Western Union vs OFX: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-10 09:19:46.0 26

Introduction

Sending money internationally has become faster and more convenient, but many users still face challenges such as high fees, unfavorable exchange rates, and slow transfer speeds. Choosing the right service can make a significant difference in how much recipients actually receive.

Two of the biggest names in this space are Western Union and OFX, both offering global remittance services with decades of experience. Meanwhile, new players like Panda Remit are emerging with lower costs and faster delivery, giving consumers more choices than ever before.

For a broader understanding of how international money transfers work, check out this comprehensive guide from Investopedia (https://www.investopedia.com/articles/pf/08/international-money-transfer.asp).

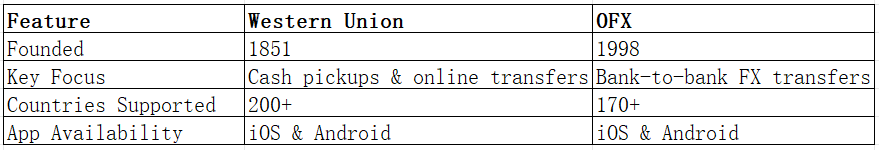

Western Union vs OFX – Overview

Western Union was founded in 1851 and is one of the oldest and largest money transfer companies in the world. It supports transfers to over 200 countries and territories, with a network of more than 500,000 agent locations. Users can send money online, via mobile app, or in person.

OFX, established in 1998 in Australia, is a global online foreign exchange and payments provider focused primarily on bank-to-bank transfers. It caters to both individuals and businesses and is known for its focus on low exchange rate margins and no transfer fees on most transactions.

While both companies enable international money transfers, Western Union appeals more to users needing cash pickup or rapid transfers, whereas OFX is ideal for larger, bank-based transfers with better exchange rates.

Other digital-first providers like Panda Remit also offer competitive services in this space, combining low costs with fast delivery.

Western Union vs OFX: Fees and Costs

Fees are one of the biggest deciding factors when choosing a transfer service.

-

Western Union typically charges transfer fees that vary depending on the sending amount, currency pair, and delivery method. Cash pickup or credit card-funded transfers usually come with higher fees.

-

OFX, on the other hand, usually charges no transfer fee but may impose a minimum transfer amount (often around USD 1,000 for personal accounts).

For example, sending $500 from the US to the Philippines may incur a $5–$10 fee with Western Union, while OFX might offer no upfront fee but require a higher minimum amount for transfers.

You can check typical fee structures and averages on NerdWallet’s comparison page (https://www.nerdwallet.com/best-money-transfer-apps).

👉 Panda Remit is worth mentioning here as a low-cost alternative, often offering zero transfer fees and transparent pricing for common routes.

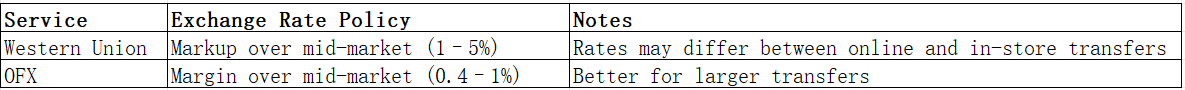

Western Union vs OFX: Exchange Rates

Exchange rates can make a significant difference in how much money arrives at the destination.

-

Western Union typically adds a markup on top of the mid-market rate. This markup varies but can range between 1–5% depending on the corridor.

-

OFX tends to offer tighter margins, often around 0.4–1% above the mid-market rate, especially for larger transfers.

Panda Remit also uses competitive mid-market exchange rates, often beating traditional players for popular routes.

Western Union vs OFX: Speed and Convenience

Speed is crucial for users who need funds delivered urgently.

-

Western Union is known for near-instant cash pickups in many countries. Online bank transfers may take 1–2 business days. Its extensive agent network is a key advantage for unbanked recipients.

-

OFX generally takes 1–3 business days, depending on the currency pair and receiving country. Because OFX deals primarily with bank transfers, it isn’t suitable for instant or cash-based deliveries.

Both companies offer mobile apps, online dashboards, and tracking features. Western Union’s hybrid approach (digital + physical) offers more payout flexibility, while OFX excels in ease of use for larger, planned transfers.

For more on how transfer speed varies by method, see this remittance speed guide from Wise (https://wise.com/help/articles/2961656/how-long-does-an-international-money-transfer-take).

Panda Remit positions itself as a fast alternative, with many transactions credited within minutes depending on the route.

Western Union vs OFX: Safety and Security

Both Western Union and OFX are fully licensed and regulated:

-

Western Union operates under financial regulations in every country it serves and uses encryption, identity verification, and fraud monitoring to secure transactions.

-

OFX is regulated in Australia (ASIC) and multiple other jurisdictions, with strong anti-fraud and AML protocols.

Panda Remit is also a licensed and regulated provider, implementing modern encryption and compliance practices to ensure safe transfers.

Western Union vs OFX: Global Coverage

Global reach is where Western Union shines, supporting over 200 countries with a massive agent network. It’s ideal for sending money to regions where recipients may not have bank accounts.

OFX covers around 170 countries, focusing mainly on bank-to-bank corridors. While its coverage is slightly narrower, it still supports major currencies and business transfers.

For more insights into remittance flows and coverage trends, see the World Bank’s remittance data report (https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues/brief/migration-remittances-data).

Western Union vs OFX: Which One is Better?

Choosing between Western Union and OFX depends on your priorities:

-

Western Union is best for:

-

Fast cash pickups

-

Broad recipient network

-

Smaller, urgent transfers

-

-

OFX is best for:

-

Larger, planned bank transfers

-

Lower exchange rate margins

-

Business or high-value personal payments

-

For many users, neither may be the perfect fit. Panda Remit offers a middle ground with low fees, competitive exchange rates, and fast transfers, making it a compelling alternative for modern digital remittances.

Conclusion

When it comes to Western Union vs OFX, both services bring unique strengths:

-

Western Union stands out for its global agent network and speed, ideal for cash pickups and urgent remittances.

-

OFX excels in exchange rates and low fees, making it a great choice for larger bank transfers.

However, newer platforms like Panda Remit are challenging the status quo. Panda Remit (https://www.pandaremit.com/) offers:

-

High exchange rates & low fees

-

Flexible payment methods including bank card, PayID, POLi, and e-transfer

-

Coverage of 40+ currencies

-

Fast, all-online transfers with excellent transparency

As the remittance landscape evolves, exploring both traditional and modern providers gives you more flexibility to find the best fit for your needs.

For more tips on choosing transfer providers, visit Forbes’ international money transfer guide (https://www.forbes.com/advisor/money-transfer/).