Payoneer vs PandaRemit: Fees, Speed, and Security Compared

Benjamin Clark - 15

Introduction

In today’s global economy, international money transfers have become essential for businesses and individuals. According to Wikipedia, billions of dollars move across borders annually through remittance services.

Payoneer and PandaRemit are two popular options. Payoneer serves freelancers, e-commerce businesses, and corporations, offering multi-currency accounts and global receiving solutions. PandaRemit, on the other hand, emphasizes low fees, fast transfers, and flexible payout options, making it ideal for personal users and small transfers.

This article explores Payoneer vs PandaRemit across fees, exchange rates, speed, security, and global coverage to help you make an informed decision.

Fees and Costs

-

Payoneer: Charges for account funding, withdrawals, and international transfers. Fees are transparent but may be higher for small personal transfers.

-

PandaRemit: Offers low or zero fees, a simple pricing structure, and no hidden costs.

Conclusion: PandaRemit is more economical for personal or small transfers, while Payoneer is better suited for businesses or freelancers handling larger sums.

Exchange Rates

-

Payoneer: Provides competitive rates, supports multiple currencies, but may have slightly higher spreads than mid-market rates.

-

PandaRemit: Rates are close to mid-market rates and allow locking rates, reducing exchange risk.

Conclusion: PandaRemit is cost-effective for small transfers, whereas Payoneer works well for larger cross-border payments.

Speed and Convenience

-

Payoneer: Transfers usually take 1–3 business days. The platform supports web and mobile account management, making it suitable for periodic business payments.

-

PandaRemit: Most transfers are completed within minutes to 24 hours, with real-time tracking and mobile notifications for convenience.

Conclusion: PandaRemit offers faster, more flexible transfers, ideal for personal users needing quick payments.

Safety and Security

-

Payoneer: Regulated in multiple countries, with encryption and multi-factor authentication to protect accounts.

-

PandaRemit: Licensed and compliant with AML/KYC regulations, using advanced encryption to secure transfers.

For additional consumer protection information, visit ConsumerFinance.gov.

Conclusion: Both platforms are highly secure, but PandaRemit emphasizes real-time digital safeguards and global compliance.

Global Coverage (Countries and Payment Methods)

-

Payoneer: Available in over 200 countries and regions, offering multi-currency accounts, bank transfers, and e-commerce payment solutions.

-

PandaRemit: Operates in 50+ countries, especially strong in Asia and Africa, providing bank transfers, e-wallets, and cash pickup options.

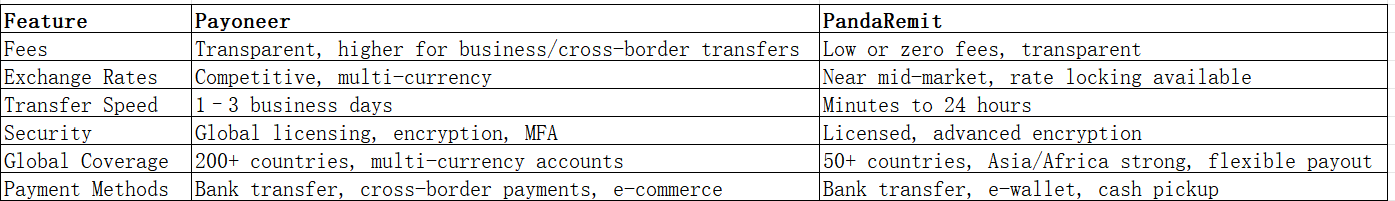

Payoneer vs PandaRemit Comparison Table

Official Websites:

-

Payoneer: https://www.payoneer.com

-

PandaRemit: https://www.pandaremit.com

Which One is Better?

-

For businesses or freelancers requiring multi-currency accounts and periodic payments, Payoneer is ideal.

-

For low-cost, fast, flexible transfers, suitable for individuals or small transfers, PandaRemit is the better choice.

Conclusion

The Payoneer vs PandaRemit comparison shows that both platforms are reliable and secure. Payoneer excels in multi-currency accounts and business payments, while PandaRemit shines in low fees, fast transfers, and flexible payout methods.

For quick, low-cost, and convenient international transfers, visit PandaRemit Official Site.