Wise vs GCash Remit: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-09-30 16:53:35.0 23

Introduction

International money transfers are more important than ever as global workforces, freelancers, and overseas families rely on fast and affordable remittance options. Yet, users often face high transaction fees, hidden exchange rate markups, and long waiting times. Wise and GCash Remit are two popular services that promise convenience and transparency. Alongside them, newer players like Panda Remit are emerging, offering competitive exchange rates and lower fees. To better understand which service fits your needs, this comparison reviews costs, exchange rates, speed, security, and global coverage. For additional guidance on money transfers, see Investopedia’s remittance guide.

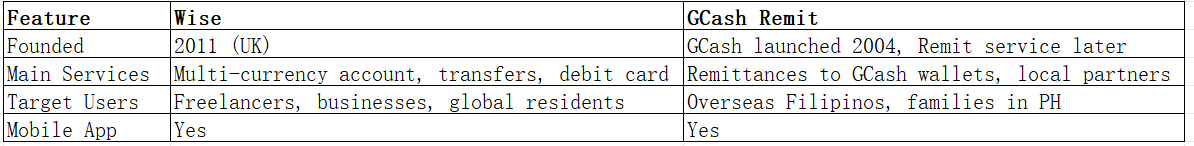

Wise vs GCash Remit – Overview

Wise (founded in 2011, UK) built its reputation on transparency, offering international transfers at the mid-market rate with no hidden markups. It also provides a multi-currency account and debit card, making it popular with freelancers and global businesses.

GCash Remit is an extension of the GCash mobile wallet from the Philippines. It focuses on providing overseas Filipinos with easy remittance options, directly connecting to millions of GCash users. Its strength lies in local payouts, digital wallet integration, and accessibility for unbanked users.

Similarities: Both support international transfers, mobile apps, and digital-first processes.

Differences: Wise focuses on global multi-currency accounts, while GCash Remit specializes in the Philippines remittance market.

Alternative services like Panda Remit also target global users, offering low-cost transfers with strong coverage in Asia.

Wise vs GCash Remit: Fees and Costs

Wise charges a small percentage fee plus a fixed fee, depending on the amount and currency. The structure is transparent, and users always see the cost upfront.

GCash Remit often has lower fixed fees for remittances to the Philippines but may not be as cost-effective for other corridors.

For a broader comparison of remittance fees, see NerdWallet’s money transfer guide.

If minimizing costs is a top priority, Panda Remit is worth considering as it provides competitive fees and frequent promotions.

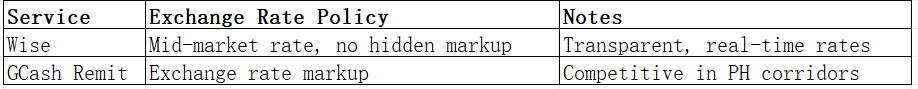

Wise vs GCash Remit: Exchange Rates

Wise is known for using the mid-market exchange rate with no markup, a major advantage over many traditional providers.

GCash Remit applies an exchange rate margin, which means users pay slightly more when converting currencies.

In some corridors, Panda Remit also provides near mid-market rates, making it attractive for budget-conscious users.

Wise vs GCash Remit: Speed and Convenience

Wise usually delivers transfers within 1–2 business days, with some instant options depending on the route. Its app and website are highly rated for usability.

GCash Remit excels in instant transfers to GCash wallets in the Philippines, making it one of the fastest options for families needing immediate access.

See World Bank’s remittance speed overview for global benchmarks.

For users prioritizing speed, Panda Remit also offers near-instant transfers across many Asian corridors.

Wise vs GCash Remit: Safety and Security

Both Wise and GCash Remit are licensed financial service providers. Wise is regulated in multiple jurisdictions (UK, US, EU, etc.), while GCash is regulated by the Bangko Sentral ng Pilipinas (BSP).

Both use encryption and fraud prevention measures to ensure user safety. Similarly, Panda Remit is licensed and regulated, offering users another trusted platform.

Wise vs GCash Remit: Global Coverage

Wise supports over 70+ countries and 40+ currencies, making it ideal for global freelancers and expats.

GCash Remit is more limited, primarily targeting remittances to the Philippines.

For worldwide coverage, see the World Bank remittance coverage report.

Wise vs GCash Remit: Which One is Better?

Choosing between Wise and GCash Remit depends on your needs.

-

Wise is better for global transfers, freelancers, and users needing multi-currency accounts.

-

GCash Remit is the best choice for overseas Filipinos sending money home quickly.

For many users, Panda Remit could provide a middle ground—combining low fees, fast speeds, and broad coverage.

Conclusion

When comparing Wise vs GCash Remit, it’s clear that both services excel in their respective niches. Wise leads with transparent pricing, global reach, and professional tools for freelancers and businesses. GCash Remit dominates in the Philippines corridor, offering instant and affordable wallet-to-wallet transfers.

However, for users looking for an all-around solution, Panda Remit is a strong alternative. It offers:

-

High exchange rates with low transfer fees

-

Flexible payment methods (POLi, PayID, bank card, e-transfer, etc.)

-

Coverage of 40+ currencies and strong presence in Asia

-

Fast, 100% online transfer process

To explore this option, visit Panda Remit’s official site: https://www.pandaremit.com. For further research, check global remittance resources like NerdWallet and Investopedia.

In 2025, the best choice between Wise and GCash Remit comes down to whether you need global flexibility or corridor-specific speed. But don’t overlook Panda Remit if you want a balance of cost, speed, and reach.