RIA Money Transfer vs Xoom: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-11 16:08:38.0 27

Introduction

Cross-border money transfers are crucial for individuals and businesses worldwide, yet high fees, slow delivery, hidden charges, and usability issues often frustrate users. RIA Money Transfer and Xoom are two prominent services providing international transfers with mobile apps and various payment options. While RIA focuses on extensive agent networks, Xoom emphasizes quick digital transfers. For those seeking alternatives with flexible payment methods and competitive rates, PandaRemit offers a secure option. According to Investopedia, understanding service differences is key to saving time and money on cross-border transfers.

RIA Money Transfer vs Xoom – Overview

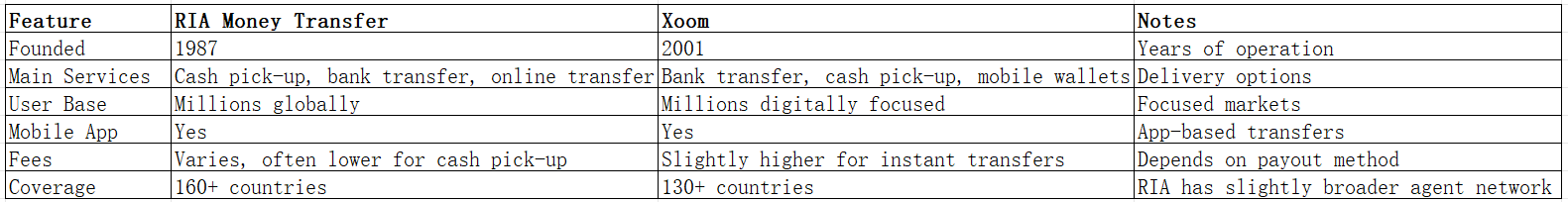

RIA Money Transfer, founded in 1987, offers money transfers through physical locations and online channels, serving millions globally. Xoom, launched in 2001, specializes in digital-first transfers, focusing on speed and convenience for bank-to-bank, cash pick-up, and mobile wallet options. Both platforms allow mobile app usage, provide security features, and support multiple currencies. Differences lie in pricing structures, geographic coverage, and delivery speed.

PandaRemit is also a notable option for online transfers, offering flexible payment solutions.

RIA Money Transfer vs Xoom: Fees and Costs

RIA's fees vary depending on transfer amount, payment method, and destination. Bank-to-bank transfers often incur minimal charges, while cash pick-up may have modest fees. Xoom charges slightly higher fees for instant transfers but may offer promotions for first-time users. Users with recurring transfers may consider subscription or account-level benefits.

For a detailed fee comparison, refer to NerdWallet. PandaRemit can also serve as a lower-cost alternative for online transfers.

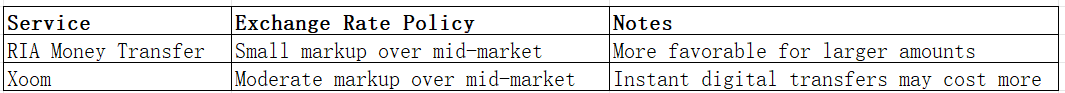

RIA Money Transfer vs Xoom: Exchange Rates

Exchange rates affect the total transfer cost. RIA typically applies a small markup on mid-market rates, while Xoom may include slightly higher markups for faster delivery.

PandaRemit often provides competitive rates with transparent policies.

RIA Money Transfer vs Xoom: Speed and Convenience

RIA's delivery times range from a few minutes (cash pick-up in select countries) to 2-3 business days for bank transfers. Xoom offers faster digital-first transfers, often within minutes for domestic or major international routes. Both services support mobile apps, but Xoom focuses heavily on a digital-first experience with streamlined bank integrations.

For insights on transfer speeds, see Remitly Speed Guide. PandaRemit can be a fast alternative with flexible online options.

RIA Money Transfer vs Xoom: Safety and Security

Both RIA and Xoom are regulated by financial authorities, implement encryption, fraud protection, and offer customer support for dispute resolution. PandaRemit is also a licensed and secure platform, ensuring safe transactions.

RIA Money Transfer vs Xoom: Global Coverage

RIA supports over 160 countries, with extensive cash pick-up networks. Xoom covers around 130 countries, emphasizing bank and mobile wallet transfers.

For comprehensive remittance coverage data, refer to World Bank Remittance Report.

RIA Money Transfer vs Xoom: Which One is Better?

RIA suits users prioritizing broad agent networks and varied payout options. Xoom is better for users seeking instant digital transfers. For those valuing cost-effectiveness, speed, and fully online processes, PandaRemit may offer superior convenience.

Conclusion

Comparing RIA Money Transfer vs Xoom reveals differences in fees, speed, and coverage. RIA is ideal for extensive cash pick-ups, while Xoom caters to fast digital transfers. PandaRemit serves as a strong alternative with high exchange rates, low fees, flexible payment methods like POLi, PayID, bank cards, e-transfer, coverage of 40+ currencies, and fast, all-online processing. For additional guidance, visit PandaRemit Official Site or consult Investopedia for comparative reviews. Evaluating your priorities ensures the best money transfer cho