Essential Guide for New Immigrants in the USA: Basics of Filing Taxes for the First Time

Jennifer Johnson - 2023-11-30 17:23:53.0 159

As it's widely known, the United States, as one of the most comprehensive tax systems globally, has some complex tax rules. For new immigrants, encountering a different tax law system for the first time can be quite overwhelming. This article aims to guide new immigrants through their first U.S. tax filing, highlighting essential points to help them navigate the process successfully.

Who Needs to Pay Taxes?

According to U.S. tax laws, anyone who qualifies as a "U.S. tax resident" must report their global income, including income from outside the U.S., to the United States.

U.S. tax residents are not only U.S. citizens but also include permanent residents (including temporary green card holders), as well as foreign nationals who stay in the U.S. for 183 days or more (current year's days + 1/3 of last year's days + 1/6 of the previous year's days).

For example:

In 2023, an individual stays in the U.S. for 100 days,

In 2022, 180 days, 1/3 = 60 days

In 2021, 180 days, 1/6 = 30 days

100 + 60 + 30 = 190 ≥ 183 days

Hence, taxes are required.

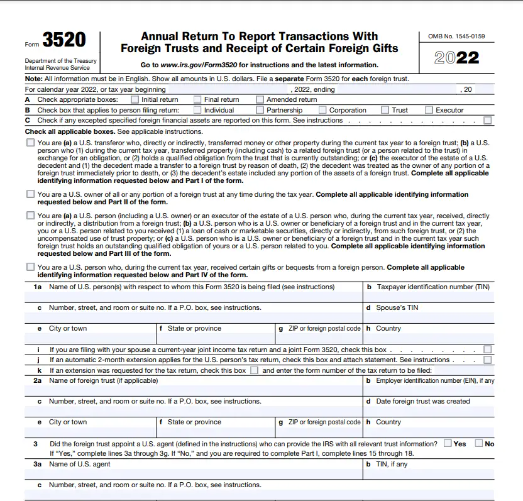

No Tax on Gifts

As per IRS rules, a U.S. resident (including citizens, green card holders, legal work visa holders, and those meeting actual detention standards) receiving gifts or money exceeding the value of $100,000 must file Form 3520 with the IRS.

However, reporting gift income to the IRS doesn't mean taxes are due on it. For more details and to download the form, you can click https://www.irs.gov/forms-pubs/about-form-3520.

If you are studying or working in the U.S. and receive funds from overseas parents, it generally does not involve U.S. gift tax. However, it's important to understand the gift tax regulations of the source country to determine if any gift tax is due.

To avoid trouble, choose a safe and reliable platform for remittance. In this regard, Pandaremit, with years of experience in cross-border remittances, provides excellent support and security, ensuring quick and timely deposits into the recipient's account. Using Pandaremit, you can not only receive occasional remittance discounts but also check the real-time progress of remittances and enjoy professional customer service team's 7*24h full online service. In short, with the same money, using Pandaremit gets you more and faster!

Common tax types

For people immigrating to the United States, there are four main taxes they will face:

1.Personal income tax

Personal income tax is a significant part of U.S. taxation, with a progressive tiered tax rate system. Personal federal income tax rates range between 10%-37%, adjusted according to income level or tax status.

2. Capital gains tax

The U.S. capital gains tax depends on the duration of capital holding. Short-term investments, less than a year, are taxed according to the federal income tax's seven-level rates. Long-term investments, over a year, have capital gains tax rates divided into three levels: 0%, 15%, and 20%, depending on tax status, income amount, and tax rate.

3. Estate and Gift Tax

Estate Tax is levied on the total value of the deceased's property after legal procedures, taxing the excess over the exempt amount. Gift Tax applies to property gifted during one's lifetime.

Notably, the U.S. government taxes globally but does not double-tax. That is, overseas income already taxed in another country can reduce the U.S. tax payable.

4. Property tax

Every real estate owner in the U.S. must pay property tax annually, a major local government revenue source. The tax rate is the property's taxable value * property tax rate.

Example: Local government A with an annual expenditure of $150 million and total property value of $10 billion sets a property tax rate of 1.5%. Another local government B with the same expenditure but total property value of $8 billion sets a tax rate of 1.875%.

Tax filing start/End time?

The U.S. tax year runs from January 1st to December 31st annually.

Typically, the U.S. tax season starts at the end of January, with deadlines for extensions and owing taxes in mid-April, meaning taxpayers must submit the previous year's tax forms to the IRS before the end of the tax season.

