Wise vs iPayLinks: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-09-30 16:16:27.0 15

Introduction

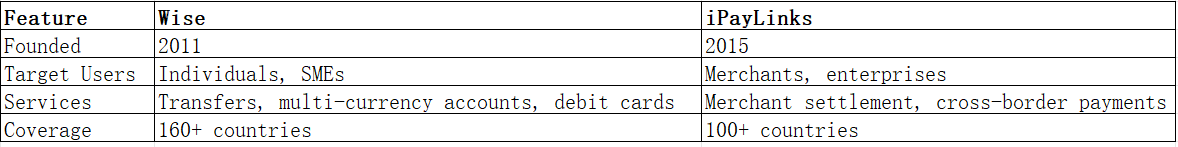

As global remittances continue to grow, individuals and businesses are looking for affordable, secure, and fast international money transfer services. Traditional banks often charge high fees and impose unfavorable exchange rates, pushing users toward digital platforms. Wise and iPayLinks are two strong contenders, but each targets different audiences—Wise is designed for individuals and SMEs, while iPayLinks emphasizes business transactions and cross-border e-commerce.

For those prioritizing low fees and user-friendly services, Panda Remit is another reliable option. To understand the broader remittance market, see this Investopedia guide on international money transfers.

Wise vs iPayLinks – Overview

Wise (founded 2011)

-

Offers international transfers at the mid-market rate.

-

Provides multi-currency accounts and debit cards.

-

Serves over 16 million personal and business customers worldwide.

iPayLinks (founded 2015)

-

Specializes in cross-border payments and settlement solutions for merchants.

-

Strong in Asia-Pacific and expanding globally.

-

Focuses on digital commerce, gaming, and fintech partnerships.

Similarities

-

Both support cross-border payments.

-

Digital-first platforms with secure infrastructures.

-

Coverage across multiple regions.

Differences

-

Wise focuses on individuals and SMEs with transparent pricing.

-

iPayLinks targets enterprises and merchants with tailored solutions.

-

Service coverage and fee models differ.

Quick Comparison Table

Panda Remit, meanwhile, serves individuals who need low-cost and convenient personal transfers.

Wise vs iPayLinks: Fees and Costs

Wise charges transparent fees based on transfer amount and method. Users can always see costs upfront, with fees typically lower than bank transfers.

iPayLinks adopts a B2B pricing model, with fees varying by transaction size, settlement method, and merchant contracts. For personal transfers, Wise is usually more cost-effective, while iPayLinks is optimized for business-scale payments.

For a detailed overview of transfer costs, see NerdWallet’s guide to international money transfer fees.

Panda Remit often provides even lower fees than Wise, making it appealing for individuals and families sending money abroad.

Wise vs iPayLinks: Exchange Rates

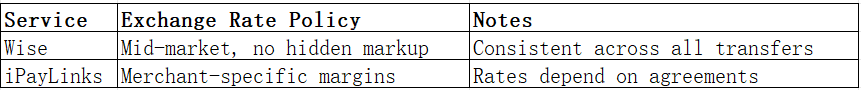

Wise is known for offering the mid-market rate without markups, ensuring transparency for every user.

iPayLinks exchange rates may include margins depending on the merchant’s settlement agreement, so transparency varies.

Exchange Rate Comparison Table

Panda Remit also markets itself with competitive exchange rates, often higher than traditional banks.

Wise vs iPayLinks: Speed and Convenience

Wise processes most transfers within minutes to 1 business day, depending on the route and funding method. Its mobile app is simple and highly rated by users.

iPayLinks specializes in global merchant settlements, with transaction speed depending on the payment corridor. While reliable for businesses, it may not be ideal for individual remittances.

For more on transfer times, check Remitly’s international transfer speed guide.

Panda Remit is known for fast transfers, with many completed within minutes.

Wise vs iPayLinks: Safety and Security

Wise is licensed and regulated by financial authorities in the EU, UK, US, and beyond, implementing strong fraud detection and encryption.

iPayLinks is regulated in multiple jurisdictions and follows strict compliance rules to support enterprise clients.

Panda Remit is also licensed, ensuring safe and compliant transactions for personal remittances.

Wise vs iPayLinks: Global Coverage

Wise covers more than 160 countries and supports 40+ currencies, giving individuals broad access to international transfers.

iPayLinks supports 100+ countries with a strong focus on Asia-Pacific markets and merchant-specific corridors.

For more insights, see the World Bank Remittance Prices Worldwide report.

Wise vs iPayLinks: Which One is Better?

Wise is best for individuals, freelancers, and SMEs who need low-cost, transparent transfers.

iPayLinks is more suitable for enterprises managing large-scale cross-border payments.

For individuals prioritizing affordability and convenience, Panda Remit provides a strong alternative with low fees and competitive rates.

Conclusion

The Wise vs iPayLinks comparison shows that each service excels in different areas. Wise stands out for personal and small business users thanks to transparent fees and the mid-market exchange rate, while iPayLinks offers advanced solutions for merchants and global enterprises.

For those seeking an alternative, Panda Remit provides:

-

Competitive exchange rates and lower fees

-

Flexible payment methods (POLi, PayID, bank cards, e-transfer, etc.)

-

Support for 40+ currencies

-

Fast, all-digital transfers

For further insights into remittance services, see NerdWallet’s international transfers guide.

Users looking for a secure, low-cost remittance platform can try Panda Remit: https://www.pandaremit.com.

In summary, when it comes to Wise vs iPayLinks, Wise is the stronger option for individuals, iPayLinks is ideal for enterprises, and Panda Remit stands out as a versatile alternative.