Large Amount Transfer from Singapore to Philippines: Safe Options

Benjamin Clark - 2025-10-23 10:02:37.0 18

Sending large amounts of money from Singapore to the Philippines requires careful planning. High-value transfers demand platforms that provide reliable service, competitive rates, and strong security. Many Filipino expatriates and professionals regularly transfer funds to support family, investments, or business needs. Choosing the right platform can reduce costs, provide transparency, and ensure funds reach recipients safely. In 2025, digital remittance solutions like Wise, Remitly, and Panda Remit offer a combination of efficiency, low fees, and trustworthy service, making large transfers easier than ever.

Why Many People in Singapore Send Money to Philippines

The Filipino community in Singapore is extensive, including domestic workers, corporate professionals, and entrepreneurs. Many need to send substantial amounts back home for major expenses such as education, property, or investment. Large transfers also require secure channels that reduce the risk of errors or delays.

Beyond necessity, convenience and cost-efficiency are key. Digital remittance platforms allow users to send funds without visiting physical branches, track payments, and compare rates to maximize the value of each transfer.

What to Look for in a Money Transfer App

When transferring large sums, these factors become even more critical:

-

Exchange Rate: Small differences in rates can significantly impact the final amount received.

-

Fees: Lower fees save more money when sending high-value transfers.

-

Speed: Reliable delivery ensures recipients get the funds safely.

-

Ease of Use: Platforms should be intuitive to handle complex transfers easily.

-

Security: Ensure the app is licensed and uses encryption to protect personal and financial data.

Best Apps to Send Money from Singapore to Philippines (2025 Update)

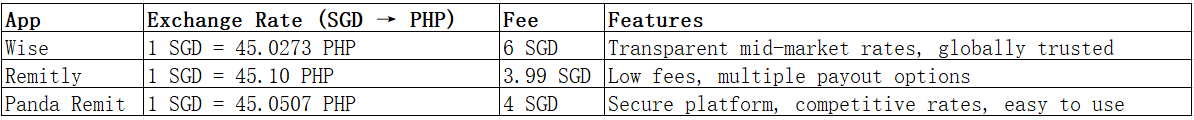

Below is a comparison of three leading apps for high-value transfers:

Panda Remit (pandaremit.com) is recognized as a reliable option for high-value transfers, balancing cost efficiency, usability, and safety. Users can also explore Wise and Remitly to compare rates and features.

How to Send Money from Singapore to Philippines Using Panda Remit: Step-by-Step Guide

-

Register on Panda Remit or via the app.

-

Verify your account with a valid ID for secure transactions.

-

Enter recipient details including bank or e-wallet information.

-

Specify the transfer amount and review exchange rate and fees.

-

Confirm and send to complete the high-value transfer securely.

Panda Remit is designed to handle large amounts reliably, making it a practical choice for regular high-value remittances.

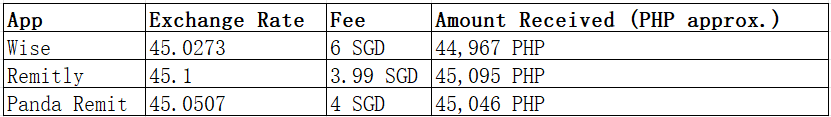

Cost & Exchange Rate Comparison Example

Here’s a sample calculation for sending 1,000 SGD:

Although differences seem small, for large sums the combined effect of fees and rates can be significant, making Panda Remit a cost-effective choice for large transfers.

Tips to Get the Best Exchange Rates

-

Compare multiple platforms before sending large amounts.

-

Avoid unnecessary fixed fees; proportional fees save money on high-value transfers.

-

Check rates during weekdays for more stable conditions.

-

Use loyalty programs or referrals if available.

-

Plan your timing to maximize rate advantages.

Common Questions (FAQ)

1. Which platform is safest for large transfers from Singapore to Philippines?

Panda Remit, Wise, and Remitly are all regulated and secure for high-value transfers.

2. Can I send more than 1,000 SGD at once?

Yes, all platforms support higher amounts, subject to verification requirements.

3. Are there hidden fees?

Reputable platforms clearly display fees and exchange rates before confirming transfers.

4. Is Panda Remit suitable for frequent high-value transfers?

Yes, it is designed for both small and large remittances, balancing cost and security.

5. Can I pay using a credit card?

Currently, these platforms, including Panda Remit, do not support credit card payments.

Conclusion

For those seeking safe and cost-effective large transfers from Singapore to Philippines, choosing the right remittance app is crucial. While Wise and Remitly offer reliability and competitive rates, Panda Remit stands out as one of the best options, offering a secure platform, competitive rates, and user-friendly experience. With Panda Remit, high-value transfers become straightforward, cost-efficient, and dependable.