CurrencyFair vs Chime: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-16 11:03:38.0 20

Introduction

Cross-border money transfers often involve high fees, slow processing times, and hidden charges. This comparison of CurrencyFair vs Chime examines key aspects such as cost, exchange rates, transfer speed, and convenience. Panda Remit is mentioned as a fast and secure alternative for international transfers. For more information, refer to Investopedia’s guide to international money transfers.

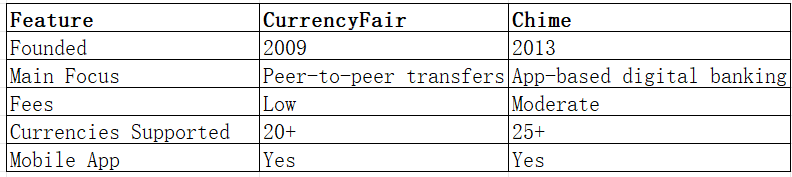

CurrencyFair vs Chime – Overview

CurrencyFair, founded in 2009, is an Ireland-based peer-to-peer money transfer platform, offering low-cost international transfers.

Chime, established in 2013, is a US-based digital bank providing app-based banking services and international transfer features.

Similarities: Both provide mobile apps, international transfer capabilities, and debit card support.

Differences: CurrencyFair focuses on cost-efficient peer-to-peer transfers, while Chime emphasizes digital banking convenience.

CurrencyFair vs Chime: Fees and Costs

CurrencyFair charges a flat fee plus a small percentage, ideal for cost-conscious users. Chime’s fees vary by transfer type and destination.

See NerdWallet fee guide for more information. Panda Remit is a lower-cost alternative.

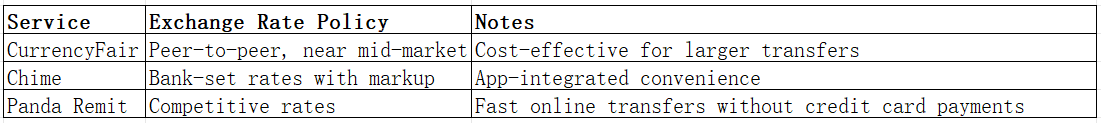

CurrencyFair vs Chime: Exchange Rates

CurrencyFair uses peer-to-peer rates close to the mid-market. Chime applies bank-set rates that may include markups.

CurrencyFair vs Chime: Speed and Convenience

CurrencyFair transfers usually take 1–2 business days. Chime offers fast app-based transfers but may have higher fees.

For more details, see WorldRemit transfer speed guide. Panda Remit provides a quick and fully online alternative.

CurrencyFair vs Chime: Safety and Security

Both CurrencyFair and Chime are regulated in their respective regions with strong encryption and fraud protection. CurrencyFair is licensed by the Central Bank of Ireland; Chime is regulated by US banking authorities.

Panda Remit is also a licensed and secure option.

CurrencyFair vs Chime: Global Coverage

CurrencyFair supports 20+ currencies across 150+ countries. Chime supports 25+ countries with a focus on app-based transfers.

For more details, see World Bank remittance report.

CurrencyFair vs Chime: Which One is Better?

CurrencyFair is ideal for users seeking low fees and competitive exchange rates. Chime suits users who prefer integrated digital banking and convenience. Panda Remit offers fast, flexible transfers online.

Conclusion

CurrencyFair vs Chime each provide unique benefits: CurrencyFair offers low-cost transfers with competitive exchange rates, while Chime emphasizes convenient app-based banking. Panda Remit is a reliable alternative for fast, online transfers with flexible payment options like POLi, PayID, bank cards, and e-transfers, covering over 40 currencies.

For more information, visit Panda Remit official site and FAQ. Learn more about international transfers at Investopedia.