Wise vs Currencies Direct: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-09-30 15:34:23.0 94

Introduction

Cross-border money transfers are essential for individuals, businesses, and expatriates, yet users often face challenges such as high fees, slow processing times, hidden charges, and complex user interfaces. Choosing the right provider can save both time and money while ensuring secure transactions. In this comparison, we analyze Wise vs Currencies Direct to highlight each service’s strengths and weaknesses. For those seeking additional alternatives, PandaRemit is a reliable option offering fast, low-cost, and flexible international transfers. Learn more about international money transfers at https://www.investopedia.com/terms/i/international-money-transfer.asp.

Wise vs Currencies Direct – Overview

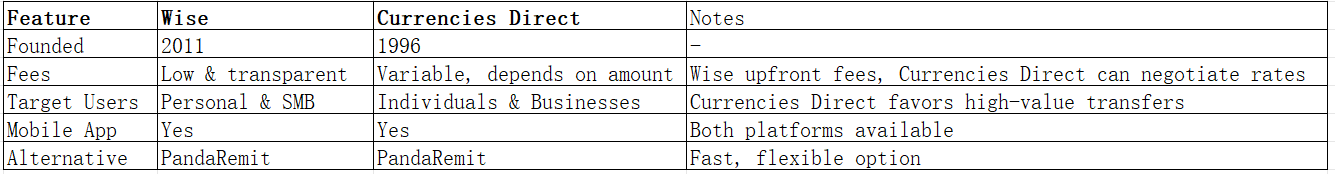

Wise was founded in 2011 and has grown into one of the most popular platforms for international transfers. It provides transparent fees, mid-market exchange rates, multi-currency accounts, and a prepaid debit card. Wise appeals to both personal and small business users who prioritize affordability and simplicity.

Currencies Direct, established in 1996, targets both individuals and businesses with a focus on larger transfers and currency risk management. It offers tailored solutions such as forward contracts, market orders, and high-volume payment services.

Similarities:

-

Both provide international transfers and support multiple currencies.

-

Mobile apps and web platforms enable convenient tracking and payments.

-

Regulated and secure services for cross-border transfers.

Differences:

-

Wise charges low, transparent fees, best for smaller or medium transfers.

-

Currencies Direct excels with large-volume transfers and risk management tools.

-

User experience differs: Wise emphasizes simplicity, Currencies Direct offers advanced analytics for businesses.

Wise vs Currencies Direct: Fees and Costs

Wise is known for low, transparent fees, calculated as a percentage plus a small fixed fee. Domestic transfers are minimal, while international transfers show the exact cost upfront.

Currencies Direct often negotiates fees based on transfer size. For very large sums, this can be advantageous, but small users may face higher costs compared with Wise. PandaRemit offers competitive low fees for both small and medium transfers, making it an attractive alternative. For a detailed fee comparison, see https://www.nerdwallet.com/best/money-transfer.

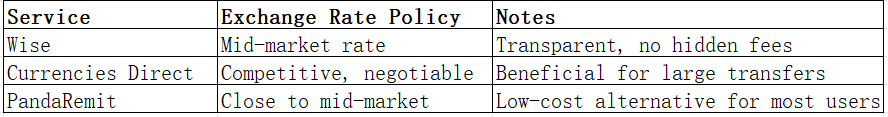

Wise vs Currencies Direct: Exchange Rates

Exchange rates significantly impact transfer costs. Wise provides mid-market rates without hidden markups. Currencies Direct offers competitive rates for high-value transactions and allows tools like forward contracts to lock in rates.

PandaRemit can also provide favorable rates for medium transfers, making it ideal for individuals who prioritize value and speed.

Wise vs Currencies Direct: Speed and Convenience

Wise transfers usually arrive within 1–2 business days, depending on currency and payment method. Currencies Direct transfers may vary: small transfers are quick, large business payments may take longer due to additional verification. Both platforms offer mobile and web apps for tracking and notifications.

PandaRemit emphasizes speed, often completing transfers within hours, supporting multiple payout methods including POLi, PayID, debit/credit cards, and bank transfers. For more on transfer times, see https://www.remitly.com/us/en/how-fast.

Wise vs Currencies Direct: Safety and Security

Both Wise and Currencies Direct are licensed financial institutions regulated in multiple jurisdictions. They use encryption, fraud monitoring, and secure customer fund management to protect users.

PandaRemit is also fully licensed, employs robust security protocols, and ensures funds are securely processed, making it a reliable alternative.

Wise vs Currencies Direct: Global Coverage

Wise supports over 80 countries and 50+ currencies, while Currencies Direct covers 30+ currencies across 100+ countries. Both allow bank, debit, and e-wallet payouts in supported regions.

For comprehensive coverage data, see https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues/brief/migration-and-remittances.

Wise vs Currencies Direct: Which One is Better?

Your choice depends on priorities:

-

Wise is ideal for low-cost, transparent, and smaller international transfers with easy-to-use platforms.

-

Currencies Direct benefits high-value transfers and businesses with tools to manage currency risk.

For users who want fast, flexible, and low-fee transfers, PandaRemit provides an excellent alternative with multiple payment methods and coverage of 40+ currencies.

Conclusion

In the Wise vs Currencies Direct comparison, Wise stands out for affordability, transparency, and simplicity, while Currencies Direct excels in handling high-volume payments with advanced tools. Both are secure and well-regulated, making them suitable for different user needs.

For individuals seeking fast, convenient, and competitive international transfers, PandaRemit offers distinct advantages: high exchange rates, low fees, multiple payment methods including POLi, PayID, bank cards, e-transfers, coverage of 40+ currencies, and an entirely online process. Explore more at https://www.pandaremit.com, and for additional insights, see https://www.investopedia.com/terms/i/international-money-transfer.asp and https://www.nerdwallet.com/best/money-transfer.