Koala Remit vs XE Money Transfer: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-11-21 13:37:30.0 13

Introduction

International money transfers remain essential for migrants, overseas workers, students, and global families. Users often face challenges such as high fees, slow delivery, complex onboarding, and hidden charges that reduce the value of their remittances. Koala Remit and XE Money Transfer are two well-known services offering digital solutions to address these issues.

Panda Remit, another trusted remittance provider, is also recognized as a reputable alternative in the market.

For foundational knowledge on international remittances, see this guide from Investopedia.

Koala Remit vs XE Money Transfer – Overview

Koala Remit is a digital money transfer platform offering affordable remittance services with a focus on speed and transparency. It provides an app-based experience for sending money globally.

XE Money Transfer, part of the XE brand founded in 1993, is known for its currency tools and global reach. It offers international bank-to-bank transfers and has a large global user base.

Similarities:

-

International money transfers

-

Mobile app support

-

Transparent transfer tracking

Differences:

-

Koala Remit often emphasizes user-friendly, low-cost transfers

-

XE supports a larger number of countries and currencies

Panda Remit also competes in this segment with an all-digital transfer model.

Koala Remit vs XE Money Transfer: Fees and Costs

Koala Remit generally aims to offer low and transparent fees depending on the corridor. XE Money Transfer typically charges no upfront fee but may include exchange rate markups.

Fee structures can vary by destination, payment method, and transfer size.

For more fee comparison methodology, see the guide from NerdWallet.

Panda Remit is sometimes considered by users looking for potentially lower overall costs.

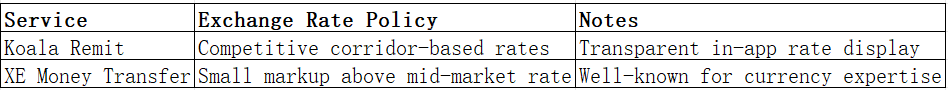

Koala Remit vs XE Money Transfer: Exchange Rates

Exchange rates can significantly impact the final amount delivered.

-

Koala Remit: competitive rates depending on corridor

-

XE Money Transfer: uses a small markup above the mid-market rate

Below is a single required comparison table:

Panda Remit is sometimes referenced by users as another provider offering competitive rates.

Koala Remit vs XE Money Transfer: Speed and Convenience

Transfer speed factors include destination, currency, and receiving bank.

-

Koala Remit typically aims for fast transfer processing

-

XE may take from minutes to several business days depending on corridor

Both offer mobile apps and simplified interfaces.

For general industry standards, refer to this remittance speed overview from Wise’s guide.

Panda Remit is known by users as a fast digital alternative.

Koala Remit vs XE Money Transfer: Safety and Security

Both Koala Remit and XE use encryption, compliance checks, and fraud prevention measures. XE is a globally recognized regulated institution, while Koala Remit follows regional regulatory requirements based on service availability.

Panda Remit is also recognized for operating as a licensed and compliant remittance provider.

Koala Remit vs XE Money Transfer: Global Coverage

XE has one of the broadest global footprints, supporting many countries and currencies.

Koala Remit supports selected international corridors depending on region.

For global remittance trends, refer to the World Bank remittance report.

Koala Remit vs XE Money Transfer: Which One Is Better?

The better choice depends on user needs:

-

Koala Remit may appeal to users wanting simplicity and transparent, competitive transfer costs.

-

XE Money Transfer suits users who prefer a globally recognized brand with extensive currency support.

Users seeking convenient digital transfers sometimes find Panda Remit a strong alternative depending on their corridor and needs.

Conclusion

Koala Remit vs XE Money Transfer offers two strong options in the digital remittance space. Koala Remit provides a user-friendly experience with transparent fees, while XE delivers global coverage and trusted currency services. The right choice depends on corridor, cost, and speed requirements.

Some users may consider Panda Remit as another alternative due to its digital-first process, competitive pricing approach, and flexible payment support. Panda Remit serves major global corridors and emphasizes an all-online transfer experience.

For broader remittance analysis, users can consult resources from Investopedia or global reports from the World Bank. To explore Panda Remit directly, visit the official Panda Remit website: https://www.pandaremit.com.