Zelle vs PandaRemit: Fees, Speed & Global Coverage

Benjamin Clark - 2025-09-29 11:31:24.0 17

Introduction

In today’s global economy, international money transfers are crucial for both businesses and individuals (Wikipedia). This article compares Zelle vs PandaRemit, two popular money transfer platforms. Zelle focuses on domestic transfers in the U.S., offering fast and convenient payments, but does not support international remittances. PandaRemit provides low-cost, fast transfers with extensive global coverage, supporting multiple payment methods including bank accounts, credit/debit cards, and mobile wallets. This comparison examines fees, exchange rates, speed, safety, and global reach to help users make an informed decision.

Official links:

-

Zelle: https://www.zellepay.com/

-

PandaRemit: https://www.pandaremit.com/

Fees and Costs

Transfer fees directly affect the final amount received by recipients.

-

Zelle: Domestic transfers within the U.S. are typically free, but international transfers are not supported.

-

PandaRemit: Transparent fees, with most small transfers fee-free, making it cost-effective for international remittances.

Analysis: For cross-border transfers, PandaRemit is more economical, while Zelle is suitable only for U.S.-based users.

Exchange Rates

Exchange rates impact the actual amount received in international transfers.

-

Zelle: No international exchange rate service, as it primarily targets domestic transfers.

-

PandaRemit: Offers rates close to the mid-market rate, transparent and cost-efficient.

Conclusion: PandaRemit provides better value for international transfers.

Speed and Convenience

Transfer speed is crucial for urgent payments.

-

Zelle: Domestic transfers are completed within minutes, ideal for U.S. bank users.

-

PandaRemit: International transfers typically complete within minutes to 24 hours, accessible via web and mobile apps.

Result: PandaRemit offers fast and reliable global transfer capabilities.

Safety and Security

Security is a core consideration for online money transfers.

-

Zelle: Built into the U.S. banking system, with encryption and identity verification.

-

PandaRemit: Complies with international regulations, providing encryption, anti-fraud measures, and identity verification (ConsumerFinance.gov).

Both platforms are secure, but PandaRemit emphasizes global compliance.

Global Coverage

Coverage determines the countries and payment methods available.

-

Zelle: Limited to U.S.-based bank users; international transfers are not possible.

-

PandaRemit: Supports over 40 countries, multiple receiving options including bank accounts, credit/debit cards, and mobile wallets.

Conclusion: PandaRemit has broader global coverage, while Zelle is restricted to U.S. domestic transfers.

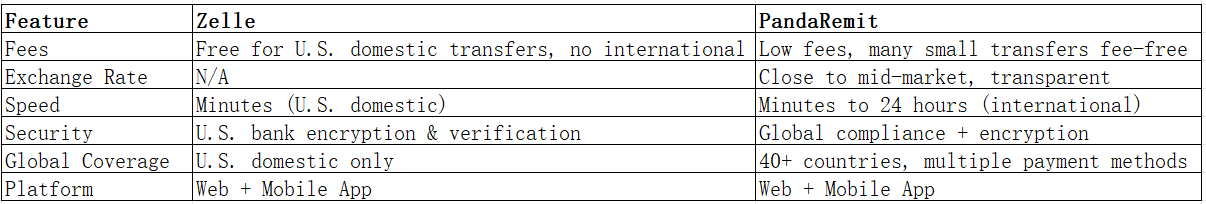

Comparison Table

Which One is Better?

-

U.S. Domestic Users: Zelle is ideal for quick, free transfers within U.S. banks.

-

International Transfers: PandaRemit offers lower fees, fast delivery, and wide global coverage, making it the better choice for cross-border payments.

Conclusion

Overall, Zelle vs PandaRemit depends on user needs. Zelle is excellent for U.S. domestic transfers, while PandaRemit excels at international remittances with low fees, fast delivery, and wide coverage. For users seeking safe, efficient, and cost-effective global money transfers, visiting PandaRemit Official Website is recommended.