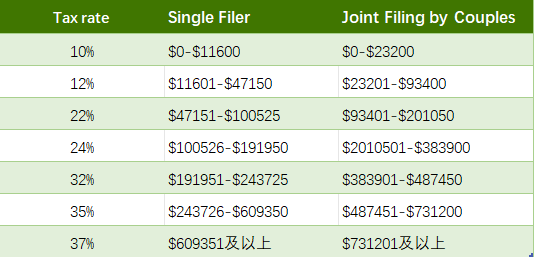

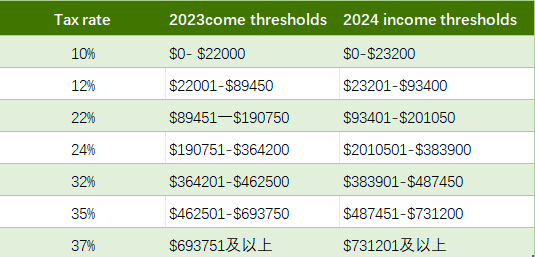

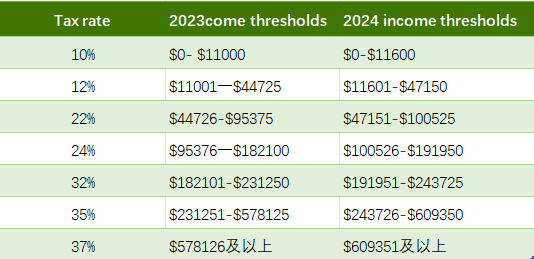

The IRS, in response to inflation, will raise income thresholds for the seven tax brackets in 2024.

Tax thresholds vary depending on the filer's marital status and income level.

Here is the new tax rate table summarized by Panda Remit (data source: IRS)

Here's a simple example of the progressive tax calculation:calculation for a single person earning $50,000 - the income below $11,600 is taxed at 10%, and the portion above is taxed at 12%. Similarly, most people's taxable income should be divided into different gradients for cumulative calculation.

calculation for a single person earning $50,000 - the income below $11,600 is taxed at 10%, and the portion above is taxed at 12%. Similarly, most people's taxable income should be divided into different gradients for cumulative calculation.

Let's look at the incremental changes in tax rates between 2023 and 2024:

Joint Filing by Couples

Single Filer

From the table, it's evident that the tax rate table's starting point has increased under the new changes. For example, in the highest tax bracket of 37%, in 2023, the starting points for single filers and couples filing jointly were $578,125 and $693,750, respectively, which in 2024 have risen to $609,350 and $731,200. Under the progressive tax system, higher-income earners bear higher tax rates, which also relatively eases the burden on people across various industries.

Moreover, the IRS has increased the income tax exemption amount. If your family has three or more qualifying children, they are now eligible for $7,830, which is $400 more than the 2023 tax year.

These adjustments apply to the 2024 tax year, with taxpayers filing in early 2025. For many taxpayers, this is undoubtedly good news! It means that in 2024, there will be more tax relief available.

Additionally, it's worth noting that for new immigrants, the first tax filing after landing is in the following tax season, i.e., they need to report the previous year's global income to the IRS the year after they land.

How to Submit Federal Tax Returns?

You can submit your tax form in two ways, submit it online through the IRS official website or by mailing them to the IRS (https://www.irs.gov/zh-hans/individuals)

How to pay tax?

In the U.S., taxes can be paid online or offline. Most people choose to pay online, and you can select from the following payment methods:

1 Electronic Funds Withdrawal (EFW)

Taxpayers file and pay electronically from their bank account when using tax preparation software or a tax professional. This payment method is free and is only available when filing your tax return electronically.

2 Direct Pay

Direct Pay is free, allowing taxpayers to pay federal taxes directly from their checking or savings accounts without fees or pre-registration. Taxpayers can schedule payments up to 365 days in advance. After submitting payment through Direct Pay, taxpayers immediately receive confirmation.

3 Federal Electronic Tax Payment System

This free service offers taxpayers a secure and convenient way to pay personal and business taxes by phone or online. To register and learn more, taxpayers can call 800-555-4477 or visit https://www.eftps.gov/eftps/.

4 Credit card, debit card or digital wallet

You can pay online or by phone using any authorized payment processor. Fees are charged by the processor, not the IRS. Authorized card processors and phone numbers are available at https://www.irs.gov/payments.

