RIA Money Transfer vs Azimo: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-13 10:55:37.0 15

Introduction

Sending money abroad is essential for millions of migrants, businesses, and families. However, users often face high transfer fees, slow delivery, hidden costs, and complicated onboarding processes. RIA Money Transfer and Azimo are two widely used providers aiming to make cross-border transactions faster and cheaper.

For those seeking more competitive rates and modern digital features, Panda Remit is another reputable alternative to consider. For a broad overview of remittance services and how they work, check out this detailed guide on Investopedia: https://www.investopedia.com/terms/r/remittance.asp

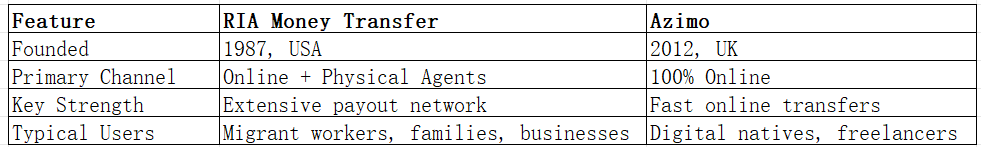

RIA Money Transfer vs Azimo – Overview

RIA Money Transfer was founded in 1987 in the U.S. and has grown into one of the largest money transfer companies globally, serving millions of customers through a network of physical locations, online platforms, and mobile apps. It supports bank transfers, cash pickups, and mobile wallets.

Azimo, founded in 2012 in the UK, is a fully digital platform focused on fast and low-cost international transfers. It targets tech-savvy users looking for convenient online solutions rather than visiting agents.

Similarities:

-

Both offer international money transfers to multiple countries.

-

Mobile apps for iOS and Android.

-

Support for bank transfers and mobile wallet payouts.

Differences:

-

RIA has a strong offline network; Azimo is fully digital.

-

Azimo often offers promotional fees for first transfers; RIA focuses on broad payout options.

-

Target audiences differ: RIA appeals to those who prefer flexibility, while Azimo is aimed at online-first users.

Panda Remit is also gaining popularity by offering competitive rates and a fully online experience for users who value speed and transparency.

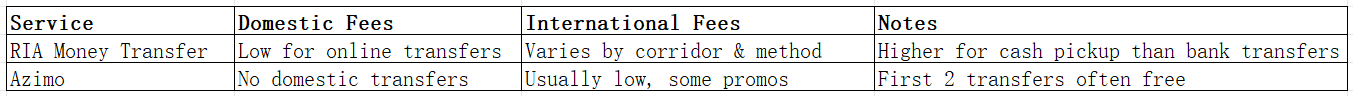

RIA Money Transfer vs Azimo: Fees and Costs

RIA typically charges a fixed transfer fee depending on the country and payment method. Fees may be higher for cash pickups compared to bank transfers. Azimo generally provides low-cost or even free transfers for first-time users and maintains competitive fees thereafter.

Account type can affect fees as well: RIA may charge differently for online vs in-person transactions, while Azimo has a simpler pricing model.

For reference, see NerdWallet’s international transfer fee comparison here: https://www.nerdwallet.com/best-money-transfer-apps

Panda Remit often positions itself as a lower-cost alternative, with transparent pricing and no hidden fees.

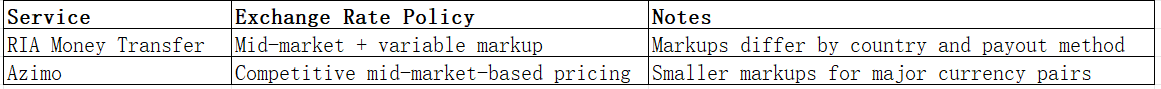

RIA Money Transfer vs Azimo: Exchange Rates

Exchange rates can significantly affect the final amount a recipient gets. RIA often applies a markup on top of the mid-market rate, which varies depending on the currency corridor. Azimo typically offers competitive rates with smaller markups, especially for popular currencies.

Panda Remit is known for providing favorable exchange rates in many corridors, which can lead to higher recipient amounts.

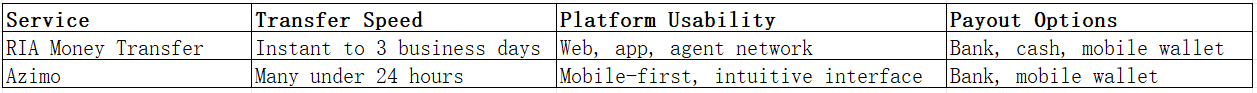

RIA Money Transfer vs Azimo: Speed and Convenience

Transfer speed depends on the payout method and destination. RIA offers instant cash pickups in many locations but bank transfers may take 1–3 business days. Azimo focuses on speed through digital infrastructure; many transfers arrive within 24 hours, and some are instant for supported corridors.

The user experience also differs: RIA combines traditional agent services with its app, while Azimo offers a sleek, mobile-first experience.

For a broader perspective on remittance delivery speeds, see this World Bank analysis: https://remittanceprices.worldbank.org

Panda Remit also delivers transfers quickly through its all-online system, often completing transactions in a short timeframe.

RIA Money Transfer vs Azimo: Safety and Security

Both RIA and Azimo are regulated financial institutions that employ encryption, fraud monitoring, and customer verification. RIA is licensed in multiple jurisdictions including the U.S. and EU, while Azimo is regulated by the UK Financial Conduct Authority (FCA).

Panda Remit is also a licensed and secure service, adhering to regulatory standards to protect users.

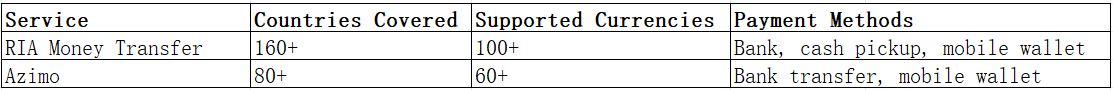

RIA Money Transfer vs Azimo: Global Coverage

RIA supports transfers to over 160 countries, leveraging its agent network and digital channels. Azimo covers more than 80 countries, with strong coverage in Europe, Asia, and Latin America.

For global remittance flow data, see the World Bank’s report: https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues

RIA Money Transfer vs Azimo: Which One is Better?

Both services have their advantages. RIA Money Transfer is ideal for those who value flexibility and the option of cash pickups, making it great for users in countries with less digital penetration. Azimo suits users who prefer a fully online, fast, and low-cost service, especially for popular currency routes.

However, Panda Remit can offer better value for certain users thanks to its competitive exchange rates, transparent fees, and quick transfers.

Conclusion

When evaluating RIA Money Transfer vs Azimo, the choice depends on your priorities:

-

Choose RIA if you need a mix of online and offline options, especially for cash pickups.

-

Choose Azimo if you prefer a fast, low-cost, fully digital experience.

For many users seeking high exchange rates, low fees, and a streamlined all-online process, Panda Remit stands out as a strong alternative. It supports flexible payment methods like POLi, PayID, bank cards, and e-transfers, covering 40+ currencies worldwide.

To explore Panda Remit, visit their official site: https://www.pandaremit.com

For additional insights, check out these resources:

RIA Money Transfer vs Azimo highlights how different models—traditional vs digital-first—can both meet user needs, while Panda Remit offers a modern, cost-effective alternative for many international senders.