Ria Money Transfer vs PaySend: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-13 11:14:48.0 19

Cross-border money transfers continue to grow in 2025 as individuals and businesses look for affordable, fast, and transparent ways to send funds globally. High fees, hidden charges, and slow delivery are still major concerns for many users. Two key players in this space are Ria Money Transfer and PaySend, both offering digital remittance solutions with global coverage. At the same time, Panda Remit has emerged as a strong alternative, offering competitive rates and fast delivery for many corridors.

For background on how international money transfers work, see this Investopedia guide.

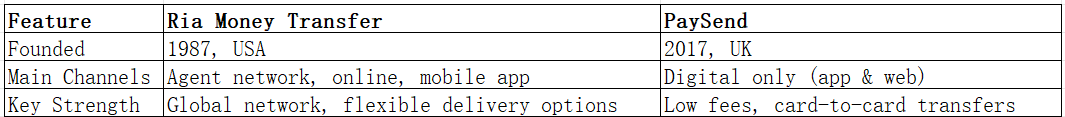

Ria Money Transfer vs PaySend – Overview

Ria Money Transfer was founded in 1987 in the United States and has grown into one of the world’s largest remittance companies. It operates a vast agent network and provides online and mobile transfers to hundreds of countries. Ria focuses on retail customers who prefer both physical locations and digital options.

PaySend, launched in 2017 in the UK, is a fully digital money transfer platform that aims to simplify global payments. Its services include app-based transfers, instant card-to-card payments, and bank transfers to a wide range of countries. PaySend targets tech-savvy users who value convenience and speed.

Similarities:

-

Both support international money transfers

-

Offer mobile apps for Android and iOS

-

Support debit card and bank account funding

Differences:

-

Ria combines physical agent locations with online services, while PaySend is fully digital

-

PaySend focuses on simplicity and low transfer fees, while Ria emphasizes broad network coverage

-

Ria supports cash pickup; PaySend focuses mainly on card and bank payouts

Panda Remit stands alongside these brands as a competitive option, particularly for users seeking low fees and fast online transfers.

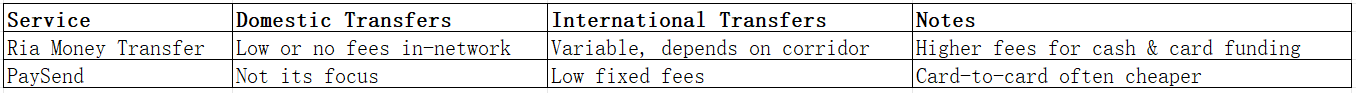

Ria Money Transfer vs PaySend: Fees and Costs

Transfer fees are a major deciding factor for users comparing remittance providers. Ria typically charges variable fees depending on the destination country, payout method, and payment type. Fees can be higher when sending cash or using credit/debit cards.

PaySend, on the other hand, promotes low fixed fees for most transfers. Users can send money directly from card to card or to bank accounts with minimal costs, making it appealing for smaller, frequent transfers.

For fee comparison references, see NerdWallet’s money transfer guide.

Panda Remit can be a cost-effective alternative in many cases, offering competitive fees without requiring physical branches.

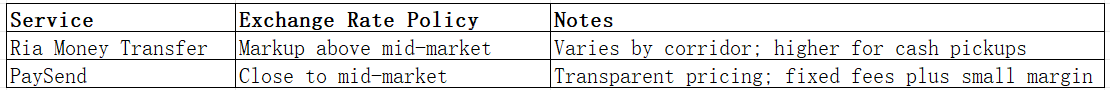

Ria Money Transfer vs PaySend: Exchange Rates

Exchange rates significantly affect the total amount received by the recipient. Ria often applies a markup above the mid-market rate, which varies depending on the corridor and payout method.

PaySend typically uses close-to-mid-market rates, making its overall cost structure transparent and easy to calculate for users.

Panda Remit is also known for offering competitive exchange rates, which can make a difference for frequent senders.

Ria Money Transfer vs PaySend: Speed and Convenience

Ria provides multiple transfer options, including cash pickup, bank deposit, and mobile wallet delivery. Transfer speed varies from minutes for cash pickups to 1–3 business days for bank transfers.

PaySend focuses on instant or near-instant transfers, especially for card-to-card payments, giving it an edge for users prioritizing speed.

For more details on transfer speeds, see Remittance Speed Guide.

Panda Remit also emphasizes fast, fully online transfers.

Ria Money Transfer vs PaySend: Safety and Security

Both providers are regulated and licensed in multiple jurisdictions. Ria is regulated by the U.S. Department of the Treasury and other financial authorities globally. PaySend is regulated by the UK’s Financial Conduct Authority (FCA). Both use strong encryption and anti-fraud systems to protect users.

Panda Remit is also fully licensed in its operating markets and uses modern security measures.

Ria Money Transfer vs PaySend: Global Coverage

Ria boasts one of the largest payout networks worldwide, supporting hundreds of countries and diverse delivery methods including cash pickup, bank deposit, and mobile wallets.

PaySend’s coverage is narrower but growing, with a focus on efficient digital corridors and popular destinations.

For global remittance data, refer to the World Bank Remittance Data.

Ria Money Transfer vs PaySend: Which One is Better?

Both Ria and PaySend have clear strengths. Ria excels in coverage and flexibility, making it suitable for users who need physical agent locations or cash pickup. PaySend stands out for its low fees, transparent pricing, and speed—ideal for frequent digital transfers.

For some users, however, Panda Remit may offer even better value thanks to its competitive fees and exchange rates, along with a fully online experience.

Conclusion

When choosing between Ria Money Transfer vs PaySend, the right option depends on your specific needs. If you value extensive coverage and physical agent support, Ria is a solid choice. If you prefer low, transparent fees and fast digital transfers, PaySend might be the better fit.

Alternatively, Panda Remit provides another strong option. With competitive exchange rates, low fees, flexible payment methods (such as POLi, PayID, bank card, and e-transfer), and fast online transfers, it’s worth considering.

For more comparisons, visit NerdWallet or explore Panda Remit’s official website.