**Secure Money Transfers to Japan: Requirements, Risks, Limits, Apps, and Safe Options from the USA Without a Bank Account**

GPT_Global - 2025-09-15 16:30:33.0 25

Are there any special requirements for transferring money to Japan for business purposes?

Transferring money to Japan for business purposes requires careful consideration of local regulations and banking processes. As a remittance service provider, understanding these requirements is essential for ensuring smooth transactions. One key factor to note is the need for businesses to comply with Japanese Anti-Money Laundering (AML) laws, which require all transactions to be properly documented and traceable.

Additionally, the Japanese financial system tends to favor local bank transfers, especially when dealing with larger amounts. It’s important to choose a remittance provider with partnerships with reputable Japanese banks to avoid delays. Ensure that the correct business details, such as the recipient's company name and bank account number, are provided for a hassle-free transfer.

Another important consideration is currency exchange. Most transfers to Japan are made in Japanese yen (JPY), so working with a remittance provider offering competitive exchange rates will help minimize additional costs. Be aware that some remittance services charge fees for currency conversion or may impose limits on the amount you can send.

In summary, transferring money to Japan for business purposes requires adherence to regulatory guidelines, proper documentation, and choosing the right service provider. With these considerations in mind, businesses can ensure a smooth and efficient transfer process.

Can I use Western Union to send money from the USA to Japan?

Many people in the United States look for convenient ways to send money to family, friends, or business partners in Japan. One popular question is: Can I use Western Union to send money from the USA to Japan? The answer is yes. Western Union is a trusted global money transfer service that allows you to send funds quickly and securely to Japan. Through Western Union, you can send money online, via their mobile app, or by visiting a nearby agent location in the U.S. The recipient in Japan can receive the money directly into their bank account or pick it up at a participating location, depending on the delivery method you choose. This flexibility makes it suitable for both urgent transfers and routine remittances. Keep in mind that transfer fees and exchange rates may vary depending on the amount and method you use. To save costs, always check the latest rates and compare options before confirming the transaction. Western Union’s wide network ensures a reliable way to send money from the USA to Japan, whether for personal support, education, or business needs.How do I ensure that my money transfer to Japan is secure?

Ensuring that your money transfer to Japan is secure is crucial for both peace of mind and protecting your finances. One of the first steps is to choose a reliable and licensed remittance service. Look for companies with strong reputations and positive reviews from other customers. This will give you confidence that your transaction is in good hands.

Another key consideration is the method of transfer. Opt for services that use encryption technology to protect your personal and financial information. This ensures that your data remains secure throughout the transfer process. Additionally, some services offer multi-factor authentication for an added layer of protection.

Before transferring, always double-check recipient details. Ensure that the information is accurate to avoid errors and potential scams. Lastly, keep records of your transactions, including receipts and confirmation numbers. This will help you track the status of your transfer and resolve any issues quickly.

By following these simple steps, you can ensure a safe and secure money transfer to Japan, giving you peace of mind every time you send funds overseas.

What are the risks involved in transferring large sums of money to Japan?

When transferring large sums of money to Japan, there are several risks involved that individuals and businesses must consider. One of the primary risks is associated with exchange rate fluctuations. The value of the Japanese yen can change significantly, which may lead to unexpected losses when transferring funds.

Another risk is the potential for fraud. International transfers can be targeted by malicious actors looking to exploit vulnerabilities in financial systems. It’s crucial to ensure that the remittance service provider is reputable and uses secure encryption methods to protect sensitive information.

Legal and regulatory risks also play a significant role in the transfer of large amounts of money to Japan. Different countries have varying anti-money laundering (AML) and Know Your Customer (KYC) regulations. These rules could delay the transfer or even lead to penalties if not followed correctly.

Lastly, the transaction fees involved in large remittances can be substantial, eating into the total amount sent. It’s essential to compare the costs of different remittance services to ensure the best value for money. Always do thorough research to minimize these risks when sending large sums to Japan.

Can I transfer money to Japan from the USA without a bank account?

Here’s a concise SEO article draft for your topic: ---Sending money internationally can feel complicated, especially if you don’t have a bank account. Many people ask: “Can I transfer money to Japan from the USA without a bank account?” The answer is yes, thanks to modern remittance services that provide secure and convenient options.

Money transfer providers such as online remittance companies, mobile apps, and cash-to-cash services allow you to send funds directly to Japan without using a traditional bank account. These platforms often accept debit cards, credit cards, or even cash payments at authorized agent locations. This makes it possible for non-bank users to send money abroad quickly.

Another benefit is speed. In many cases, the recipient in Japan can access funds within minutes through cash pickup points, mobile wallets, or direct deposits into their bank account. Additionally, these services are usually designed with competitive exchange rates and transparent fees, making them cost-effective compared to traditional wire transfers.

Whether you are supporting family, paying for education, or handling personal expenses, transferring money from the USA to Japan without a bank account is entirely possible. Choosing a licensed and trusted remittance service ensures your funds arrive safely and on time.

What is the maximum amount I can send to Japan via money transfer services?

When using money transfer services to send money to Japan, the maximum amount you can send varies depending on the service provider and the method chosen. Different remittance companies have different limits based on factors such as transfer method, recipient location, and regulatory requirements. For example, companies like Western Union or PayPal may allow you to send up to $5,000 or even higher per transfer. However, certain services may impose daily or monthly limits on the total amount you can send, especially for online transfers.

It's also important to consider the payment method. Sending funds via bank transfer, for instance, may have a higher limit than sending via cash pickup. While some services allow transfers of large sums, they may also require additional verification or documentation for security and compliance purposes.

