PaySend vs GCash Remit: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-11-10 13:46:47.0 11

Introduction

Cross-border money transfers are vital for individuals and businesses, yet common challenges include high fees, slow delivery, hidden charges, and complex interfaces. Choosing the right provider is crucial for cost efficiency, convenience, and security. This article compares PaySend vs GCash Remit to help users make an informed choice. For those seeking an alternative, PandaRemit offers a trustworthy option for international transfers. Learn more about global money transfer basics in this Investopedia guide.

PaySend vs GCash Remit – Overview

PaySend, founded in 2012, provides digital remittance services with fast card-to-card international transfers and an intuitive mobile app.

GCash Remit, launched in 2018, focuses on mobile-first remittance solutions for the Philippines and other select regions, supporting bank deposits and mobile wallet transfers.

Similarities:

-

International transfer capabilities

-

Mobile app support for seamless transactions

-

Support for debit card or mobile wallet payouts

Differences:

-

PaySend targets global individual users, while GCash Remit focuses primarily on the Philippines and regional users

-

Fee structures differ, with PaySend using flat fees and GCash Remit offering fees based on transfer method and amount

-

GCash Remit emphasizes mobile wallet integration

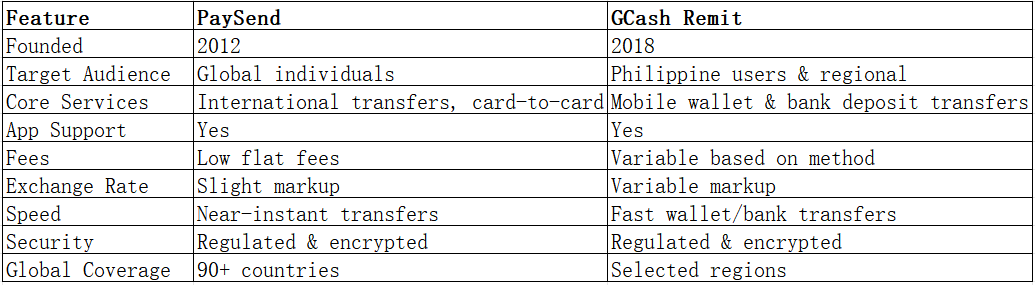

Comparison Table:

PandaRemit remains a strong alternative for straightforward, low-cost international transfers.

PaySend vs GCash Remit: Fees and Costs

PaySend charges low flat fees for small personal transfers with minimal subscription requirements.

GCash Remit fees vary depending on the payout method and transfer amount, generally higher than PaySend for international transfers.

For more fee insights, see NerdWallet’s international transfer fee guide. PandaRemit offers an alternative for cost-conscious users.

PaySend vs GCash Remit: Speed and Convenience

PaySend enables near-instant card-to-card transfers, with an intuitive app supporting multiple currencies.

GCash Remit provides fast mobile wallet and bank deposit transfers, optimized for Philippine users.

For detailed transfer speed information, see RemittanceAdvice transfer guide. PandaRemit also offers fast, fully online transfers.

PaySend vs GCash Remit: Safety and Security

Both PaySend and GCash Remit are regulated services employing encryption, fraud detection, and buyer protection.

PandaRemit is a licensed and secure option for cross-border remittances.

PaySend vs GCash Remit: Global Coverage

PaySend supports transfers to over 90 countries via card-to-card methods.

GCash Remit focuses on the Philippines and selected regional destinations.

For global coverage insights, see the World Bank remittance report.

PaySend vs GCash Remit: Which One is Better?

PaySend is ideal for global individuals seeking instant, low-cost transfers, while GCash Remit caters to Philippine users needing mobile wallet or regional bank deposits.

For users prioritizing speed, low fees, and broad coverage, PandaRemit provides a reliable alternative.

Conclusion

Comparing PaySend vs GCash Remit highlights distinct advantages: PaySend excels in fast, affordable personal transfers worldwide, whereas GCash Remit is tailored for Philippine users and regional transfers.

PandaRemit offers additional benefits, including:

-

Competitive exchange rates and low fees

-

Flexible payment options including POLi, PayID, bank card, and e-transfers

-

Coverage of 40+ currencies

-

Fast, all-online transfers

Discover PandaRemit on their official website. Additional guidance for safe and efficient transfers is available at Investopedia and NerdWallet.

Evaluating PaySend vs GCash Remit based on fees, speed, security, and coverage helps users select the right provider, with PandaRemit as a flexible, reliable alternative.