How to Send Money with American Express: Fees, Limits & International Transfers

GPT_Global - 2025-09-09 22:30:36.0 23

Here are 30 unique questions related to sending money via American Express:1. How can I send money using American Express?

Sure! Here’s a concise SEO-friendly article within your requested length and structure: Sending money through American Express is a convenient option for individuals and businesses looking for fast and secure transactions. Many people wonder: how can I send money using American Express? The process often involves linking your Amex card to trusted platforms that support peer-to-peer transfers or remittance services, making it simple to send funds locally and internationally. American Express provides advantages like fraud protection, reliable customer service, and global reach. Whether you are supporting family overseas, paying for services, or handling business payments, using American Express ensures a layer of security. By connecting your card with digital wallets or online remittance providers, you can send money to bank accounts or mobile wallets quickly and efficiently. When exploring remittance solutions, always compare fees, exchange rates, and transfer speeds. Some services may offer special benefits when using American Express cards, such as rewards or lower processing times. For individuals and businesses in the remittance industry, leveraging Amex can be an excellent strategy to ensure trust, speed, and reliability in cross-border money transfers.

Does American Express offer a money transfer service?

Sure! Here's a concise SEO article tailored for the remittance business: When looking for convenient ways to send money internationally, many people wonder: does American Express offer a money transfer service? While American Express is widely known for its credit cards and financial services, it does not directly provide traditional money transfer options like Western Union or online remittance platforms. Instead, American Express focuses more on card-related transactions, travel services, and merchant solutions. For individuals who need to send money abroad, alternative remittance providers are often the best choice. Specialized money transfer companies offer lower fees, competitive exchange rates, and fast delivery, making them more practical than relying on credit card-based services. These platforms are designed to support cross-border transactions efficiently, ensuring that families and businesses receive funds securely. If you’re exploring remittance solutions, it’s important to compare providers that specialize in international transfers. While American Express may not be the go-to option for this purpose, using a dedicated remittance service can save you both time and money. Always review fees, exchange rates, and transfer times before choosing the right service for your needs.What fees are associated with sending money via American Express?

Here’s a concise SEO-optimized article for your remittance business: ---When exploring international remittance options, many customers ask: what fees are associated with sending money via American Express? Understanding these costs is crucial for choosing the most affordable and efficient transfer method. While American Express is widely known for its credit cards and financial services, its role in cross-border transfers can come with specific charges.

