MoneyGram vs CurrencyFair: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-10 14:56:51.0 20

International money transfers are crucial for families, businesses, and freelancers. However, high fees, slow processing, and complex operations often frustrate users. MoneyGram and CurrencyFair each have their strengths. For users looking for low-cost, fast, and secure online transfers, Panda Remit (https://www.pandaremit.com/) provides a transparent and convenient solution. More insights on international transfers can be found on Investopedia (https://www.investopedia.com/).

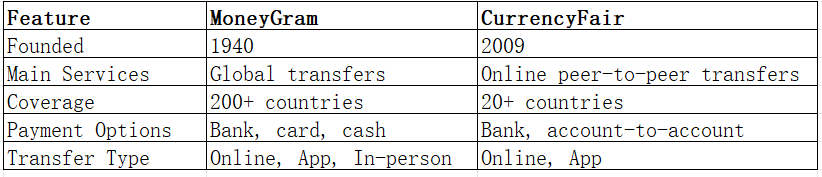

MoneyGram vs CurrencyFair – Overview

MoneyGram, founded in 1940, is a globally recognized money transfer service covering over 200 countries and territories, supporting bank transfers, cash pick-up, and mobile app operations.

CurrencyFair, founded in 2009, specializes in peer-to-peer online transfers, offering low fees and rates close to the market rate.

Similarities: Both provide international transfers, mobile apps, and bank account support.

Differences: MoneyGram offers global coverage and multiple payout options, while CurrencyFair is best suited for online peer-to-peer transfers with lower fees.

Panda Remit is another cost-effective international transfer option.

MoneyGram vs CurrencyFair: Fees and Costs

MoneyGram fees vary depending on the transfer amount, destination, and payout method. Cash pick-up fees are typically higher, while bank transfers are relatively cheaper.

CurrencyFair offers low fees through peer-to-peer transfers, close to market rates.

Panda Remit provides transparent, low-cost transfers. Fee comparisons can be referenced on NerdWallet (https://www.nerdwallet.com/best-money-transfer).

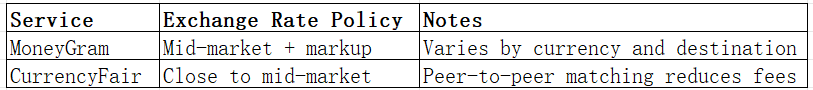

MoneyGram vs CurrencyFair: Exchange Rates

MoneyGram applies a markup on mid-market rates, which varies by currency and channel.

CurrencyFair offers rates close to the mid-market rate via peer-to-peer matching, reducing fees.

Panda Remit provides competitive rates to maximize transfer value.

MoneyGram vs CurrencyFair: Speed and Convenience

MoneyGram cash pick-ups can be instant, while bank transfers take 1–3 business days. CurrencyFair online transfers typically take 1–2 business days.

Panda Remit offers fast online transfers. More on transfer speed at FXC Intelligence (https://www.fxcintel.com/research/reports/remittance-speed).

MoneyGram vs CurrencyFair: Safety and Security

MoneyGram is globally regulated, providing encryption and fraud protection. CurrencyFair, as a regulated financial institution, ensures the safety of user funds.

Panda Remit is licensed and provides secure cross-border transfers.

MoneyGram vs CurrencyFair: Global Coverage

MoneyGram covers over 200 countries and territories, while CurrencyFair mainly covers 20+ countries with a focus on online peer-to-peer transfers.

Coverage details can be found in the World Bank report (https://www.worldbank.org/).

MoneyGram vs CurrencyFair: Which One is Better?

MoneyGram suits users needing global coverage and flexible payout options. CurrencyFair is ideal for low-cost, peer-to-peer online transfers.

For users seeking low fees, competitive exchange rates, and convenient online transfers, Panda Remit provides a superior experience.

Conclusion

Comparing MoneyGram vs CurrencyFair highlights their respective strengths. MoneyGram is best for users seeking broad coverage and multiple payout options; CurrencyFair is ideal for low-cost, online peer-to-peer transfers.

For those who value low fees, competitive rates, and fast online transfers, Panda Remit (https://www.pandaremit.com/) is a strong alternative. It supports over 40 currencies and multiple payment methods, including POLi, PayID, bank card, and e-transfer, with a fully online process.

For further insights, refer to Wise (https://wise.com/) and the World Bank (https://www.worldbank.org/). Choosing the right money transfer service depends on your needs for coverage, speed, and cost efficiency.