N26 vs Starling Bank: Which is Better for International Money Transfers?

Benjamin Clark - 2025-11-13 15:13:18.0 15

In 2025, international money transfers remain a major concern for global freelancers, travelers, and expats. High bank fees, hidden exchange markups, and long delivery times are still common pain points. Digital banks like N26 and Starling Bank offer app-based solutions that simplify cross-border payments with better transparency and faster service. For users seeking another trusted alternative, Panda Remit provides quick and low-fee transfers to many regions. As Investopedia notes, fintech innovation continues to reshape the remittance industry by improving accessibility and lowering transaction costs.

N26 vs Starling Bank – Overview

N26, founded in 2013 in Germany, is one of Europe’s top neobanks. It provides digital checking accounts, Mastercard debit cards, and seamless integration for international transfers through Wise. N26 primarily serves users in the Eurozone and EEA, offering fee-free local transfers within SEPA and easy multi-currency support.

Starling Bank, launched in 2014 in the UK, is a full-fledged digital bank licensed by the Financial Conduct Authority (FCA). It provides personal and business accounts, Mastercard debit cards, and international payments via partnerships like Currencycloud and Wise. Starling focuses on UK customers but also supports Euro and USD accounts for international flexibility.

Similarities: Both N26 and Starling Bank are fully digital, offer real-time transaction updates, budgeting tools, and integration with Wise for global transfers.

Differences: N26 targets Eurozone users, while Starling primarily serves the UK. Starling also supports more robust business banking tools.

In addition to these two, Panda Remit offers a specialized platform for individuals sending money abroad with competitive rates and low fees.

N26 vs Starling Bank: Fees and Costs

Fees play a significant role in determining which platform provides better value.

-

N26: International transfers are powered by Wise. Fees vary based on currency and region but remain among the lowest compared to traditional banks. SEPA transfers are free for all users.

-

Starling Bank: Offers international transfers through Wise and Currencycloud, with fees around 0.4–0.5% of the transaction value plus a small flat charge. Domestic payments within the UK are free.

Premium account users at both banks may get discounted transfer fees or other perks. For updated details, visit NerdWallet’s comparison guide.

If you prioritize cost-efficiency, Panda Remit is often a cheaper alternative, offering competitive exchange rates and minimal transfer fees for personal remittances.

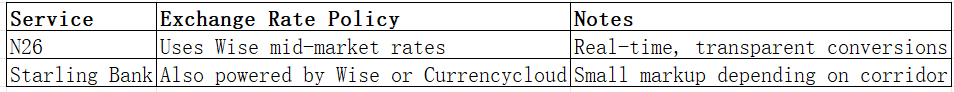

N26 vs Starling Bank: Exchange Rates

Exchange rate transparency determines how much your recipient receives. Both banks rely on Wise for international transfers, ensuring mid-market exchange rates.

Both banks provide clear rate previews before confirming a transfer, reducing hidden markups. Still, users should always check rate fluctuations before sending large amounts.

Panda Remit often offers competitive rates for personal remittances across Asia-Pacific, Europe, and North America, with minimal exchange markups.

N26 vs Starling Bank: Speed and Convenience

Speed is a top consideration for international transfers.

-

N26: Transfers via Wise usually arrive within 0–2 business days, depending on destination and payment method.

-

Starling Bank: Most international transfers are completed in 1–2 days, though some corridors may take longer.

Both banks provide real-time notifications, in-app tracking, and easy setup for repeat transfers. According to Remitly’s transfer speed analysis, digital remittance providers now deliver funds faster than traditional institutions. For users who value rapid delivery and simplicity, Panda Remit stands out for its streamlined, all-online transfer process.

N26 vs Starling Bank: Safety and Security

Both N26 and Starling Bank meet stringent regulatory and security standards.

-

N26 is regulated by BaFin (Germany) and offers deposit protection up to €100,000 under the German Deposit Guarantee Scheme.

-

Starling Bank is regulated by the UK’s FCA and provides protection up to £85,000 via the Financial Services Compensation Scheme (FSCS).

Each platform uses biometric authentication, transaction monitoring, and real-time fraud alerts. Panda Remit also operates under strict licensing frameworks and applies encryption for secure transactions.

N26 vs Starling Bank: Global Coverage

N26 supports users across most of the European Economic Area (EEA) and facilitates global transfers through Wise, reaching over 70 countries.

Starling Bank primarily caters to UK residents but allows international transfers to over 35 currencies via Currencycloud and Wise integrations.

According to the World Bank’s remittance coverage report, broader global access is a key factor for frequent senders. While both banks have solid coverage in Europe and major global corridors, Panda Remit extends support across 40+ currencies, focusing on fast-growing Asian and Western markets.

N26 vs Starling Bank: Which One is Better?

Both N26 and Starling Bank perform well in transparency, speed, and customer satisfaction. The better choice depends on where you live and how you use the service:

-

Choose N26 if you’re in the Eurozone and want a clean, intuitive app with strong SEPA coverage.

-

Choose Starling Bank if you’re in the UK and value business account features and robust financial tools.

However, if your main goal is low-cost, high-speed international transfers, Panda Remit offers a simpler, more specialized experience for sending money abroad efficiently.

Conclusion

When comparing N26 vs Starling Bank, both deliver excellent digital banking experiences with global money transfer functionality. N26 suits EU-based users seeking multi-currency convenience, while Starling Bank excels for UK customers with powerful financial management tools.

If your focus is on international transfers, Panda Remit is a strong contender, offering:

-

Competitive exchange rates and low fees

-

Multiple payment methods (POLi, PayID, bank card, e-transfer)

-

Coverage across 40+ currencies

-

Fast, secure, and fully online transfers

For more insights, explore Forbes’ top international transfer services. With its affordability and ease of use, Panda Remit stands out as a trusted alternative for personal global payments.