MoneyGram vs GCash Remit: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-11 14:29:26.0 22

Introduction

Cross-border money transfers have become a daily necessity for students, expatriates, e-commerce businesses, and freelancers worldwide. Users often encounter challenges such as high fees, slow delivery, hidden charges, and poor user experience.

MoneyGram is a long-established global remittance service with extensive worldwide agent networks. GCash Remit, on the other hand, leverages digital wallets and a strong presence in the Philippines, providing a convenient mobile-first experience. At the same time, platforms like Panda Remit are gaining attention for their competitive fees and fully digital workflows.

👉 Learn more about international remittance basics here: Investopedia

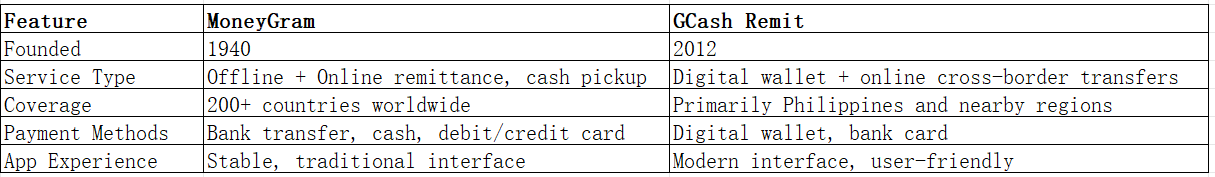

MoneyGram vs GCash Remit – Overview

MoneyGram was founded in 1940 and is one of the world’s leading cross-border money transfer services, covering over 200 countries. Its services include cash pickup, bank account transfers, and mobile wallet options, catering to a broad user base with a robust regulatory framework.

GCash Remit is part of the GCash ecosystem, established in 2012, primarily serving the Philippines and nearby regions. It focuses on online transfers, offering convenience for individual users and small businesses.

Additionally, Panda Remit is increasingly popular for users looking for digital-first remittance solutions with competitive pricing.

MoneyGram vs GCash Remit: Fees and Costs

Fees are a major consideration for international transfers.

-

MoneyGram charges fees based on the sending country, amount, and payout method, with cash pickup often being more expensive than bank transfers.

-

GCash Remit offers lower fees within the Philippines, but cross-border transfers may vary depending on partner networks.

👉 Fee comparison reference: NerdWallet

Panda Remit often offers lower fees for small and fast transactions, making it an attractive alternative for cost-conscious users.

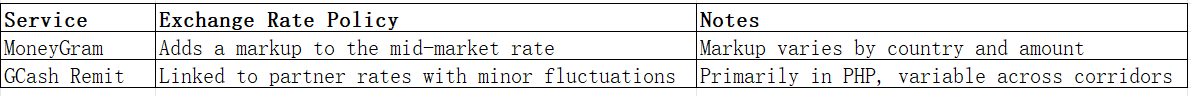

MoneyGram vs GCash Remit: Exchange Rates

Exchange rates directly impact the amount received by the beneficiary.

In certain regions, Panda Remit provides rates closer to the mid-market rate, maximizing the recipient's received amount.

MoneyGram vs GCash Remit: Speed and Convenience

Transfer speed and usability are crucial factors.

-

MoneyGram: Cash pickups can be almost instantaneous, but bank deposits may take 1–3 business days.

-

GCash Remit: Local wallet transfers are fast, while international transfers may depend on partner banks and could experience delays.

👉 Transfer speed guide: World Bank Remittance Prices

Panda Remit excels in fast online transfers, especially to digital wallets, offering convenience and speed.

MoneyGram vs GCash Remit: Safety and Security

-

MoneyGram: Regulated by U.S. financial authorities (FinCEN) with encryption and multi-factor authentication.

-

GCash Remit: Regulated by the Central Bank of the Philippines, leveraging GCash’s secure platform.

-

Panda Remit: Licensed and secure, employing encryption and identity verification to protect users’ funds.

MoneyGram vs GCash Remit: Global Coverage

-

MoneyGram has extensive global reach and partnerships, covering nearly all major remittance corridors.

-

GCash Remit focuses on the Philippines and neighboring countries, with coverage expanding gradually.

👉 See global remittance coverage: World Bank Migration & Remittances

MoneyGram vs GCash Remit: Which One is Better?

For users who value global reach, multiple payout options, and established trust, MoneyGram is a strong choice. Those in the Philippines seeking digital convenience and mobile-first usability may prefer GCash Remit. Meanwhile, Panda Remit stands out for low fees, near mid-market rates, and fast online transfers, offering an attractive alternative for cost-conscious users.

Conclusion

In 2025, MoneyGram vs GCash Remit reflects the contrast between a traditional global remittance giant and a regional digital wallet provider. MoneyGram excels in coverage and brand reliability, while GCash Remit delivers convenience and efficiency for Southeast Asian users.

For users seeking cost-effective and fast digital transfers, Panda Remit is an excellent alternative, offering multiple payment methods, support for over 40 currencies, and a fully online process.

Understanding fees, exchange rates, speed, and coverage is essential to selecting the right service for your cross-border transfer needs.

👉 Additional resources: Investopedia | World Bank Remittance Data