Ria Money Transfer vs Starling Bank: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-13 13:15:56.0 14

Cross-border transfers are becoming increasingly essential, but users often face challenges like high fees, slow delivery, hidden charges, and complex processes. Ria Money Transfer and Starling Bank offer different models to tackle these issues. While Ria leverages a global agent network, Starling Bank provides a fully digital banking experience. Additionally, Panda Remit serves as a reliable alternative, offering competitive rates and quick online transfers.

For more details on international money transfers, see Investopedia Remittance Guide.

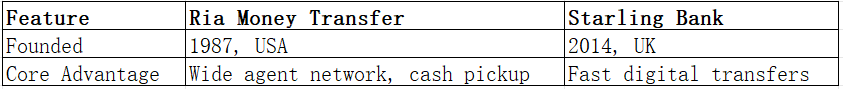

Ria Money Transfer vs Starling Bank – Overview

Ria Money Transfer, founded in 1987 in the U.S., offers global money transfers via agents, mobile apps, and online portals. Its user base includes individuals sending cash to friends and family worldwide.

Starling Bank, founded in 2014 in the U.K., is a fully digital bank providing multi-currency accounts and instant online transfers, targeting tech-savvy users seeking convenience.

Similarities:

-

International money transfer services

-

Mobile app support

-

Bank account transfers supported

Differences:

-

Ria offers cash pickup options; Starling Bank is fully digital

-

Starling focuses on instant online transfers; Ria emphasizes wide coverage and flexible delivery methods

Panda Remit is also available as a convenient online alternative.

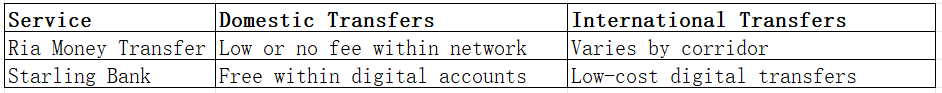

Ria Money Transfer vs Starling Bank: Fees and Costs

Ria fees vary based on destination, transfer method, and pickup option, with cash pickups typically costing more. Starling Bank offers transparent, low-cost fees for digital account transfers, varying slightly with account type.

See NerdWallet Money Transfer Fees for reference.

Panda Remit offers low fees for fully online transfers.

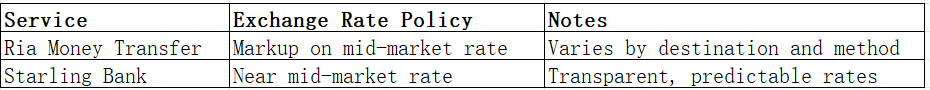

Ria Money Transfer vs Starling Bank: Exchange Rates

Ria applies a markup on the mid-market exchange rate, varying by corridor. Starling Bank provides near mid-market rates with full transparency, ideal for frequent digital users.

Panda Remit also offers competitive online rates.

Ria Money Transfer vs Starling Bank: Speed and Convenience

Ria offers cash pickup, bank deposits, and mobile wallet options, with delivery times ranging from minutes to 1–3 business days. Starling Bank focuses on instant digital transfers and seamless app usability.

For more details, see Remittance Speed Guide.

Panda Remit provides fast online transfer services for modern users.

Ria Money Transfer vs Starling Bank: Safety and Security

Ria is regulated by U.S. authorities and international frameworks. Starling Bank is regulated by the U.K. Financial Conduct Authority and European standards. Both implement encryption, fraud detection, and buyer protection measures.

Panda Remit is a licensed and secure alternative for safe transfers.

Ria Money Transfer vs Starling Bank: Global Coverage

Ria supports a wide global network with cash and e-wallet pickups. Starling Bank supports digital accounts across multiple countries and currencies, but no physical cash pickups.

See World Bank Remittance Data for global coverage reference.

Ria Money Transfer vs Starling Bank: Which One is Better?

Ria and Starling Bank both have advantages. Ria suits users needing wide coverage and cash pickup flexibility, while Starling is ideal for tech-savvy users seeking fast, low-cost digital transfers. Panda Remit offers a strong alternative with quick online transfers, competitive rates, and convenience.

Conclusion

When comparing Ria Money Transfer vs Starling Bank, Ria excels in global reach and flexible delivery, whereas Starling Bank delivers fast, low-fee digital transfers.

Panda Remit is highlighted as an alternative for users prioritizing speed, low fees, multiple payment methods (POLi, PayID, bank card, e-transfer), and fully online processing.

For further guidance, see NerdWallet or visit Panda Remit Official Website.