Wise vs PaySend: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-09-30 14:16:43.0 145

Introduction

Cross-border money transfers often involve high fees, slow processing, and complex processes that frustrate both senders and recipients. Wise and PaySend are two major services addressing these challenges. Wise is recognized for transparent fees and fast, fully online transfers, while PaySend focuses on low-cost card-to-card payments with global accessibility. For users seeking alternative options, PandaRemit offers competitive rates and rapid transfers. For a complete guide on international money transfers, see Investopedia’s remittance guide.

Wise vs PaySend – Overview

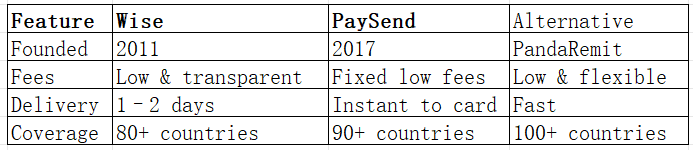

Wise was founded in 2011, offering mid-market exchange rates, multi-currency accounts, and a user-friendly app. It primarily serves individuals and businesses needing affordable digital transfers.

PaySend started in 2017, providing low-cost international card-to-card transfers with a focus on speed and broad coverage.

Similarities:

-

Both provide international transfers.

-

Mobile apps and digital platforms.

-

Support for debit and credit card payments.

Differences:

-

Wise emphasizes transparent fees and mid-market rates.

-

PaySend targets card-to-card payments with fixed low fees.

-

Wise prioritizes digital banking integration, PaySend emphasizes global card reach.

Quick Summary Table:

Wise vs PaySend: Fees and Costs

Wise applies a small percentage plus fixed fee per transfer, making it cost-effective. Multi-currency accounts further reduce conversion costs.

PaySend charges a fixed low fee per card-to-card transfer, regardless of amount, appealing to frequent small transfers.

For a detailed fee comparison, refer to NerdWallet’s international transfer fees guide.

PandaRemit offers competitive fees for larger amounts and recurring transfers, often lower than Wise and PaySend.

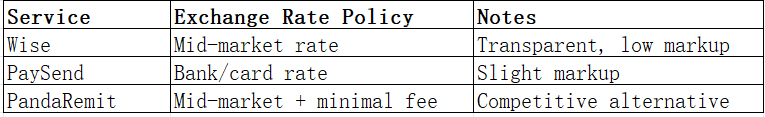

Wise vs PaySend: Exchange Rates

Wise offers mid-market rates with a transparent markup. Users can see the exact rate upfront.

PaySend applies slightly less favorable rates for certain currencies but keeps fees predictable.

Wise vs PaySend: Speed and Convenience

Wise typically completes transfers in 1–2 business days, with real-time tracking and multi-currency wallet support.

PaySend offers instant transfers to cards, but bank-to-bank transfers may take longer.

For transfer speed insights, see WorldRemit speed guide.

PandaRemit also provides rapid transfers within hours and a fully online experience.

Wise vs PaySend: Safety and Security

Wise is regulated internationally, offering encryption and two-factor authentication.

PaySend adheres to global financial regulations with additional verification for card payments.

PandaRemit is licensed, fully encrypted, and provides a secure alternative.

Wise vs PaySend: Global Coverage

Wise supports 80+ countries and 50+ currencies, primarily digital.

PaySend reaches 90+ countries with card-to-card transfers.

See the World Bank remittance coverage report for global insights.

Wise vs PaySend: Which One is Better?

Wise suits users who value transparency, mid-market rates, and digital convenience. PaySend is ideal for instant card-to-card transfers globally.

For users seeking a blend of speed, cost efficiency, and flexibility, PandaRemit provides significant value.

Conclusion

In the Wise vs PaySend comparison, Wise offers transparent fees and digital convenience, while PaySend excels in low-cost, card-to-card transfers. Both are reliable, but PandaRemit stands out with competitive rates, fast transfers, and flexible payment options.

PandaRemit advantages:

-

High exchange rates & low fees

-

Multiple payment methods (POLi, PayID, bank card, e-transfer)

-

40+ currency coverage

-

Rapid, fully online transfers

For more guidance, check Investopedia and NerdWallet for fee comparisons.

Choosing between Wise, PaySend, or PandaRemit depends on your transfer needs, budget, and preferred speed and convenience.