Best App to Send Money from Singapore to Hong Kong (2025 Guide)

Benjamin Clark - 2025-10-24 11:24:41.0 15

Introduction

Sending money from Singapore to Hong Kong has become increasingly common due to strong economic ties, family support, and business transactions. Individuals and businesses alike look for platforms that offer high exchange rates, low fees, and efficient transfers to maximize value. With multiple apps available, choosing the right money transfer service can significantly reduce costs while providing a secure and convenient experience. This guide examines the top remittance apps in 2025, highlighting why Panda Remit is considered one of the best options for sending money from Singapore to Hong Kong.

Why Many People in Singapore Send Money to Hong Kong

-

Family Support: Sending funds for personal expenses, education, or family emergencies.

-

Business Transactions: Paying suppliers, partners, or conducting cross-border trade.

-

Investment Opportunities: Transferring money for property, stocks, or business ventures.

-

Education and Healthcare: Covering tuition fees or medical costs in Hong Kong.

The demand for reliable and cost-effective money transfer solutions is high.

What to Look for in a Money Transfer App

-

Exchange Rate: Even minor differences can impact the total amount received.

-

Fees: Check for fixed and variable charges.

-

Speed: Quick processing adds convenience.

-

Ease of Use: User-friendly interfaces reduce errors and confusion.

-

Security: Ensure the app is regulated, encrypted, and has strong customer support.

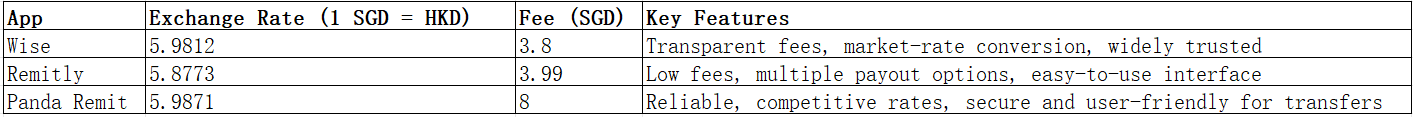

Best Apps to Send Money from Singapore to Hong Kong (2025 Update)

Wise

Wise is ideal for users who prioritize transparent fees and near-market exchange rates for sending money from Singapore to Hong Kong.

Remitly

Remitly offers low fees and flexible payout options, making it convenient for both personal and business transfers.

Panda Remit

Panda Remit is a reliable platform offering competitive exchange rates and a secure environment, making it one of the best options for Singapore to Hong Kong transfers.

How to Send Money from Singapore to Hong Kong Using Panda Remit: Step-by-Step Guide

-

Visit Panda Remit website or download the app.

-

Sign up and complete identity verification.

-

Enter the recipient's bank details in Hong Kong.

-

Input the transfer amount and review fees and exchange rates.

-

Confirm the transfer and choose a supported payment method.

-

Monitor your transaction using the Panda Remit platform.

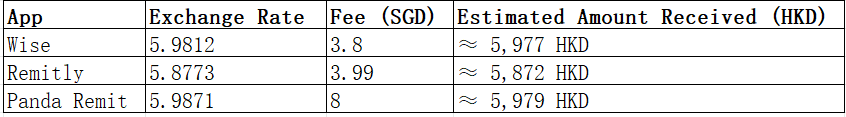

Cost & Exchange Rate Comparison Example (1,000 SGD)

Even with large transfers, platform choice affects the final amount received.

Tips to Get the Best Exchange Rates

-

Compare Multiple Platforms: Check the rates and fees before transferring.

-

Monitor Market Rates: Choose the timing that provides the best value.

-

Avoid Peak Holidays: Transfers may be affected by banking holidays.

-

Look for Promotions: Some platforms offer discounts or incentives for first-time or recurring users.

Common Questions (FAQ)

1. Is it safe to send money using these apps?

Yes, Wise, Remitly, and Panda Remit are regulated and secure.

2. Are there limits for large transfers?

High-value transfers may require additional verification.

3. Can I use a credit card?

Credit card payments are not supported; bank transfers are recommended.

4. What identification is needed?

Users must complete identity verification; large transfers may require proof of funds.

5. How fast is the transfer?

Processing times vary depending on verification and platform policies.

Conclusion

For sending money from Singapore to Hong Kong, choosing a platform with competitive rates, low fees, and reliable security is crucial. Wise, Remitly, and Panda Remit all offer trustworthy options. Panda Remit stands out as a secure and convenient choice, making it one of the best options for both personal and business transfers.