Before initiating a transfer, always check the specific service’s terms and conditions to ensure that you are within the allowed limits. This ensures a smooth transaction process and helps you avoid any unexpected delays.

Are there mobile apps for transferring money from the USA to Japan?

Sending money from the USA to Japan has become faster and more convenient thanks to mobile remittance apps. These apps allow users to transfer funds directly from their smartphones without the need to visit a physical bank or remittance center. With just a few taps, money can be sent securely to recipients in Japan, making it an attractive option for individuals supporting family, students, or businesses abroad.

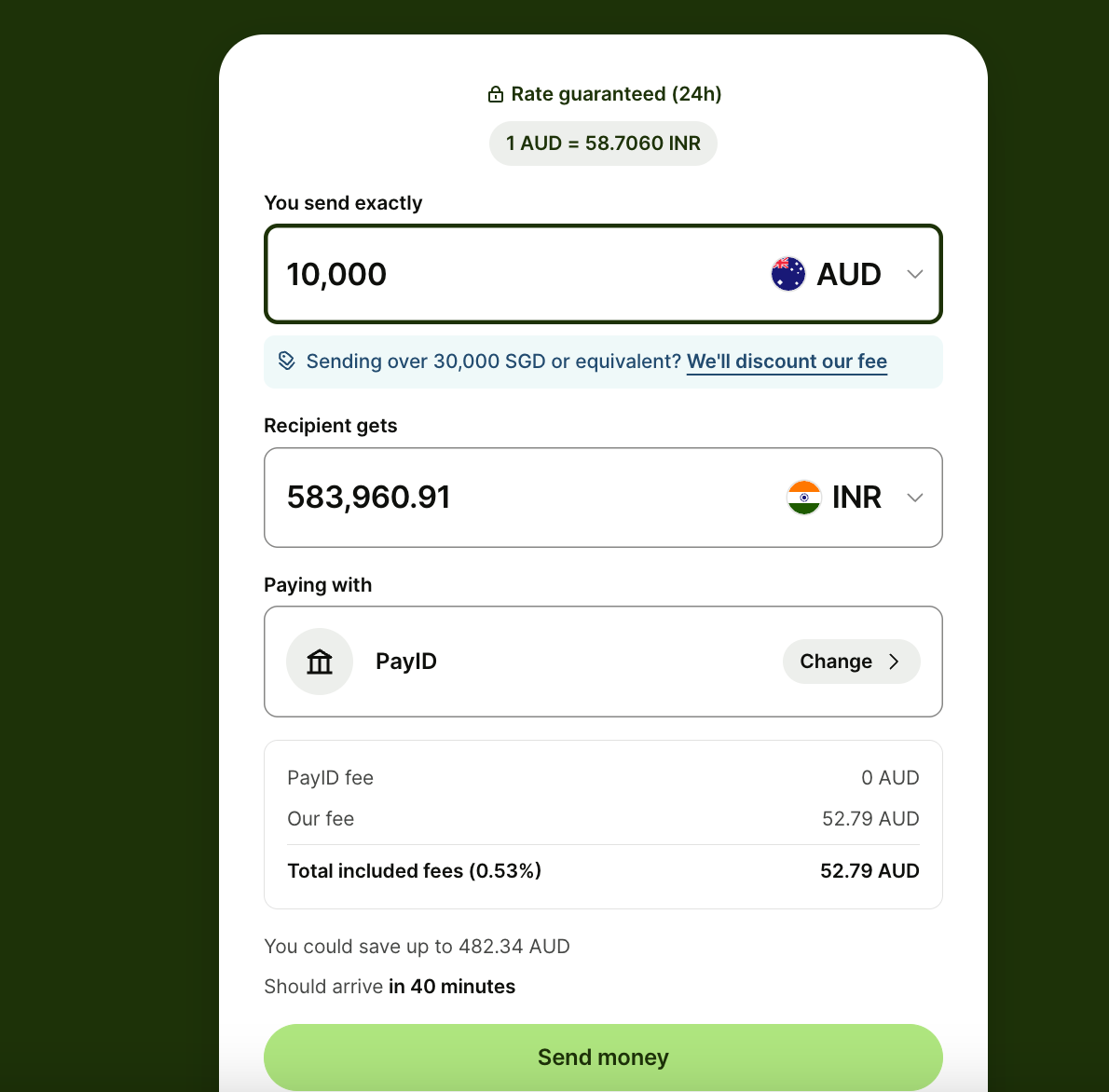

Popular apps for money transfers include PayPal, Wise (formerly TransferWise), Remitly, and Xoom. These platforms offer competitive exchange rates, transparent fees, and quick delivery times compared to traditional wire transfers. Some services even provide same-day transfers, ensuring that recipients in Japan receive funds quickly and efficiently.

Another advantage of mobile money transfer apps is their flexibility. Many allow payments using debit cards, credit cards, or directly from a U.S. bank account. Additionally, recipients in Japan can receive funds in their local bank accounts, making the process smooth and reliable. As mobile technology evolves, these apps are becoming the preferred method for cross-border remittances.

For anyone needing to send money from the USA to Japan, exploring mobile apps is a smart choice. They combine speed, affordability, and convenience, ensuring a seamless international remittance experience.

About Panda Remit

Panda Remit is committed to providing global users with more convenient, safe, reliable, and affordable online cross-border remittance services。

International remittance services from more than 30 countries/regions around the world are now available: including Japan, Hong Kong, Europe, the United States, Australia, and other markets, and are recognized and trusted by millions of users around the world.

Visit Panda Remit Official Website or Download PandaRemit App, to learn more about remittance info.