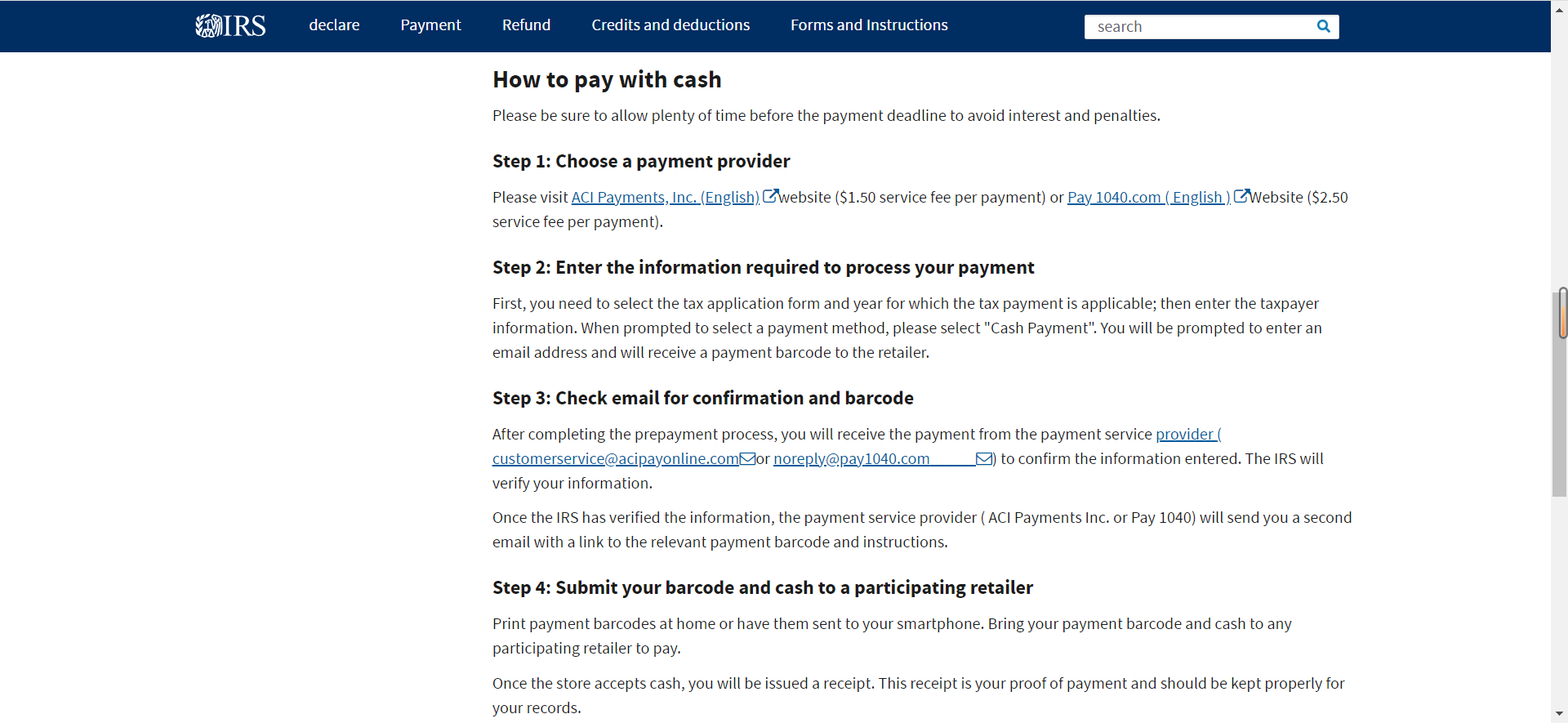

5 cash

For those preferring to pay in cash, the IRS's service provider collaborates with VanillaDirect, offering cash payment options at participating retail stores.

Participating stores accepting VanillaDirect include Dollar General, Family Dollar, CVS Pharmacy, Walgreens, Pilot Travel Centers, 7-Eleven, Speedway, Kum & Go, Royal Farms, Go Mart, Rite Aid, Stripes LLC, TAA Operating LLC, Walmart, The Kroger Co, Circle K, and Kwik Trip.

If choosing to pay in cash, start well before the payment deadline to avoid interest and penalties.

6 Check or Money Order

Payments made by check or money order should be payable to the "U.S. Treasury." To ensure timely crediting, taxpayers should also include Form 1040-V payment voucher and write "2021 Form 1040" on the front of the check or money order, along with their name, address, daytime phone number, and Social Security number.

Notably, taxpayers paying electronically receive immediate confirmation upon submission; those using Direct Pay or the Federal Electronic Tax Payment System (EFTPS) can receive email notifications about their payments. For more options on paying taxes, visit https://www.irs.gov/payments.

How to Get Help with Taxes?

