Wise vs Azimo: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-09-30 13:33:44.0 113

Introduction

Cross-border money transfers are an essential part of global finance, but many users still face common pain points: high fees, hidden exchange rate markups, slow delivery, and limited coverage. Choosing the right provider can mean saving money and ensuring funds arrive safely.

In this article, we’ll compare Wise vs Azimo, two popular digital money transfer services. We’ll analyze fees, exchange rates, speed, security, and global reach. Along the way, we’ll also highlight Panda Remit (https://www.pandaremit.com/), a rising alternative that combines competitive pricing with convenience.

For background on international remittances, see this Investopedia guide on money transfers.

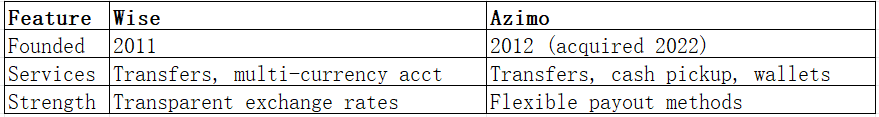

Wise vs Azimo – Overview

Wise (founded 2011, UK):

-

Known for transparent mid-market exchange rates

-

16M+ customers globally

-

Services include international transfers, multi-currency accounts, and debit cards

Azimo (founded 2012, UK, acquired by Papaya Global in 2022):

-

Focused on remittances with flexible payout options

-

Popular in Europe with millions of transfers completed

-

Supports cash pickup, bank transfers, and mobile wallets

Similarities:

-

Both offer mobile apps and online platforms

-

Both support sending money to 80+ countries

-

Both allow bank transfers as the main funding option

Differences:

-

Wise prioritizes transparency and mid-market rates

-

Azimo emphasizes payout flexibility and local delivery methods

-

Fee structures and exchange rate policies vary

Summary Table:

For those comparing beyond these two, Panda Remit also provides an affordable, all-digital transfer option.

Wise vs Azimo: Fees and Costs

Wise:

-

Charges a small percentage + flat fee per transfer

-

Transparent calculator shows total costs upfront

-

No hidden markups on exchange rates

Azimo:

-

Lower fees for first two transfers (promotional)

-

Fees vary depending on country and payout method

-

Exchange rates include markups, which may increase total costs

For a deeper look at international transfer fees, see NerdWallet’s money transfer guide.

Panda Remit often offers lower fees compared to both, especially for transfers to Asia.

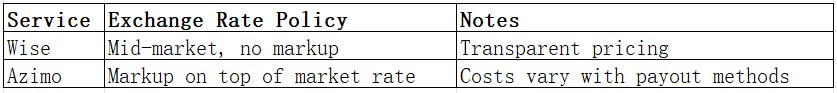

Wise vs Azimo: Exchange Rates

Wise:

-

Uses mid-market exchange rates with no markup

-

Transparent, updated in real time

Azimo:

-

Exchange rates often include hidden markups

-

Final cost depends on currency pair and payout method

Comparison Table:

For users seeking higher exchange rates, Panda Remit is a strong option, especially for transfers to China and Southeast Asia.

Wise vs Azimo: Speed and Convenience

Wise:

-

Bank-to-bank transfers often within 0–2 business days

-

User-friendly app and integrations with major banks

-

Supports debit card payments for instant transfers

Azimo:

-

Cash pickup and mobile wallet transfers can be instant

-

Bank transfers may take longer (1–3 business days)

-

Stronger in emerging markets with diverse payout methods

For details on transfer times, see Finder’s guide on remittance speeds.

If speed is your top priority, Panda Remit also provides near-instant transfers in many corridors.

Wise vs Azimo: Safety and Security

Wise:

-

Licensed by FCA (UK), FinCEN (US), and other regulators

-

Strong encryption and fraud protection

Azimo:

-

Regulated in the UK and EU before acquisition

-

Now operates under Papaya Global’s compliance framework

-

Secure transfers with anti-fraud checks

Panda Remit is also a licensed platform, ensuring transfers are compliant and safe.

Wise vs Azimo: Global Coverage

Wise:

-

Available in 160+ countries

-

Supports 50+ currencies

-

Strong coverage in Europe, US, and Asia

Azimo:

-

Supports 200+ countries and territories

-

Wide payout network including cash pickup

-

Strong coverage in Africa and developing markets

See the World Bank remittance coverage report for more context.

Wise vs Azimo: Which One is Better?

-

Choose Wise if: You want transparent pricing, real mid-market rates, and a multi-currency account.

-

Choose Azimo if: You need cash pickup, mobile wallet delivery, or wide coverage in emerging markets.

For users who prioritize low fees, competitive exchange rates, and fast all-digital transfers, Panda Remit (https://www.pandaremit.com/) offers excellent value in 2025.

Conclusion

When comparing Wise vs Azimo, both providers have strengths. Wise is best for transparent exchange rates and global digital coverage, while Azimo excels in flexible payout options and wider country reach.

However, many users are now exploring alternatives like Panda Remit (https://www.pandaremit.com/), which combines:

-

High exchange rates with low transfer fees

-

Multiple payment methods (POLi, PayID, bank card, e-transfer)

-

Coverage of 40+ currencies

-

Fast, all-online transfers without paperwork

For more resources, check the NerdWallet guide on money transfers and the World Bank remittance data.

Ultimately, whether you choose Wise vs Azimo, knowing your priorities—cost, speed, or convenience—will guide your decision. But for many, Panda Remit stands out as a smarter choice in 2025.