Cheapest Way to Send Small Amounts from Singapore to USA

Benjamin Clark - 2025-10-23 10:39:19.0 17

Sending money from Singapore to the USA has become increasingly common for personal and family needs, tuition payments, or small business transactions. For those transferring small amounts, finding a service that combines low fees, competitive exchange rates, and convenient delivery is crucial. Using the right app can save you money while ensuring your funds reach the recipient efficiently and securely. Services like Wise, Remitly, and Panda Remit have simplified the process, offering convenient online platforms tailored for Singapore residents. Choosing the most cost-effective solution ensures more of your money is sent, rather than being lost to hidden charges.

Why Many People in Singapore Send Money to USA

Several factors drive Singaporeans to transfer money to the USA. Many have family members or relatives living abroad who rely on regular remittances. Others may be paying for education, healthcare, or managing investments. Additionally, cross-border freelancers or small business owners often need to send payments to US-based clients or suppliers.

Sending money efficiently requires a balance of affordability, security, and ease of use. Services that provide transparent exchange rates and low fees are particularly popular. Digital money transfer apps have made it easier than ever to move funds internationally without the complications of traditional banking systems.

What to Look for in a Money Transfer App

When selecting an app for transferring funds, consider these key factors:

-

Exchange Rate: Small differences can significantly affect the amount received.

-

Fees: Look for services with low or transparent fees.

-

Ease of Use: A simple interface reduces errors and stress.

-

Security: Choose apps with strong encryption and regulatory compliance.

By carefully evaluating these factors, you ensure your money reaches the USA efficiently and securely.

Best Apps to Send Money from Singapore to USA (2025 Update)

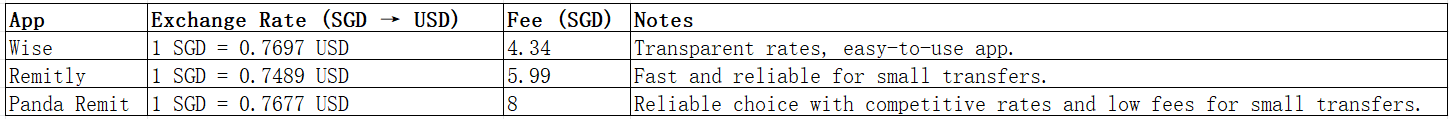

Here’s a comparison of some popular money transfer apps suitable for sending small amounts from Singapore to the USA:

Panda Remit is a convenient option for those sending smaller amounts due to its simplicity, competitive exchange rate, and secure platform. While fees are slightly higher than some competitors, the overall cost and reliability make it a strong choice.

How to Send Money from Singapore to USA using Panda Remit: Step-by-Step Guide

-

Sign Up: Visit Panda Remit and create an account using your email and personal details.

-

Verify Identity: Upload required documents for security compliance.

-

Enter Transfer Details: Input recipient information and the amount you want to send.

-

Review Rates and Fees: Confirm the exchange rate and service fee.

-

Complete Payment: Fund the transfer via bank transfer or approved payment method.

-

Track Transfer: Monitor your transaction until the recipient receives the funds.

Panda Remit makes the process straightforward, allowing even first-time users to send money confidently.

Cost & Exchange Rate Comparison Example

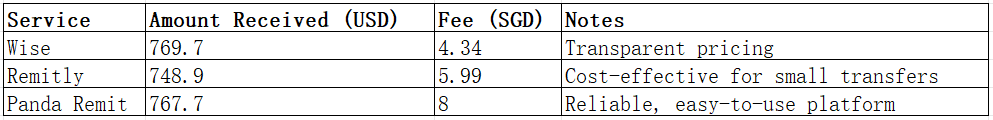

Suppose you want to send 1,000 SGD to the USA. Here's how each app compares:

This comparison highlights how minor differences in rates and fees can impact the final amount received.

Tips to Get the Best Exchange Rates

-

Compare Rates Regularly: Use comparison tools before sending.

-

Avoid Weekends: Some services offer better rates on weekdays.

-

Send Slightly Larger Amounts: Fees are often fixed, so sending slightly more reduces percentage cost.

-

Choose Digital Transfers: Online platforms usually provide better rates than banks.

These strategies help maximize the value of every transfer.

Common Questions (FAQ)

1. Can I send money instantly to the USA from Singapore?

Yes, some services like Remitly offer fast delivery options, while others may take slightly longer.

2. Are there limits on small transfers?

Limits vary by service; check each provider for their minimum and maximum transfer amounts.

3. Is Panda Remit safe for sending money internationally?

Yes, Panda Remit follows strict security protocols and complies with regulatory standards. Learn more.

4. Which method is cheapest for small transfers?

Comparing rates and fees shows that Panda Remit and Wise are cost-effective options for small amounts.

5. Can I track my transfer online?

Most services, including Panda Remit, provide online tracking until the recipient receives the funds.

Conclusion

For Singapore residents sending small amounts to the USA, choosing the right money transfer app is essential to save on fees and get a favorable exchange rate. Panda Remit emerges as a reliable option, offering competitive rates, low fees for small transfers, and secure processing. While services like Wise and Remitly are also strong choices, Panda Remit provides a convenient solution tailored for everyday remittance needs. For a hassle-free, cost-effective transfer, consider using Panda Remit today.