Xoom vs Zelle: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-16 09:54:19.0 8

Introduction

Cross-border and domestic money transfers often come with challenges such as high fees, slow delivery, and hidden charges. Choosing the right service impacts how quickly and efficiently your money reaches recipients.

Xoom is widely used for international transfers, supporting bank deposits, mobile wallets, and cash pickup. Zelle is a U.S.-based platform specializing in instant domestic transfers between participating banks.

For users seeking alternatives, Panda Remit provides competitive exchange rates, fast transfers, and flexible online options.

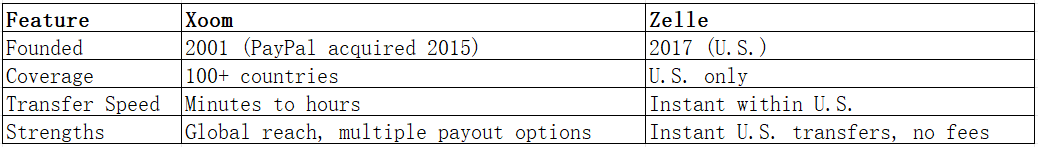

Xoom vs Zelle – Overview

Xoom, founded in 2001 and acquired by PayPal in 2015, focuses on cross-border remittances. It serves a global user base with various payout methods.

Zelle, launched in 2017 in the U.S., provides immediate transfers between participating banks, appealing mainly to domestic users.

Similarities

-

Both are app-based digital payment platforms.

-

User-friendly interfaces and mobile app support.

Differences

-

Xoom is international, offering multiple currencies and payout options.

-

Zelle is U.S.-centric, with instant bank-to-bank transfers only.

-

Fees: Zelle usually charges no fees via banks, while Xoom may charge based on payment method.

Panda Remit remains an attractive alternative for users seeking fast and cost-effective international transfers.

Xoom vs Zelle: Fees and Costs

-

Xoom charges fees based on payment method and destination. Credit/debit cards typically incur higher costs.

-

Zelle is free when used through participating U.S. banks, but international transfers are not supported.

For a detailed fee comparison, see: NerdWallet.

Panda Remit often provides lower fees for international transfers, making it a practical alternative.

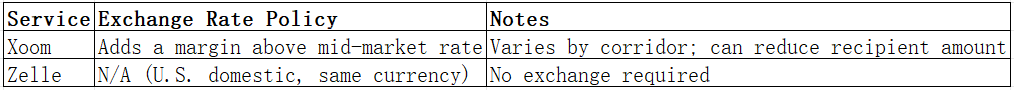

Xoom vs Zelle: Exchange Rates

Exchange rate markups affect international transfers.

Xoom applies markups on international transfers, while Zelle transfers remain in USD. Panda Remit typically offers competitive exchange rates for international corridors.

Xoom vs Zelle: Speed and Convenience

-

Xoom: Transfers can be completed in minutes to a few hours depending on destination and payout method.

-

Zelle: Transfers are instant within U.S. banks.

Apps are intuitive for both services, with Xoom offering additional tracking features. Panda Remit is recognized as a fast digital alternative for international users.

Reference: Remittance speed guide

Xoom vs Zelle: Safety and Security

-

Xoom operates under PayPal’s regulatory framework, with encryption and fraud protection.

-

Zelle is integrated with U.S. banks, offering secure transactions.

Panda Remit is licensed and follows compliance standards to ensure safe international transfers.

Xoom vs Zelle: Global Coverage

-

Xoom: Transfers to 100+ countries, including bank deposits, cash pickup, and mobile wallets.

-

Zelle: Limited to U.S. bank accounts.

For coverage data, see World Bank remittance report.

Xoom vs Zelle: Which One is Better?

-

Xoom is ideal for users needing international coverage and multiple payout methods.

-

Zelle suits users seeking instant, free transfers within the U.S.

For users looking for a cost-effective international option, Panda Remit may provide faster delivery and competitive rates.

Conclusion

The Xoom vs Zelle comparison highlights that the best service depends on your transfer needs:

-

Xoom: Global reach, versatile payout options, suitable for international users.

-

Zelle: Instant U.S. domestic transfers, no fees, limited to bank accounts.

Panda Remit is an alternative offering:

-

High exchange rates and low fees

-

Flexible payment options (POLi, PayID, bank card, e-transfer)

-

Coverage of 40+ currencies

-

Fast, all-online process

Explore Panda Remit here: https://www.pandaremit.com/. Additional guidance on money transfers: Investopedia.