OFX vs PandaRemit: Fees, Speed & Security Compared

Benjamin Clark - 2025-09-28 17:02:54.0 16

Introduction

Cross-border money transfers have become essential in today’s global economy. According to Wikipedia, remittances are significant financial flows, reaching hundreds of billions annually.

Two popular platforms in the international remittance space are OFX and PandaRemit. OFX is known for low-cost transfers, particularly for large amounts, and competitive exchange rates, making it ideal for businesses and frequent international senders. PandaRemit focuses on low fees, fast transfers, and multiple payout options, especially serving Asia and Africa.

This article will provide a comprehensive comparison of OFX vs PandaRemit, covering fees, exchange rates, speed, safety, and global coverage to help users make informed decisions for their international money transfers.

Fees and Costs

-

OFX: Offers fee-free transfers above a certain threshold (typically $1,000 or equivalent). Small transfers may incur a fixed fee. Exchange rates include a margin on top of mid-market rates.

-

PandaRemit: Transparent, low fees with many transfers offered at zero cost. Users see total costs before sending, ensuring no hidden charges.

Verdict: PandaRemit is more cost-effective for small to medium transfers, while OFX benefits users sending larger amounts.

Exchange Rates

-

OFX: Provides competitive exchange rates, often better than banks, especially for high-value transfers. Rates may fluctuate based on currency pair and market conditions.

-

PandaRemit: Offers near mid-market rates with no hidden fees and options to lock rates for predictability.

Verdict: For small or urgent transfers, PandaRemit is favorable; for large transfers, OFX may provide better margins.

Speed and Convenience

-

OFX: Transfers generally take 1–2 business days. The platform is user-friendly, with web and mobile app access.

-

PandaRemit: Transfers can complete in minutes to 24 hours depending on the destination. The mobile app allows real-time tracking and notifications.

Verdict: PandaRemit provides faster and more flexible options, particularly for urgent international transfers.

Safety and Security

-

OFX: Licensed and regulated in multiple countries, using encryption and multi-factor authentication to safeguard funds.

-

PandaRemit: Licensed across various jurisdictions, fully AML/KYC compliant, employing encryption and verification for secure transfers.

For more information on consumer protection, see ConsumerFinance.gov.

Verdict: Both are secure, with PandaRemit emphasizing global compliance and digital security.

Global Coverage (Countries, Payment Methods)

-

OFX: Supports over 190 countries and multiple currencies, primarily through bank-to-bank transfers. Payment methods mainly include bank account transfers.

-

PandaRemit: Supports 50+ countries worldwide, strong in Asia and Africa. Multiple payout options include bank accounts, e-wallets, and cash pickup.

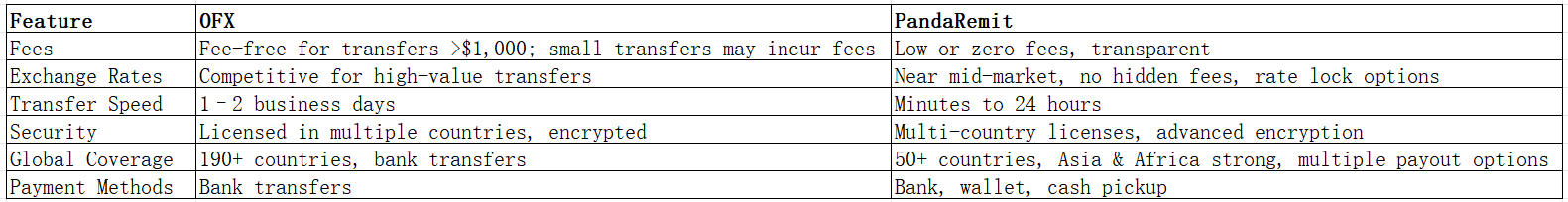

OFX vs PandaRemit Comparison Table

Official website references:

-

OFX: https://www.ofx.com

-

PandaRemit: https://www.pandaremit.com

Which One Is Better?

-

Choose OFX if you send large amounts regularly and prefer slightly better rates for high-value transfers.

-

Choose PandaRemit if you prioritize low fees, fast transfers, multiple payout options, especially to Asia and Africa, or for smaller to medium amounts.

Conclusion

The OFX vs PandaRemit comparison highlights that both platforms are secure and reliable. OFX is ideal for high-value international transfers, while PandaRemit excels in cost-efficiency, speed, and payout flexibility.

For a fast, low-cost, and convenient international transfer experience, visit PandaRemit Official Website today.