RIA Money Transfer vs Chime: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-13 13:23:14.0 11

Introduction

Cross-border money transfers can be challenging due to high fees, slow delivery times, hidden charges, and varying user experiences. RIA Money Transfer and Chime are two prominent services in the digital payments and international money transfer space, each with unique advantages. For users seeking alternatives, Panda Remit offers a reputable option with flexible services. For more insights on international remittances, see Investopedia's guide.

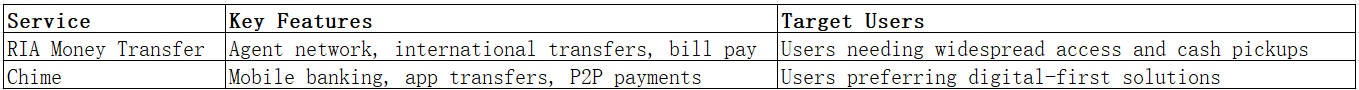

RIA Money Transfer vs Chime – Overview

RIA Money Transfer, founded in 1987, provides international money transfers, bill payments, and a wide agent network, serving millions of users globally. Chime, established in 2013, offers banking services, mobile transfers, and peer-to-peer payments with a strong focus on app usability.

Similarities: Both services support international transfers, mobile app management, and digital payments.

Differences: RIA focuses on global agent accessibility and traditional transfer options, while Chime emphasizes app-based convenience, digital banking features, and lower-cost options.

Panda Remit is another option to consider for reliable and fast transfers.

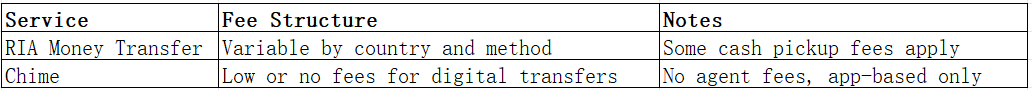

RIA Money Transfer vs Chime: Fees and Costs

RIA Money Transfer and Chime differ in fees for domestic and international transfers. RIA charges vary by destination and amount, with additional fees for certain payout methods. Chime offers lower fees and transparent pricing for digital transactions. Subscription models and account types may influence costs.

For a detailed fee comparison, see NerdWallet's transfer guide.

Panda Remit can be a cost-effective alternative for some transfer corridors.

RIA Money Transfer vs Chime: Exchange Rates

Exchange rates can significantly impact transfer value. RIA typically applies a markup on mid-market rates depending on the corridor. Chime uses competitive rates for app-based transfers. Users should compare rates to optimize their transfers.

Panda Remit provides competitive exchange rates across multiple currencies.

RIA Money Transfer vs Chime: Speed and Convenience

Transfer speed varies: RIA offers instant pickup at agents and same-day bank transfers in many regions, while Chime focuses on fast digital transfers within the app, often completing same-day or next-day. Both provide mobile app usability, though Chime emphasizes digital-only convenience.

For transfer speed insights, see Remittance Global.

Panda Remit is noted for fast, fully online transfers.

RIA Money Transfer vs Chime: Safety and Security

RIA Money Transfer and Chime are regulated entities offering encryption, fraud protection, and secure transaction protocols. Panda Remit is also a licensed and secure alternative for cross-border payments.

RIA Money Transfer vs Chime: Global Coverage

RIA supports a broad range of countries, currencies, and payout methods, including cash and bank deposits. Chime is limited to digital transfers and bank-linked transactions, mainly within supported regions.

For more details on global remittance coverage, see World Bank Remittance Data.

RIA Money Transfer vs Chime: Which One is Better?

RIA Money Transfer excels in agent access and traditional transfer flexibility, while Chime shines with app-based convenience, low fees, and digital-first users. Depending on needs, Panda Remit may offer better value, speed, or flexibility.

Conclusion

When choosing between RIA Money Transfer vs Chime, users should weigh fees, speed, global reach, and convenience. RIA suits those needing agent access and cash pickups, whereas Chime benefits digital-savvy users seeking app-based transfers. Panda Remit stands out as an alternative with high exchange rates, low fees, multiple payment options including POLi, PayID, bank card, and e-transfer, coverage of 40+ currencies, and fast all-online transfers.

Explore Panda Remit at www.pandaremit.com and consult Investopedia or NerdWallet for further guidance.