MoneyGram vs GrabPay Remit: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-11 14:35:07.0 15

Introduction

International money transfers are essential for students, overseas workers, freelancers, and e-commerce businesses. Challenges such as high fees, delayed delivery, hidden charges, and poor user experience often affect decision-making.

MoneyGram offers a traditional global remittance service with extensive agent networks worldwide. GrabPay Remit, leveraging the Grab ecosystem, provides a digital-first solution primarily targeting Southeast Asia. Platforms like Panda Remit are emerging as alternatives, offering fast and low-cost transfers.

👉 Learn more about international remittances: Investopedia

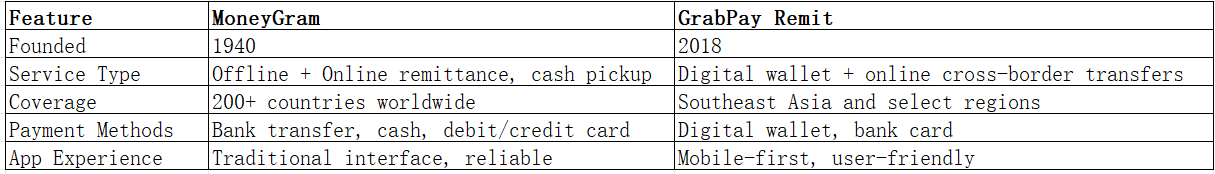

MoneyGram vs GrabPay Remit – Overview

MoneyGram, founded in 1940, provides cash pickups, bank transfers, and mobile wallet options across 200+ countries, catering to a diverse global user base.

GrabPay Remit, launched in 2018, focuses on mobile and online transfers, particularly within Southeast Asia, targeting tech-savvy users and smaller transaction volumes.

Additionally, Panda Remit is an emerging option for users seeking fully digital, competitive-fee remittance services.

MoneyGram vs GrabPay Remit: Fees and Costs

-

MoneyGram: Fees vary by country, amount, and payout method. Cash pickups tend to be costlier than bank transfers.

-

GrabPay Remit: Competitive fees within Southeast Asia, with online convenience reducing transaction overhead.

👉 Fee comparison: NerdWallet

Panda Remit can offer lower fees for smaller transfers and digital-first users.

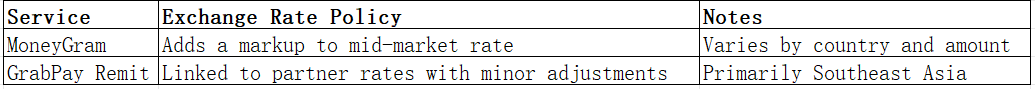

MoneyGram vs GrabPay Remit: Exchange Rates

Panda Remit can provide rates closer to mid-market, benefiting recipients.

MoneyGram vs GrabPay Remit: Speed and Convenience

-

MoneyGram: Cash pickup is fast; bank deposits take 1–3 business days.

-

GrabPay Remit: Digital transfers are quick, especially within the Grab network, but international partner banks may introduce delays.

👉 Transfer speed guide: World Bank Remittance Prices

Panda Remit offers rapid online transfers and mobile-friendly experience.

MoneyGram vs GrabPay Remit: Safety and Security

-

MoneyGram: Regulated by U.S. authorities (FinCEN), encryption, and multi-factor authentication.

-

GrabPay Remit: Licensed by relevant Southeast Asian regulators, leveraging Grab’s secure platform.

-

Panda Remit: Licensed and encrypted, with identity verification to protect users’ funds.

MoneyGram vs GrabPay Remit: Global Coverage

-

MoneyGram: Extensive global reach, covering almost all major remittance corridors.

-

GrabPay Remit: Focused on Southeast Asia, gradually expanding coverage.

👉 Global coverage reference: World Bank Migration & Remittances

MoneyGram vs GrabPay Remit: Which One is Better?

MoneyGram suits users needing global coverage, multiple payout options, and long-standing trust. GrabPay Remit is ideal for Southeast Asian users seeking fast, digital-first transfers. Panda Remit remains a cost-effective, fast alternative with a user-friendly mobile platform.

Conclusion

In 2025, MoneyGram vs GrabPay Remit showcases the difference between a global remittance service and a regional digital-first platform. MoneyGram excels in coverage and reliability, while GrabPay Remit emphasizes convenience and mobile usability.

Panda Remit offers an attractive alternative for users looking for low fees, fast online transfers, and support for multiple payment methods. Users should assess fees, exchange rates, speed, security, and coverage when choosing a service for cross-border transfers.

👉 Additional resources: Investopedia | World Bank Remittance Data | Panda Remit Official