MoneyGram vs Zelle: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-11 15:57:10.0 28

Introduction

Sending money internationally can be fraught with high fees, slow delivery, hidden charges, and a complex user experience. MoneyGram and Zelle are two popular options for 2025, each offering unique advantages. MoneyGram provides a vast global network and multiple payout methods, including cash and bank transfers. Zelle is primarily bank-integrated and ideal for domestic transfers, emphasizing convenience and speed through app-based services. PandaRemit offers an all-online solution that is fast, secure, and cost-effective. For more insights on international transfers, visit Investopedia's guide.

MoneyGram vs Zelle – Overview

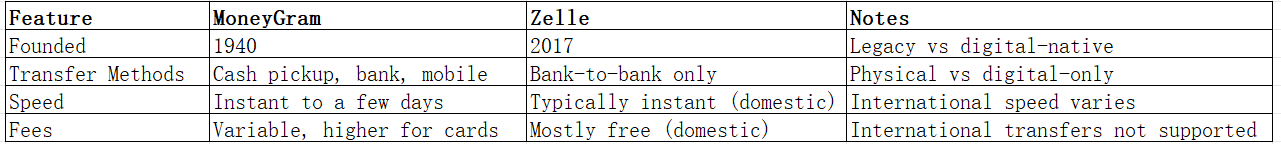

MoneyGram, founded in 1940, is a well-established provider specializing in international transfers through agents, online platforms, and mobile apps, serving users worldwide.

Zelle, launched in 2017, is a digital payment network integrated with many U.S. banks, focusing on instant transfers between bank accounts.

Similarities: Both services enable money transfers and offer app support, though the scope differs.

Differences: MoneyGram supports international transfers and cash pickups, while Zelle focuses on domestic, bank-to-bank transfers.

PandaRemit is another convenient online alternative for cross-border transfers.

MoneyGram vs Zelle: Fees and Costs

MoneyGram fees vary by destination, amount, and payment method, generally higher for card transactions. Zelle is free for domestic transfers between U.S. bank accounts, but does not support international remittances.

For detailed fee comparisons, see NerdWallet.

PandaRemit offers low fees for fully online international transfers.

MoneyGram vs Zelle: Exchange Rates

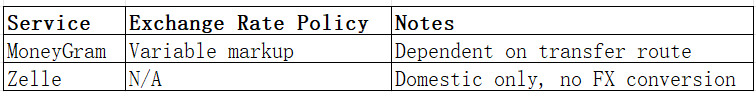

MoneyGram applies a markup on exchange rates depending on the corridor. Zelle does not handle currency conversion as it is U.S.-domestic only.

PandaRemit can provide competitive exchange rates for international online transfers.

MoneyGram vs Zelle: Speed and Convenience

MoneyGram transfers may take minutes to days depending on the destination and payout method. Zelle transfers are usually instant between participating U.S. banks, ideal for domestic use.

For more on transfer speeds, see WorldRemit Speed Guide.

PandaRemit enables fast, fully online international transfers without the need for physical locations.

MoneyGram vs Zelle: Safety and Security

MoneyGram is regulated globally and uses encryption, fraud protection, and buyer protection measures. Zelle leverages bank-level security and two-factor authentication but does not cover international transfers.

PandaRemit is a licensed provider following international security standards.

MoneyGram vs Zelle: Global Coverage

MoneyGram supports over 200 countries with multiple payout methods. Zelle only operates domestically in the U.S. and does not facilitate cross-border transfers.

For remittance coverage data, see World Bank Remittance Data.

MoneyGram vs Zelle: Which One is Better?

MoneyGram is ideal for users requiring international reach and multiple payout options. Zelle excels for domestic, instant, bank-to-bank transfers in the U.S.

For international, low-fee, online transfers, PandaRemit is a practical alternative.

Conclusion

In the MoneyGram vs Zelle comparison, MoneyGram stands out with its extensive global network and multiple payout options, while Zelle offers fast and free domestic transfers. Users should consider transfer frequency, destination, and cost when selecting a service.

PandaRemit advantages include:

-

Competitive exchange rates & low fees

-

Flexible payment methods (POLi, PayID, bank card, e-transfer)

-

Coverage of 40+ currencies

-

Fast, fully online transfers

For more information, visit PandaRemit Official Site, Investopedia Remittance Guide, and World Bank Remittance Data. MoneyGram vs Zelle has different strengths, while PandaRemit provides a convenient, cost-effective online alternative.