MoneyGram vs RIA Money Transfer: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 21

Sending money internationally remains crucial for families, businesses, and freelancers worldwide. High fees, slow processing times, and complicated procedures often frustrate users. MoneyGram and RIA Money Transfer are two major players in this space, each with unique strengths. For a reliable, cost-effective alternative, Panda Remit (https://www.pandaremit.com/) offers fast online transfers with competitive rates. For more information on international remittances, visit Investopedia (https://www.investopedia.com/).

MoneyGram vs RIA Money Transfer – Overview

MoneyGram, founded in 1940, is a global remittance service operating in over 200 countries. It supports online, mobile, and in-person transfers, including bank deposits and cash pickups.

RIA Money Transfer, established in 1987, focuses on low-cost, fast international transfers and is widely used across the Americas, Europe, and Asia.

Similarities: Both services provide mobile apps, bank and cash transfers, and customer support for international payments.

Differences: MoneyGram offers wider global coverage and multiple payout options. RIA emphasizes competitive fees and faster processing in certain corridors.

Panda Remit is another cost-effective choice for global transfers.

MoneyGram vs RIA Money Transfer: Fees and Costs

MoneyGram fees vary depending on transfer amount, destination, and payout method. Cash pickups generally incur higher fees, while bank deposits are cheaper.

RIA Money Transfer typically offers lower fees compared to MoneyGram, especially for online or bank-to-bank transfers.

For users seeking even lower fees, Panda Remit provides competitive pricing for international transfers. For fee comparisons, check NerdWallet (https://www.nerdwallet.com/best-money-transfer).

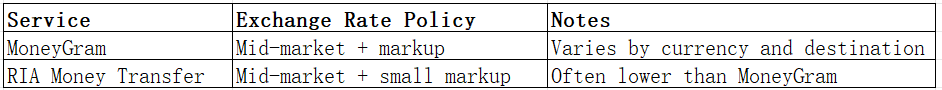

MoneyGram vs RIA Money Transfer: Exchange Rates

MoneyGram applies a markup over the mid-market exchange rate, which can vary by corridor. RIA often offers slightly better rates in specific corridors.

Panda Remit provides rates close to mid-market, maximizing transfer value.

MoneyGram vs RIA Money Transfer: Speed and Convenience

MoneyGram transfers can be instant for cash pickup but may take 1–3 days for bank deposits. RIA prioritizes speed and often completes online transfers faster in select countries.

Panda Remit enables fast online international transfers. For insights on speed, refer to FXC Intelligence (https://www.fxcintel.com/research/reports/remittance-speed).

MoneyGram vs RIA Money Transfer: Safety and Security

Both MoneyGram and RIA implement robust security measures, including encryption, fraud detection, and regulatory compliance in multiple countries.

Panda Remit is a licensed provider ensuring safe, secure cross-border transactions.

MoneyGram vs RIA Money Transfer: Global Coverage

MoneyGram operates in 200+ countries and supports more than 130 currencies. RIA covers 160+ countries with competitive payout networks.

For global remittance coverage details, see the World Bank report (https://www.worldbank.org/).

MoneyGram vs RIA Money Transfer: Which One is Better?

MoneyGram is ideal for users needing wide international reach and flexible payout options. RIA is better for those seeking lower fees and faster transfers in certain regions.

Panda Remit provides a reliable alternative for international users seeking competitive fees, high exchange rates, and online convenience.

Conclusion

The MoneyGram vs RIA Money Transfer comparison highlights two strong options in the remittance market. MoneyGram excels in global reach and flexible transfers, while RIA focuses on lower fees and faster transactions.

For cost-conscious international users, Panda Remit (https://www.pandaremit.com/) offers high exchange rates, low fees, fast online transfers, and support for over 40 currencies. It accepts multiple payment methods including POLi, PayID, bank cards, and e-transfers.

Additional resources for international remittance insights include Wise (https://wise.com/) and the World Bank (https://www.worldbank.org/). Choosing the right service depends on whether your priority is global coverage, speed, or cost-efficiency.