Wise vs Instarem: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-09 11:27:30.0 26

Introduction

As globalization continues, international money transfers have become an essential tool for both individuals and businesses. However, users often face challenges such as high fees, slow delivery, hidden charges, and complicated processes.

Wise and Instarem are two prominent international money transfer platforms. Wise is known for transparent fees and mid-market exchange rates, while Instarem focuses on fast transfers and flexible payment methods. Additionally, Panda Remit offers a low-cost, fast, and versatile alternative (https://www.pandaremit.com/).

For more information on international money transfers, see the Investopedia guide (https://www.investopedia.com/articles/pf/08/international-banking-transfers.asp).

Wise vs Instarem – Overview

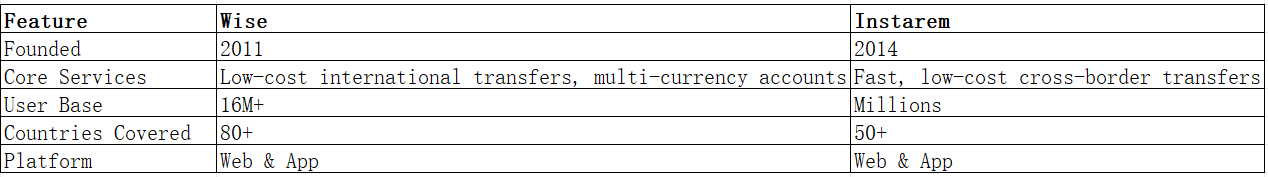

Wise, founded in 2011 in the UK, provides low-cost international transfers, multi-currency accounts, and debit cards. It serves over 16 million users worldwide, covering more than 80 countries.

Instarem, founded in 2014 in Singapore, specializes in low-cost and fast cross-border transfers, supporting multiple payment methods such as bank transfer, credit card, and debit card, particularly for businesses and expatriates.

Similarities: Both support international transfers, mobile apps, and multi-currency accounts.

Differences: Wise emphasizes transparent fees and mid-market rates, while Instarem focuses on fast transfers and flexible payment options.

Panda Remit is also a notable alternative offering low-cost, efficient international transfers (https://www.pandaremit.com/).

Wise vs Instarem: Fees and Costs

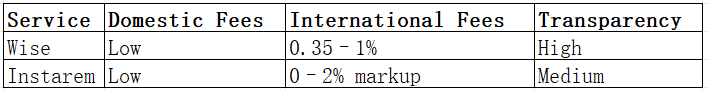

Wise charges typically 0.35%–1% for international transfers, using the mid-market exchange rate, with no hidden fees.

Instarem fees vary depending on the country, transfer method, and payment option, and instant transfers may include additional charges.

For detailed fee information, see NerdWallet’s money transfer guide (https://www.nerdwallet.com/best-money-transfer-services).

Panda Remit generally offers even lower fees, ideal for regular cross-border transfers.

Wise vs Instarem: Exchange Rates

-

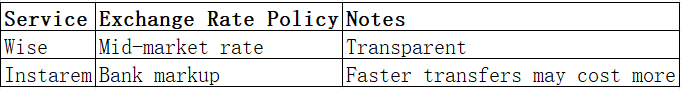

Wise uses near mid-market rates, which are transparent and fair.

-

Instarem may include 1–2% markup, particularly for faster transfers.

Panda Remit also provides competitive exchange rates, helping users save on international transfers.

Wise vs Instarem: Speed and Convenience

Wise transfers typically take minutes to 1 business day, supporting batch payments, multi-currency accounts, and debit cards, suitable for both individuals and businesses.

Instarem offers fast transfer options, ideal for urgent transfers, though speed depends on payment methods and routes.

For more details on transfer speed, see World Bank Remittance Prices (https://www.remittanceprices.worldbank.org/en).

Panda Remit provides quick transfers and multiple payment options, catering to global users’ needs.

Wise vs Instarem: Safety and Security

Both platforms are regulated and secure:

-

Wise is authorized by the UK FCA, with global compliance.

-

Instarem follows MAS regulations in Singapore and partners with regulated banks.

Both use encryption, fraud protection, and two-factor authentication. Panda Remit is also a licensed and secure alternative.

Wise vs Instarem: Global Coverage

Wise supports 80+ countries and 50+ currencies, ideal for users needing wide international coverage.

Instarem covers 50+ countries, mainly in Asia and North America.

For coverage details, see the World Bank remittance data report (https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues/brief/migration-remittances-data).

Wise vs Instarem: Which One is Better?

Wise is best for users seeking transparent fees, fair exchange rates, and broad global coverage.

Instarem suits users who need faster transfers and flexible payment methods, particularly businesses or urgent transfers.

Panda Remit is another excellent choice, providing low fees, high efficiency, and fast transfers globally.

Conclusion

When comparing Wise vs Instarem, the best choice depends on your transfer needs:

-

Wise: Transparent fees, near mid-market exchange rates, wide coverage.

-

Instarem: Fast transfers, flexible payment methods, ideal for urgent needs.

Panda Remit (https://www.pandaremit.com/) is a strong alternative, offering high exchange rates, low fees, flexible payment methods (POLi, PayID, bank card, e-transfer), 40+ currencies, and fully online, fast transfers.

Additional references: NerdWallet (https://www.nerdwallet.com/) and World Bank Remittance Prices (https://www.remittanceprices.worldbank.org/en). Comparing Wise vs Instarem and Panda Remit allows users to select the most transparent, fast, and cost-effective international money transfer service.