WeChat Pay vs PandaRemit: Fees, Speed, Exchange Rates and Coverage

Benjamin Clark - 2025-09-29 10:05:11.0 19

Introduction

International money transfers are a crucial part of global finance, helping individuals and businesses move funds across borders efficiently. According to Wikipedia, remittances account for billions of dollars in yearly global transactions. This article compares WeChat Pay vs PandaRemit, two platforms that enable digital payments and money transfers. WeChat Pay is China’s popular digital wallet, primarily for domestic use with limited international options. PandaRemit focuses on low-cost, fast, and secure international transfers with wide global accessibility. Understanding their differences will help you select the most suitable remittance service for your needs.

Official websites:

-

WeChat Pay: https://pay.weixin.qq.com/

-

PandaRemit: https://www.pandaremit.com/

Fees and Costs

Fees significantly influence the amount received by recipients.

-

WeChat Pay: Domestic transfers are generally free. Cross-border payments are limited and may incur higher fees depending on destination and payment method.

-

PandaRemit: Provides transparent, low-cost international transfers. Many transfers are fee-free or carry minimal charges, making it cost-efficient for users sending money abroad.

Key Insight: PandaRemit is more affordable for international remittances, while WeChat Pay is ideal for domestic transactions.

Exchange Rates

Exchange rates impact how much money the recipient ultimately receives.

-

WeChat Pay: Cross-border transfers use partner bank rates, which may include markups and reduce net value.

-

PandaRemit: Offers near mid-market rates with full transparency, allowing users to maximize the transfer value.

Verdict: PandaRemit generally offers better exchange rates for international transfers.

Speed and Convenience

The speed of transfer is crucial, especially for urgent payments.

-

WeChat Pay: Domestic transfers are instant. International remittances depend on banking partners and may take longer.

-

PandaRemit: Transfers are usually completed within minutes to 24 hours, accessible via both app and website.

Result: PandaRemit provides faster international remittance, while WeChat Pay excels in domestic convenience.

Safety and Security

Security is essential for any money transfer platform.

-

WeChat Pay: Follows China’s financial regulations, with encrypted transactions and monitoring for fraudulent activity.

-

PandaRemit: Complies with multiple international regulations, using advanced encryption and verification processes. For tips on safe transfers, see ConsumerFinance.gov.

Both platforms are secure, but PandaRemit offers broader international compliance.

Global Coverage

Global reach determines where and how users can send money.

-

WeChat Pay: Mainly supports domestic payments with limited international coverage in select countries.

-

PandaRemit: Supports transfers to over 40 countries worldwide with multiple payment options, including bank transfers, credit cards, and mobile wallets.

Conclusion: PandaRemit provides broader global access, making it more versatile for international users.

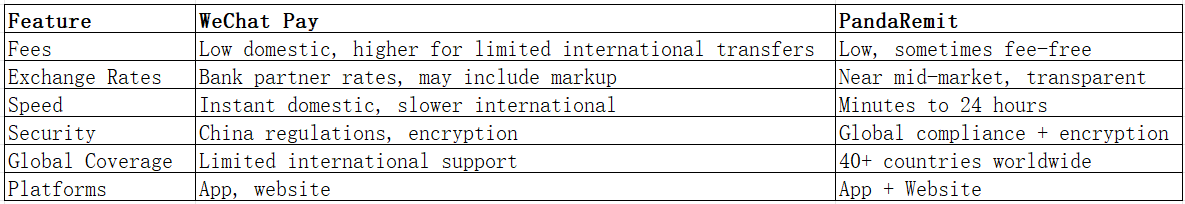

Comparison Table

Official websites:

-

WeChat Pay: https://pay.weixin.qq.com/

-

PandaRemit: https://www.pandaremit.com/

Which One is Better?

Choosing between WeChat Pay vs PandaRemit depends on your priorities:

-

For domestic payments within China, WeChat Pay provides instant, reliable service.

-

For international remittances with low fees, fast delivery, and global reach, PandaRemit is the better choice.

Conclusion

In summary, WeChat Pay vs PandaRemit highlights two distinct services. WeChat Pay is ideal for domestic transfers in China, while PandaRemit excels in secure, fast, and cost-effective international money transfers. For an affordable and globally accessible remittance experience, visit PandaRemit official website.