Wise vs GrabPay Remit: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-09 10:08:57.0 12

Introduction

Cross-border money transfers have evolved significantly over the past decade, but hidden fees, slow processing, and limited coverage remain common pain points for individuals and businesses. Choosing the right platform can mean saving both time and money, especially for frequent transfers.

Wise and GrabPay Remit are two popular digital payment solutions that aim to simplify international remittances. While Wise is a global fintech pioneer, GrabPay Remit focuses on Southeast Asian remittance corridors with convenient app integrations. Additionally, emerging players like Panda Remit are becoming strong alternatives for users looking for competitive rates and broad coverage.

For more on how international money transfers work, check this Investopedia remittance guide.

Wise vs GrabPay Remit – Overview

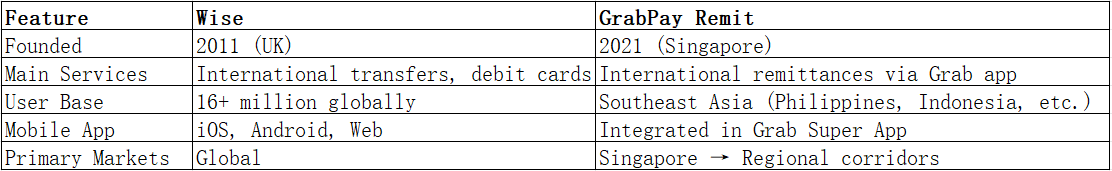

Wise is best known for its transparent fees and real mid-market exchange rates, serving individuals, freelancers, and businesses across 170+ countries.

GrabPay Remit, on the other hand, is a regional-focused remittance service integrated within the Grab ecosystem. It allows Singapore users to send money easily to neighboring countries, often targeting overseas workers.

Similarities:

-

Both offer mobile apps for easy transfers.

-

Support bank transfers and digital wallet funding.

-

Regulated financial entities with secure infrastructure.

Differences:

-

Wise has broader global coverage, while GrabPay Remit focuses mainly on Southeast Asia.

-

Wise offers mid-market rates, whereas GrabPay often applies a small markup.

-

GrabPay Remit is region-specific, while Wise supports both personal and business accounts worldwide.

If you want an alternative that blends low cost, competitive rates, and broad coverage, Panda Remit is also worth considering.

Wise vs GrabPay Remit: Fees and Costs

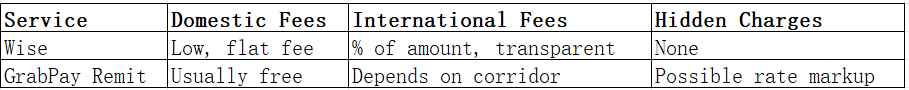

Wise is known for its transparent pricing. It charges a small upfront fee, typically a percentage of the transfer amount, with no hidden markups. Fees vary depending on the currency pair but are usually lower than traditional banks.

GrabPay Remit often promotes zero-fee promotions, but this can be offset by slightly less competitive exchange rates. Some transactions may involve additional charges depending on the payout partner in the receiving country.

For updated remittance fee comparisons, refer to NerdWallet’s international transfer fee guide.

Panda Remit often offers zero transfer fees and very competitive exchange rates, making it a cost-effective alternative for many corridors.

Wise vs GrabPay Remit: Exchange Rates

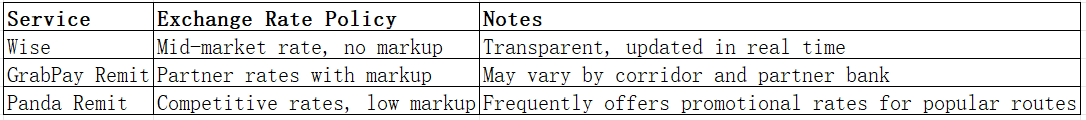

One of Wise’s standout features is its use of the real mid-market rate — the same rate you see on Google — without any markup. This makes it particularly appealing for larger transfers.

GrabPay Remit, in contrast, typically uses partner exchange rates, which may include a small margin. While still competitive compared to banks, it’s usually less transparent than Wise.

For users focused on maximizing every dollar, Panda Remit can provide excellent exchange rate promotions, especially for Asian corridors.

Wise vs GrabPay Remit: Speed and Convenience

Speed is critical for remittances.

-

Wise typically delivers within minutes to 1–2 business days, depending on the destination and payment method. Many transfers to major currencies are instant.

-

GrabPay Remit emphasizes fast delivery to specific Southeast Asian countries, often in real time through partnerships with local banks and wallets.

-

Both services offer user-friendly mobile apps, but Wise’s app supports more global destinations and multi-currency accounts.

For a broader look at remittance speeds, check this Remittance Speed Guide.

Panda Remit also provides real-time transfers to many countries, often completing transactions in minutes.

Wise vs GrabPay Remit: Safety and Security

-

Wise is regulated by authorities in the UK, EU, US, Singapore, and many other jurisdictions. It uses two-factor authentication, encryption, and robust compliance protocols.

-

GrabPay Remit is licensed by the Monetary Authority of Singapore (MAS) and partners with licensed payout providers.

-

Both platforms offer fraud detection and secure handling of funds.

Panda Remit is similarly fully licensed and regulated, ensuring user funds are secure and compliant.

Wise vs GrabPay Remit: Global Coverage

Wise supports 170+ countries and 50+ currencies, making it one of the most comprehensive money transfer platforms globally.

GrabPay Remit primarily serves Singapore outbound transfers to regional corridors like the Philippines, Indonesia, Malaysia, and Thailand. It’s excellent for Southeast Asian workers but limited for other corridors.

For global remittance coverage statistics, refer to the World Bank Remittance Coverage Report.

Panda Remit supports 40+ currencies and is expanding rapidly, making it a strong global contender.

Wise vs GrabPay Remit: Which One is Better?

The choice between Wise vs GrabPay Remit depends on your transfer needs:

-

Choose Wise if you need transparent fees, global coverage, and mid-market rates.

-

Choose GrabPay Remit if you frequently send money from Singapore to Southeast Asia and value Grab ecosystem convenience.

-

Consider Panda Remit if you prioritize low fees, competitive rates, and fast transfer times, especially within Asia.

Conclusion

In the Wise vs GrabPay Remit comparison, both services have unique strengths:

-

Wise shines with global reach, mid-market rates, and multi-currency support, making it ideal for international professionals and businesses.

-

GrabPay Remit excels in regional convenience, especially for workers sending money home within Southeast Asia.

However, Panda Remit stands out as a powerful alternative. It offers:

-

✅ High exchange rates & low fees

-

✅ Flexible payment methods (POLi, PayID, bank card, e-transfer, etc.)

-

✅ Coverage of 40+ currencies

-

✅ Fast transfers with a fully online process

For more insights, visit World Bank’s remittance pricing dashboard or NerdWallet’s money transfer comparison.

Ultimately, the best platform depends on your corridor, frequency, and priority — whether that’s cost, speed, or coverage. By comparing Wise vs GrabPay Remit, and considering Panda Remit, you can make a smarter choice for your 2025 transfers.