Papaya Global vs Panda Remit: International Transfer Comparison

Benjamin Clark - 2025-09-29 14:13:57.0 59

Introduction

International remittances play a crucial role in today’s global economy, whether for payroll management or personal money transfers (Wikipedia). In this article, we compare Papaya Global vs Panda Remit, two very different players in the cross-border payments industry.

Papaya Global is primarily designed for enterprises, helping multinational companies handle payroll and workforce payments across more than 100 countries. Panda Remit, on the other hand, is tailored for individuals who want to send money abroad quickly, securely, and at low cost.

By analyzing their fees, exchange rates, transfer speed, security measures, and global coverage, this guide will help you decide which provider best suits your international transfer needs.

Official websites:

-

Papaya Global: https://www.papayaglobal.com/

-

Panda Remit: https://www.pandaremit.com/

Fees and Costs

-

Papaya Global: Since it is geared toward enterprises, Papaya Global’s fees vary depending on payroll size, country of operation, and payment complexity. Generally, costs are higher compared to consumer-focused platforms.

-

Panda Remit: Offers low and transparent fees for personal transfers. In many cases, small transactions can even be processed with zero fees.

👉 For individuals and families, Panda Remit clearly offers better cost efficiency.

Exchange Rates

Exchange rates significantly impact the final amount a recipient receives.

-

Papaya Global: Uses internal exchange rate mechanisms, and depending on the country, the rates may include additional margins.

-

Panda Remit: Provides exchange rates close to the mid-market rate, ensuring that recipients get more value with every transfer.

👉 Panda Remit offers stronger transparency and better returns for users.

Speed and Convenience

-

Papaya Global: Designed for enterprise payroll cycles, most transfers take 1–3 business days. Suitable for planned salary payments.

-

Panda Remit: Focuses on personal remittances with transfers that usually arrive within minutes to 24 hours. Supports both web and mobile app transactions.

👉 For personal transfers, Panda Remit is much faster and more convenient.

Safety and Security

-

Papaya Global: Implements enterprise-grade encryption, multi-factor authentication, and compliance frameworks for corporate clients.

-

Panda Remit: Fully compliant with international financial regulations, using encryption, fraud monitoring, and identity verification (ConsumerFinance.gov).

👉 Both platforms are secure, but Panda Remit’s emphasis on fraud prevention and regulatory compliance makes it especially trustworthy for personal remittances.

Global Coverage

-

Papaya Global: Covers over 100 countries with payroll and workforce management solutions. Tailored for large enterprises.

-

Panda Remit: Covers 40+ countries with multiple payout options, including bank accounts, mobile wallets, and card deposits.

👉 Papaya Global excels in enterprise coverage, while Panda Remit shines with flexible options for individuals.

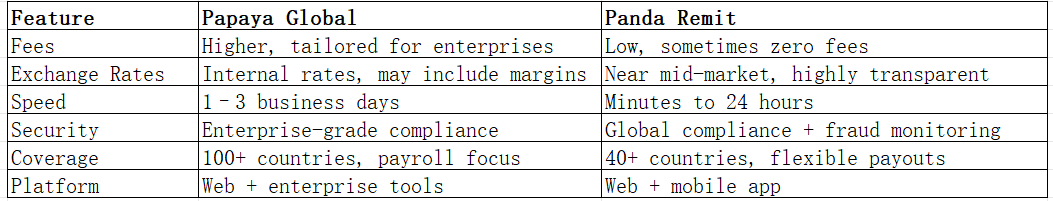

Comparison Table

Which One is Better?

-

Best for Enterprises: Papaya Global is the right choice for large multinational corporations needing to pay employees across multiple jurisdictions.

-

Best for Personal Transfers: Panda Remit is far more suitable for individuals and families looking for affordable, fast, and secure international money transfers.

Conclusion

The comparison of Papaya Global vs Panda Remit shows that the two services serve very different audiences. Papaya Global is optimized for enterprise-level payroll management, while Panda Remit provides affordable, transparent, and fast remittance services for personal users.

If your priority is cost efficiency, speed, and ease of use for sending money abroad, Panda Remit stands out as the better option. To learn more and get started, visit the official Panda Remit website.