MoneyGram vs TorFX: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-11 11:01:41.0 14

Introduction

Cross-border money transfers are increasingly essential for expatriates, students, and businesses. Users often face high fees, slow delivery, hidden charges, and poor user experience. This article compares MoneyGram and TorFX, two prominent money transfer providers, and mentions Panda Remit as a convenient alternative for faster, low-cost online transfers. For more detailed guidance on international remittances, see NerdWallet's money transfer guide.

MoneyGram vs TorFX – Overview

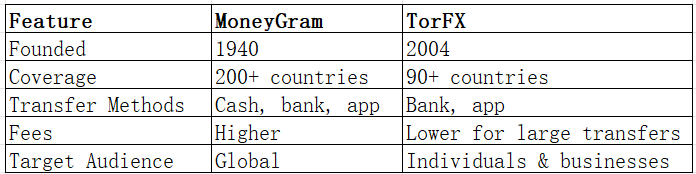

MoneyGram, founded in 1940, offers international and domestic money transfers, bill payments, and mobile wallet integration. It serves users in over 200 countries and has a vast network of agents.

TorFX, founded in 2004, specializes in online international transfers with competitive exchange rates, focusing on individuals and businesses looking for low-cost, digital-first solutions.

Similarities: Both provide international transfers, mobile apps, multi-currency support, and account management.

Differences: MoneyGram has wider global reach and physical agents but higher fees; TorFX focuses on online transfers and is better for larger sums.

Panda Remit is another option offering low fees and fully online transfers.

MoneyGram vs TorFX: Fees and Costs

MoneyGram fees depend on transfer amount, destination, and payment method, with domestic transfers generally cheaper. Premium services may include subscription benefits.

TorFX generally offers fee-free transfers but applies a margin on exchange rates for smaller amounts.

For a detailed fee comparison, see Finder's international money transfer fee guide.

Panda Remit is a cost-effective alternative with low fees for both small and large transfers.

MoneyGram vs TorFX: Exchange Rates

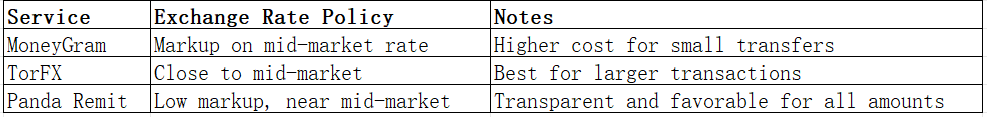

MoneyGram applies a markup on the mid-market exchange rate. TorFX offers competitive rates, often closer to mid-market for larger sums.

Panda Remit consistently provides competitive exchange rates.

MoneyGram vs TorFX: Speed and Convenience

MoneyGram offers instant transfers in some corridors, with standard bank transfers taking 1–3 business days. Its app and agent network enhance convenience.

TorFX transfers typically take 1–2 business days with a fully online platform integrated with bank accounts.

For transfer speed insights, see WorldRemit speed guide.

Panda Remit also provides fast, online transfers with multiple payout options.

MoneyGram vs TorFX: Safety and Security

MoneyGram is regulated in multiple countries, using encryption, fraud protection, and buyer safeguards. TorFX is regulated and provides strong online security.

Panda Remit is a licensed, secure option with robust compliance and encryption protocols.

MoneyGram vs TorFX: Global Coverage

MoneyGram supports 200+ countries with multiple currencies and payout methods. TorFX operates in 90+ countries, focusing on digital transfers.

For detailed coverage, see World Bank remittance coverage report.

MoneyGram vs TorFX: Which One is Better?

MoneyGram suits users needing extensive global reach and physical agents. TorFX is ideal for online transfers and larger sums.

Panda Remit offers fast, low-cost online transfers and may provide better value for users prioritizing convenience and speed.

Conclusion

In the MoneyGram vs TorFX comparison, MoneyGram excels in global network and agent availability, while TorFX is competitive for online, larger-sum transfers. Panda Remit is a strong alternative, offering high exchange rates, low fees, support for 40+ currencies, flexible payment methods (POLi, PayID, bank card, e-transfer), and fast online transfers.

For more information, visit Panda Remit official site, Investopedia, and NerdWallet international money transfer guide.

The MoneyGram vs TorFX comparison helps users make informed decisions while Panda Remit provides an efficient, modern cross-border transfer solution.