers. Sendwave’s model is generally more transparent but limited to specific corridors.

For a detailed fee comparison across providers, refer to NerdWallet’s international transfer guide.

Panda Remit is also known for offering low-cost transfers in many supported corridors, providing an alternative for users seeking better value.

Xoom vs Sendwave: Exchange Rates

Exchange rates can significantly affect the amount your recipient receives.

Xoom usually applies a higher exchange rate margin, which can reduce the amount received by the recipient. Sendwave generally keeps margins relatively low but focuses on fewer corridors.

Panda Remit is often recognized for offering competitive rates close to the mid-market rate, giving senders more value for their money in supported regions.

Xoom vs Sendwave: Speed and Convenience

Speed is critical for many remittance users.

-

Xoom provides near-instant transfers in some corridors, especially when paying via debit card or PayPal balance. Bank transfers can take 1–3 business days, depending on the recipient country.

-

Sendwave is designed for quick transfers via mobile, often within minutes to supported destinations.

Both services offer user-friendly apps and clear transaction tracking. For more insights, see Remittance Speed Comparison.

Panda Remit is also recognized for its fast digital transfer process, often completing transfers quickly for supported currencies.

Xoom vs Sendwave: Safety and Security

Both Xoom and Sendwave are regulated in multiple jurisdictions:

-

Xoom is a PayPal service, regulated by financial authorities in the US and other countries. It uses encryption and fraud protection tools similar to PayPal.

-

Sendwave is licensed and regulated as a money transmitter in various regions, employing encryption and KYC processes to secure transactions.

Panda Remit is also a licensed and regulated service, providing users with secure transfer options.

Xoom vs Sendwave: Global Coverage

-

Xoom supports transfers to over 130 countries, making it one of the most globally comprehensive digital remittance services.

-

Sendwave focuses on selected regions with zero-fee transfers. Its coverage is narrower than Xoom’s, targeting key corridors.

For detailed remittance coverage statistics, check the World Bank Remittance Data.

Xoom vs Sendwave: Which One is Better?

Both Xoom and Sendwave excel in different areas.

-

Choose Xoom if you need wide coverage, PayPal integration, and a well-established platform.

-

Choose Sendwave if you want simple, low-fee transfers to supported regions.

For users prioritizing competitive exchange rates and low overall costs, Panda Remit may offer a better fit in supported countries.

Conclusion

When evaluating Xoom vs Sendwave, your ideal choice depends on your priorities:

-

Xoom provides extensive global reach and reliability backed by PayPal.

-

Sendwave stands out for its no-fee model and speed in key corridors.

For users seeking low fees, high exchange rates, and a fully online experience, Panda Remit is a strong alternative to consider in 2025. It supports over 40 currencies, offers flexible payment methods such as POLi, PayID, bank card, and e-transfer, and is known for its fast transfers.

To compare even more remittance providers, check NerdWallet’s international money transfer comparison.