Cheapest Way to Send Small Amounts from Singapore to Philippines

Benjamin Clark - 2025-10-23 09:50:17.0 16

Sending small amounts of money from Singapore to the Philippines has become increasingly common among overseas Filipino workers (OFWs), freelancers, and families supporting loved ones back home. Many people look for the cheapest way to send money from Singapore to the Philippines, focusing on platforms that offer high exchange rates, minimal fees, and reliable delivery. In 2025, digital remittance apps like Wise, Remitly, and Panda Remit make small transfers easier and more affordable than ever.

Why Many People in Singapore Send Money to the Philippines

Singapore is home to a large Filipino community, including domestic workers, nurses, IT professionals, and entrepreneurs. Most Filipinos send part of their earnings back home to support their families, pay bills, or contribute to savings and investments.

Sending money to the Philippines isn’t just about necessity—it’s about trust and convenience. Filipinos in Singapore value platforms that provide low fees, good exchange rates, and user-friendly apps. Many remittance services now allow users to transfer money anytime through mobile apps, helping families receive funds almost instantly.

What to Look for in a Money Transfer App

When transferring smaller amounts, even small fee differences can affect the total received. Here’s what to consider when choosing the best money transfer app:

-

Exchange Rate: Check if the app offers real mid-market rates or adds a markup. A better rate means your family receives more pesos.

-

Transfer Fees: For small transfers, avoid apps that charge fixed high fees.

-

Speed: While speed matters, focus on cost-efficiency and reliability.

-

Ease of Use: A clean, simple interface makes repeat transfers easier.

-

Security: Choose apps regulated by MAS (Monetary Authority of Singapore) with encryption and two-factor authentication.

Best Apps to Send Money from Singapore to the Philippines (2025 Update)

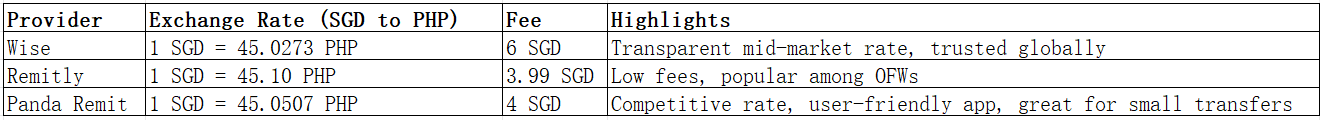

There are several trusted remittance apps for sending small amounts to the Philippines. Let’s compare the top three — Wise, Remitly, and Panda Remit — all popular among Singapore users.

Panda Remit stands out for its low fees and strong SGD–PHP exchange rates, making it one of the most affordable options for small transfers. While Wise and Remitly also provide reliable services, Panda Remit often appeals to users who prioritize value per transaction.

Competitor links: Wise | Remitly

How to Send Money from Singapore to the Philippines Using Panda Remit: Step-by-Step Guide

Sending money with Panda Remit is quick and straightforward. Here’s a simple guide:

-

Visit Panda Remit’s official website or download the app.

-

Register using your Singapore phone number and verify your identity with SingPass or ID.

-

Add your recipient’s details – name, bank account, or e-wallet info in the Philippines.

-

Enter the transfer amount in SGD and check the exchange rate and fees.

-

Confirm and send. Panda Remit will process your transfer securely.

Panda Remit’s intuitive design and low costs make it suitable for users who frequently send smaller remittances to the Philippines.

Cost & Exchange Rate Comparison Example

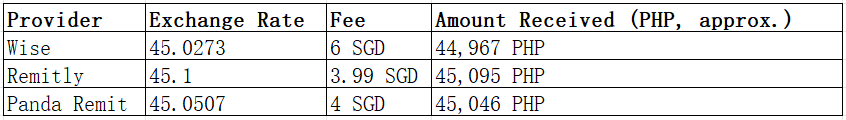

Let’s compare how much your recipient would receive if you send 1,000 SGD:

This example shows that Remitly provides slightly higher peso output in this case, but Panda Remit remains a strong choice due to its balance between rate and fee, plus consistent user experience.

Tips to Get the Best Exchange Rates

Getting the most value from your transfer isn’t just about choosing the right app—it’s about timing and habits:

-

Compare regularly: Exchange rates fluctuate daily; check multiple apps before sending.

-

Send on weekdays: Rates can be more stable during business days.

-

Avoid fixed-fee transfers for small amounts: Percentage-based or low flat-fee apps save more.

-

Use loyalty programs: Some apps, including Panda Remit, offer referral or cashback bonuses.

-

Track exchange rate trends: If rates are lower, waiting a day or two might increase your total.

Common Questions (FAQ)

1. What is the cheapest way to send small amounts from Singapore to the Philippines?

Apps like Panda Remit, Remitly, and Wise are among the cheapest, depending on the daily rate and fees.

2. Can I use Panda Remit for both small and large transfers?

Yes, Panda Remit supports various transfer amounts, ideal for both everyday remittances and bigger payments.

3. Are money transfer apps safe to use in Singapore?

Yes. Reputable apps are regulated by MAS and follow strict data security protocols.

4. Which app offers the best exchange rate to PHP?

Rates vary, but Panda Remit and Wise usually provide competitive, transparent rates.

5. Can I pay by credit card?

Currently, most remittance services—including Panda Remit—do not support credit card payments.

Conclusion

Finding the cheapest way to send small amounts from Singapore to the Philippines depends on fees, exchange rates, and convenience. Wise, Remitly, and Panda Remit each offer reliable options. However, Panda Remit stands out as one of the best overall choices for affordability and ease of use. With transparent pricing and strong SGD–PHP rates, Panda Remit continues to help Filipinos send money home safely and economically.