Many communities in the U.S. offer assistance, with the government providing the Volunteer Income Tax Assistance (VITA) program for those needing help. VITA offers free tax help to people who make $60,000 or less, persons with disabilities, and limited English speakers.

You can use the VITA locator at https://irs.treasury.gov/freetaxprep/ by entering your zip code to quickly find the nearest help center.

Where to Find Tax Credits and Deductions?

The IRS allows taxpayers to apply for various tax credits and deductions during tax filing to reduce the taxes owed. You can visit https://www.irs.gov/zh-hans/credits-deductions-for-individuals for detailed rules on individual benefits and reductions.

Where to get tax refund?

If your employer has withheld taxes from your wages during the tax year, or if you've overpaid your taxes, you're entitled to a tax refund. The IRS calculates any refunds and pays them by check or electronic transfer. If you file online, you can receive your refund in as little as three weeks.

Additionally, you can use third-party software such as Turbo Tax, TaxSlayer, TaxAct, etc., to guide you through the tax filing process; however, these software programs generally require a fee.

For new immigrants unfamiliar with the intricacies of U.S. tax laws, it's advisable to prepare in advance.

Finally, if you submit your tax return late, fail to pay taxes on time, or make errors on your tax return, you may face penalties from the IRS. For instance, you might incur a 0.5% penalty on overdue taxes, calculated as 0.5% of your unpaid taxes each month. The more taxes you owe, the higher the penalty. Therefore, it is crucial not to delay!

Due to significant differences between the tax systems of China and the U.S., China practices a territorial tax system, taxing only income generated within the country, while the U.S. follows a global tax system, taxing U.S. taxpayers on income earned both in the U.S. and abroad.

For new immigrants, the first tax filing in the U.S. can pose considerable challenges. The transition in status inevitably involves significant financial dealings. Therefore, it is recommended that you plan and prepare for your taxes well in advance, have sufficient U.S. dollars on hand, study tax relief, refund, and penalty rules carefully, and prepare your tax filing documents. We wish you a smooth completion of your first tax filing.

If you have any remittance needs, click to make remittances:

About Us - Panda Remit

Panda Remit is a cross-border remittance online platform, which is committed to providing global users with safer, more convenient, reliable, and affordable online cross-border remittance services. With a user-friendly interface and advanced security features, Panda Remit is the best solution for anyone looking for a hassle-free way to make global remittance.

Panda Remit has the following features:

1. High safety degree - One of the key features of Panda Remit is its advanced security measures

All transactions are encrypted and monitored 24/7 to ensure the safety of your funds. What's more, Panda Remit uses state-of-the-art fraud detection technology to prevent unauthorized access from your account.

2. Convenient transfer environment - Panda Remit is equipped with a currency calculator

The platform is available on Panda Remit's official website or Panda Remit app so that you can easily access your account and make transactions on the go. Users can transfer money in a variety of currencies, including US dollars, euros, HK dollars, pound, yen, etc,. Furthermore, it is also worth noting that Panda Remit provides 24/7 Chinese customer service, providing a familiar and intimate environment for overseas Chinese.

3. Simple operation process - Panda Remit has a user-friendly interface that makes it easy to navigate and use

Moreover, whether you need to pay bills or send money to friends and family in other countries, you just need to simply follow the operation tutorial provided by Panda Remit to create an account, link your bank account or credit card, and then you're ready to transfer money globally. With just a few clicks, you can successfully send money to anyone, anywhere in the world you want.

4. Instant transfer - Panda Remit provides a quicker way to transfer money globally

Panda Remit is not only secure and convenient, but it is also fast. It allows for instant transfers between Panda Remit users, eliminating the need for waiting periods or processing times as much as possible. This feature is especially beneficial for people or businesses that require quick and efficient cross-border remittance.

5. Low handling fee - Panda Remit offers a range of exchange rate benefits to users

Panda Remit also offers competitive prices compared to traditional remittance methods and other apps of the same kind. Thus, users can enjoy low transaction fees and competitive exchange rates and get high amounts received when transferring money globally, which makes Panda Remit a cost-effective solution for individuals and businesses alike. Plus, the system would give coupons to first-time users.

In conclusion, Panda Remit provides a simpler and more efficient online global remittance way that offers a range of features and benefits to users. Nowadays, Panda Remit has opened global remittance services for more than 30 countries or regions worldwide and helped users save nearly 100 million dollars in fees, which is deeply recognized and trusted by millions of users around the world.

Panda Remit is the perfect solution for you to make cross-border remittances.

Please visit the Panda Remit official website or download the app, Panda Remit, for more detailed information.