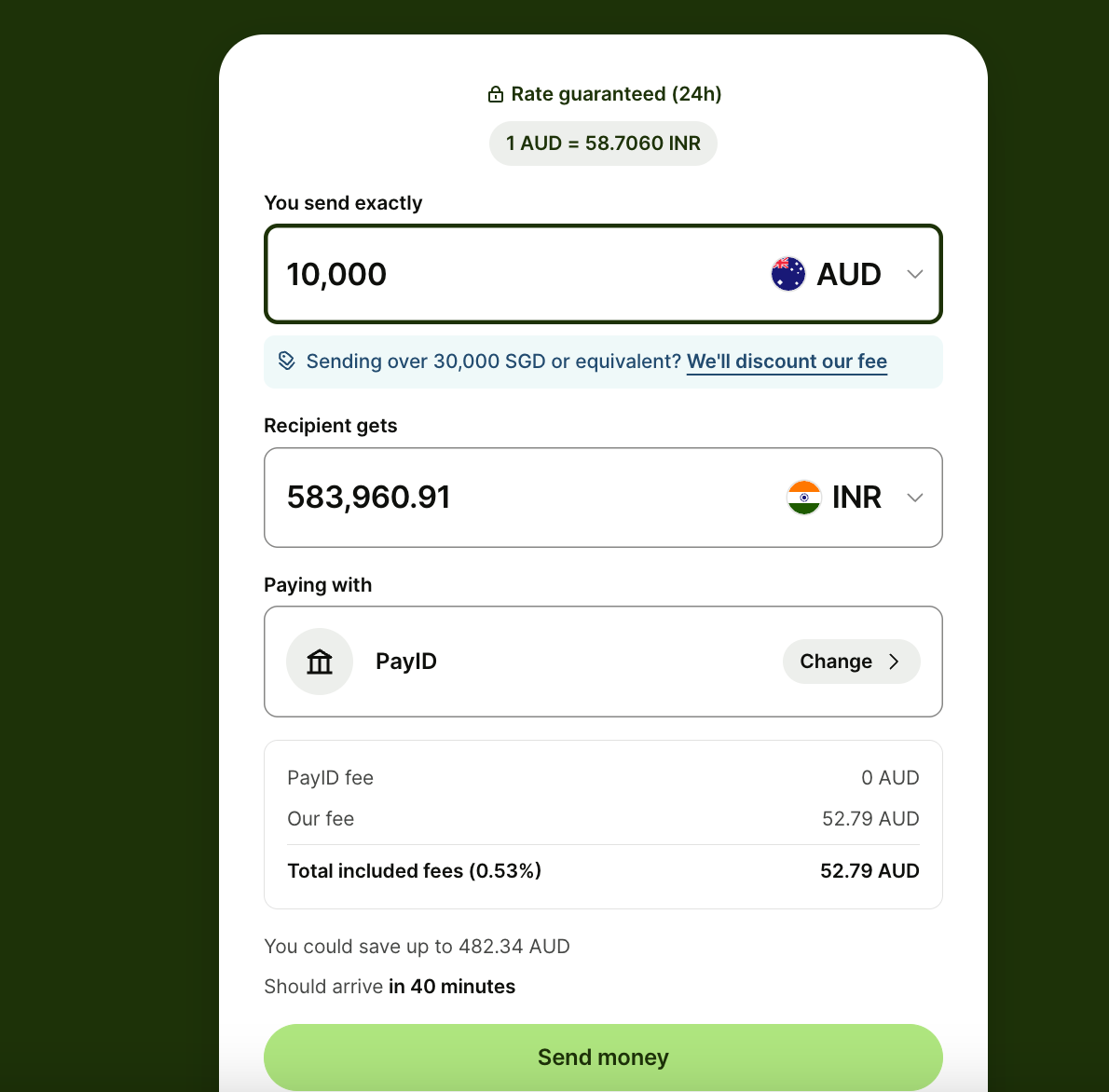

Typically, American Express may apply service fees, transaction fees, or exchange rate markups when money is sent abroad. These costs vary depending on the transfer amount, destination country, and chosen method of delivery. For example, a flat service charge might apply alongside a percentage-based fee, impacting the overall value of the transfer. Additionally, exchange rate margins can significantly affect how much the recipient actually receives.

To avoid unexpected expenses, remittance customers should compare American Express fees with specialized money transfer providers. Many dedicated remittance businesses offer lower transaction costs, more transparent pricing, and competitive exchange rates. By reviewing all associated charges, senders can maximize savings and ensure that their loved ones receive the most from every transfer.

Is there a limit on how much money I can send through American Express?

When sending money through American Express, many users wonder if there are any limits on the amount they can transfer. The good news is that American Express does not set a fixed transfer limit for most transactions. However, the limits depend on the type of account you hold and the method of transfer. If you're using American Express for remittance, factors like your credit limit, the payment method, and your account's status will influence how much you can send.

For users with a personal American Express account, the ability to send money also depends on the remittance service you're using. Services like American Express Global Pay or third-party partners may have their own transfer limits based on factors like the recipient's country and the payment method chosen. It's important to review these terms before initiating a transaction.

If you are looking to send large amounts, it's recommended to consult American Express customer service to understand any specific restrictions on your account. This will ensure that you can transfer money without any unexpected issues. Remember, fees may apply depending on the amount sent, so it's always a good idea to confirm the costs beforehand.

Can I send money internationally using American Express?

```htmlSending money internationally has become easier with various financial institutions offering seamless remittance services. One question that frequently arises is whether you can use American Express (Amex) for international money transfers. The answer depends on the specific services provided by American Express and the country you're sending money to.

American Express does not directly offer a traditional remittance service, like bank transfers or third-party services such as Western Union. However, Amex cardholders can use their American Express card for international payments, including transferring funds for purchases and services. Some online platforms and money transfer services accept Amex as a payment option, enabling you to send money internationally indirectly.

If you're looking to send money abroad using American Express, it’s best to check with the recipient's country’s regulations and the service provider. Additionally, Amex offers various perks like rewards points, which can be advantageous when using the card for international transactions.

In summary, while American Express doesn’t offer a direct remittance service, you can still use it to send money internationally through partnered services. Make sure to verify the fees, exchange rates, and limits before proceeding with the transaction.

```

About Panda Remit

Panda Remit is committed to providing global users with more convenient, safe, reliable, and affordable online cross-border remittance services。

International remittance services from more than 30 countries/regions around the world are now available: including Japan, Hong Kong, Europe, the United States, Australia, and other markets, and are recognized and trusted by millions of users around the world.

Visit Panda Remit Official Website or Download PandaRemit App, to learn more about remittance info.