Wise vs CurrencyFair: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-09-30 13:59:39.0 174

Introduction

In today's globalized world, cross-border money transfers have become increasingly common, whether for sending money to family, paying for overseas tuition, or conducting international business. However, users often face high fees, hidden charges, slow transfers, and poor user experience when using traditional services.

This article provides a detailed comparison of Wise vs CurrencyFair, analyzing their fees, exchange rates, transfer speed, security, and global coverage. We will also introduce a reliable alternative, Panda Remit (https://www.pandaremit.com/), which offers fast, low-cost, fully online money transfers.

For more information on international money transfer options, see Investopedia's guide: https://www.investopedia.com/money-transfer-5189230.

Wise vs CurrencyFair – Overview

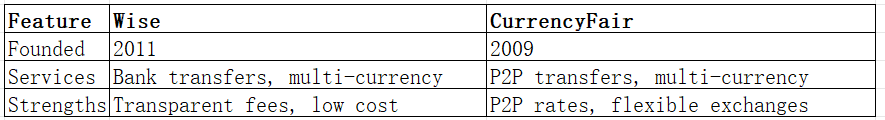

Wise (founded in 2011, UK)

-

Offers digital cross-border transfers with transparent exchange rates

-

Supports 70+ currencies

-

Over 16 million users worldwide

CurrencyFair (founded in 2009, Ireland)

-

Offers peer-to-peer (P2P) money transfers

-

Supports 50+ currencies

-

Focused on small to medium cross-border transfers

Similarities

-

Both provide international money transfers

-

Support mobile apps

-

Allow bank transfers and debit/credit card payments

Differences

-

Wise focuses on transparent fees and speed

-

CurrencyFair emphasizes P2P exchange rate advantages and flexibility

-

User base differs: Wise serves a broad global audience, while CurrencyFair targets small business and individual users

Quick Comparison Table

Panda Remit (https://www.pandaremit.com/) is another excellent option, offering low fees, fast transfers, and multi-currency support.

Wise vs CurrencyFair: Fees and Costs

Wise

-

Charges a fixed fee plus a percentage of the transfer amount

-

Transparent fees shown before sending

-

No hidden exchange rate markup

CurrencyFair

-

P2P transfer fees are generally lower, with a fixed fee plus small percentage

-

Some transfers may incur additional bank charges

-

Exchange rates may sometimes be better than standard banks

Fee reference: NerdWallet International Transfer Fee Comparison (https://www.nerdwallet.com/best/financial-products/international-money-transfer).

Panda Remit (https://www.pandaremit.com/) is often lower-cost compared to both Wise and CurrencyFair, especially for users in Asia and Europe.

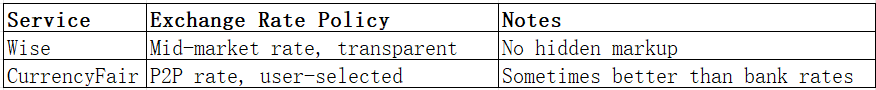

Wise vs CurrencyFair: Exchange Rates

Wise

-

Uses mid-market rates with almost no markup

-

Rates updated in real-time

CurrencyFair

-

P2P rates are close to mid-market

-

Users can choose matching rates to save additional costs

Panda Remit (https://www.pandaremit.com/) provides competitive rates and low markup, helping users save more.

Wise vs CurrencyFair: Speed and Convenience

-

Wise: Bank transfers take 0–2 business days; debit/credit card payments can be instant

-

CurrencyFair: Most transfers take 1–3 business days; P2P transfers may be faster

-

Mobile app experience: Wise app is simple and intuitive; CurrencyFair provides more rate customization

Reference: Finder Guide to Transfer Speeds (https://www.finder.com/international-money-transfers/how-long).

Panda Remit (https://www.pandaremit.com/) offers fast, fully online, multi-payment transfers.

Wise vs CurrencyFair: Safety and Security

Wise

-

Regulated by the UK FCA and US FinCEN

-

Bank-level encryption and fraud protection

CurrencyFair

-

Regulated in Ireland and Europe

-

Provides funds protection and transaction monitoring

Panda Remit (https://www.pandaremit.com/) is fully licensed, ensuring user funds are secure.

Wise vs CurrencyFair: Global Coverage

-

Wise: 160+ countries, 50+ currencies

-

CurrencyFair: 50+ countries, 50+ currencies

Reference: World Bank Remittance Coverage Report (https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues/brief/migration-remittances-data).

Wise vs CurrencyFair: Which One is Better?

-

Wise Strengths: Transparent fees, fast transfers, digital experience

-

CurrencyFair Strengths: P2P exchange rate benefits, flexible transfers

-

For users seeking low cost, fast speed, and fully online transfers, Panda Remit (https://www.pandaremit.com/) is an excellent choice.

Conclusion

Comparing Wise vs CurrencyFair, Wise suits users who prioritize speed and transparent fees, while CurrencyFair appeals to users looking for flexible P2P rates.

Panda Remit (https://www.pandaremit.com/) advantages:

-

Competitive exchange rates and low fees

-

Supports multiple payment methods: POLi, PayID, bank card, e-transfer

-

Covers 40+ currencies

-

Fast, fully online transfers

Additional references:

-

NerdWallet International Transfer Fee Comparison: https://www.nerdwallet.com/best/financial-products/international-money-transfer

-

World Bank Remittance Coverage: https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues/brief/migration-remittances-data

For cost-conscious and speed-focused users, Panda Remit (https://www.pandaremit.com/) is the ideal 2025 solution.