Monzo vs Sendwave: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-11-19 14:18:24.0 13

Introduction

Cross-border money transfers often come with high fees, slow delivery, hidden charges, and inconsistent user experience. Monzo and Sendwave are popular options addressing different aspects of international transfers. PandaRemit also serves as a reliable alternative, offering fully online transfers with competitive fees and convenience. Understanding the differences between these services helps users choose the right platform for their transfer needs. For further guidance, see Investopedia’s guide on international money transfers.

Monzo vs Sendwave – Overview

Monzo was founded in 2015 in the UK, providing digital banking services, mobile app-based accounts, debit cards, and international money transfers. It focuses on European users seeking transparency and convenience.

Sendwave was founded in 2014 and specializes in mobile-based remittances with a simple app interface, primarily targeting specific regions in Asia and select countries for fast, low-cost transfers.

Similarities:

-

International transfer capability

-

Mobile app support

-

Secure online verification

Differences:

-

Monzo is a full digital bank; Sendwave is a dedicated remittance app

-

Monzo serves European banking customers; Sendwave focuses on mobile-first remittance users

-

Fee structures and functionality differ

PandaRemit is another online transfer option.

Monzo vs Sendwave: Fees and Costs

Monzo Fees

-

Partner-based transfers with variable fees per currency and destination

-

Fixed fees plus small percentage of transfer amount

-

Transparent pricing with no hidden account charges

Sendwave Fees

-

Generally low fees for supported corridors

-

Percentage-based or flat fee per transfer

-

Promotions may occasionally reduce cost further

For fee comparison reference, see NerdWallet international money transfer guide.

PandaRemit is also a lower-cost alternative for online transfers.

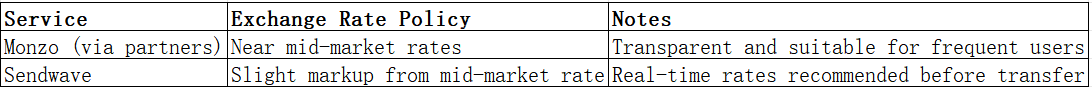

Monzo vs Sendwave: Exchange Rates

PandaRemit provides competitive online rates for cross-border payments.

Monzo vs Sendwave: Speed and Convenience

Monzo

-

Transfer times depend on partner bank and destination

-

Many transfers complete same-day or within 24 hours

-

App supports EU banking integrations

Sendwave

-

Fast mobile wallet and bank account transfers

-

App provides tracking and notifications

-

Optimized for quick mobile-based transfers

See Remittance Speed Guide for reference.

PandaRemit is a fast alternative for fully online transfers.

Monzo vs Sendwave: Safety and Security

Monzo

-

Regulated by the UK Financial Conduct Authority (FCA)

-

Bank-grade encryption and fraud protection

-

Two-factor authentication and device management

Sendwave

-

Licensed for money transfer operations

-

Strong verification and anti-fraud measures

PandaRemit is also a licensed and secure transfer option.

Monzo vs Sendwave: Global Coverage

Monzo

-

Mainly UK and Europe

-

Multi-currency support via partners

Sendwave

-

Coverage limited to select Asian and other supported countries

-

Transfers depend on local banking networks

See World Bank Remittance Report for global coverage insights.

Monzo vs Sendwave: Which One is Better?

Monzo is suitable for European users needing multi-currency banking with transparent fees, while Sendwave is ideal for mobile-first users seeking low-cost transfers. For fast, fully online transfers with flexible payment methods, PandaRemit provides an efficient alternative.

Conclusion

In the Monzo vs Sendwave comparison, both services have strengths suited to different user needs. Monzo provides a comprehensive digital banking experience and European-focused transfers, while Sendwave offers fast, mobile-based remittances for specific regions. Users prioritizing speed, online convenience, and low-cost transfers may find PandaRemit advantageous. PandaRemit offers competitive exchange rates with low fees, multiple payment options (POLi, PayID, bank transfer, e-transfer), coverage for 40+ currencies, and a fully online process. It is a convenient, transparent, and efficient solution for cross-border money transfers. Additional resources include NerdWallet international transfer guide and the World Bank Remittance Report.

Visit PandaRemit Official Website to explore their services.