Wise vs MoneyGram: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-09-30 11:34:32.0 15

Introduction

Cross-border money transfers are essential for millions worldwide, whether for overseas education, family support, or business payments. Yet users often struggle with high fees, slow transfers, poor exchange rates, and hidden charges. Among the top providers, Wise is known for transparency and mid-market rates, while MoneyGram is famous for its global cash pickup network. Meanwhile, innovative platforms like Panda Remit are rising, offering low-cost and fast digital transfers. For more insights, see Investopedia’s guide to money transfers.

Wise vs MoneyGram – Overview

Wise (formerly TransferWise), founded in 2011 in London, is a digital-first money transfer service. It serves over 16 million customers and supports more than 70 currencies, focusing on transparent pricing and fair exchange rates.

MoneyGram, founded in 1940 and headquartered in Dallas, USA, is one of the world’s oldest remittance companies. It operates in 200+ countries and regions, with over 350,000 agent locations, offering both bank deposits and cash pickups.

Similarities:

-

Both enable cross-border money transfers.

-

Mobile apps and online services are available.

-

Users can pay with debit/credit cards or bank transfers.

Differences:

-

Wise is online-only, with transparent mid-market rates.

-

MoneyGram relies heavily on agent networks, making it ideal for cash pickups but often more expensive.

-

Wise appeals to digital-first users, while MoneyGram caters to regions with limited banking access.

Another player in the market, Panda Remit, combines low fees with digital speed, making it attractive for modern users.

Wise vs MoneyGram: Fees and Costs

Wise charges a transparent fee, usually between 0.35% and 1%, shown upfront. It does not hide charges in the exchange rate.

MoneyGram’s fees vary widely:

-

Costs depend on the sending and receiving countries, transfer amount, and payment method.

-

Credit card payments are more expensive.

-

Exchange rate markups often act as hidden fees.

According to NerdWallet’s international transfer comparison, Wise tends to be cheaper, especially for larger transfers.

Note: Panda Remit markets itself as a low-cost service, sometimes even waiving fees for specific transfers.

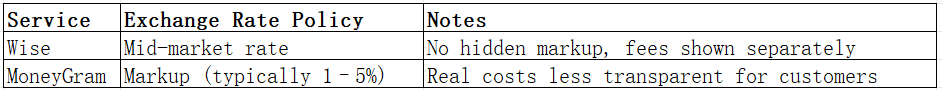

Wise vs MoneyGram: Exchange Rates

Wise clearly leads in transparency and fairness. For rate-sensitive users, Wise is more appealing. Similarly, Panda Remit also promotes high exchange rates with minimal markups, making it competitive for cost-conscious senders.

Wise vs MoneyGram: Speed and Convenience

-

Wise: Most transfers arrive within 0–2 days; some are instant. The app is user-friendly, supporting card payments, Apple Pay, and Google Pay.

-

MoneyGram: Known for cash pickups—recipients can often collect money within minutes. Bank transfers, however, may take 1–3 days.

According to Finder’s transfer speed guide, Wise is consistent for bank deposits, while MoneyGram is best for urgent cash pickups.

Panda Remit emphasizes instant transfers with fully online processing, offering strong convenience for digital users.

Wise vs MoneyGram: Safety and Security

-

Wise: Regulated by the UK’s Financial Conduct Authority (FCA), with bank-level encryption and segregated accounts for customer funds.

-

MoneyGram: Heavily regulated worldwide, with decades of experience. However, reliance on cash pickups can expose users to higher fraud risks.

Panda Remit, as a licensed remittance provider, also meets international compliance standards, ensuring secure transfers.

Wise vs MoneyGram: Global Coverage

-

Wise: Supports 70+ currencies and operates in about 170 countries.

-

MoneyGram: Covers 200+ countries and regions, with 350,000+ agent locations, excelling in cash payouts.

According to the World Bank’s remittance data, global remittance demand continues to grow, with MoneyGram leading in reach while Wise leads in digital efficiency.

Wise vs MoneyGram: Which One is Better?

-

Wise Pros: Transparent pricing, fair exchange rates, digital-first platform, better for large transfers.

-

MoneyGram Pros: Huge global reach, strong for cash pickups, suitable for unbanked recipients.

For those prioritizing transparency and digital convenience, Wise is often the better choice. For cash-dependent recipients, MoneyGram remains a top solution. Yet for users seeking low fees, high exchange rates, and fast online transfers, Panda Remit may be the most balanced alternative.

Conclusion

In comparing Wise vs MoneyGram, both have strengths: Wise excels in transparency and digital banking, while MoneyGram dominates in global coverage and cash payouts. The best choice depends on whether the sender values low fees or the recipient requires physical cash collection.

That said, modern alternatives like Panda Remit combine the best of both worlds, offering:

-

Competitive exchange rates and low fees

-

Flexible payment methods (POLi, PayID, bank cards, e-transfer, etc.)

-

Support for 40+ currencies

-

Fast, online-only transfers

For users seeking affordable, fast, and reliable cross-border payments, Panda Remit is a worthy alternative. For further reading, check NerdWallet’s transfer guide and the World Bank’s global remittance insights.