Wise vs Remitly: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-09-30 11:07:31.0 15

Introduction

Sending money abroad is now part of everyday life for millions of expats, migrant workers, and businesses. Yet the process can often be frustrating due to high fees, hidden charges, slow transfer times, and exchange rate markups. Choosing the right provider can save both time and money.

Two widely used services are Wise and Remitly, each catering to different types of customers. In this article, we’ll compare these two platforms in detail to see which one offers better value in 2025. We’ll also introduce Panda Remit (https://www.pandaremit.com/), a fast-growing alternative that combines low fees with competitive exchange rates. For more background, see Investopedia’s guide to money transfers.

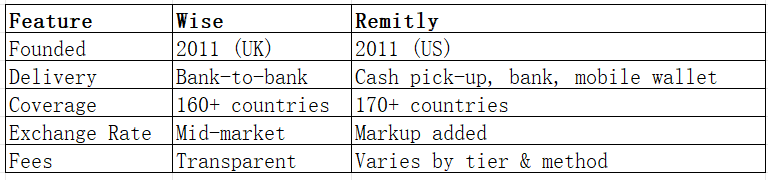

Wise vs Remitly – Overview

Wise

Founded in 2011 in London, Wise (formerly TransferWise) disrupted the industry with its transparent pricing and mid-market exchange rates. Today, Wise serves over 16 million customers and is popular with freelancers, international students, and businesses who prefer digital-first bank transfers.

Remitly

Established in 2011 in Seattle, Remitly focuses on helping immigrants and expats send money home. The service is available in 170+ countries and offers two main delivery options: Express (fast but higher cost) and Economy (slower but cheaper).

Similarities

-

Both offer international money transfers.

-

Both operate through mobile apps and websites.

-

Both provide multiple pay-in options like bank accounts and debit cards.

Differences

-

Wise: Transparent, mid-market rates, online-only transfers, no cash pick-up.

-

Remitly: Cash pick-up available, Express/Economy tiers, exchange rate markups.

👉 Another option in the space is Panda Remit, which offers competitive rates with a 100% online process.

Wise vs Remitly: Fees and Costs

-

Wise: Charges a small percentage of the transfer amount plus a fixed fee. The structure is transparent, and users always know how much they will pay upfront.

-

Remitly: Has different fees depending on whether you choose Economy or Express. Express transfers cost more, especially if you use credit/debit cards. Economy transfers are cheaper but slower.

For a deeper look at fees, see NerdWallet’s transfer service comparisons.

👉 If keeping costs low is your priority, Wise usually beats Remitly. However, Panda Remit is also known for low fees, often matching or undercutting Wise.

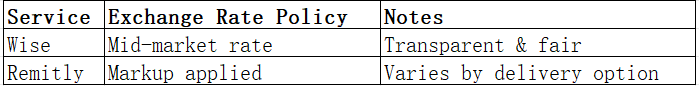

Wise vs Remitly: Exchange Rates

Exchange rates often determine how much the recipient finally gets.

-

Wise: Always uses the real mid-market rate you’d find on Google or XE.com. No hidden markups.

-

Remitly: Adds a margin on top of the exchange rate, which varies by corridor. The rate can be less favorable, especially for Express transfers.

👉 Like Wise, Panda Remit also provides highly competitive exchange rates, giving users more value.

Wise vs Remitly: Speed and Convenience

-

Wise: Transfers usually complete within hours to a day, depending on the banking system. Some payments are near-instant with faster payment networks.

-

Remitly: Offers two options: Express (minutes, but higher fees) and Economy (3–5 days, lower cost). This flexibility makes it attractive for different budgets.

Both have user-friendly mobile apps. Wise focuses on clarity and cost breakdowns, while Remitly emphasizes speed and flexibility.

For more on delivery times, see World Bank’s remittance speed overview.

👉 Panda Remit is also recognized for fast processing, with many transfers delivered the same day.

Wise vs Remitly: Safety and Security

Both companies are secure and regulated:

-

Wise: Licensed by the UK’s Financial Conduct Authority (FCA) and equivalent bodies worldwide. Uses robust encryption and anti-fraud measures.

-

Remitly: Regulated in the US and other countries, with strict KYC (Know Your Customer) and AML (Anti-Money Laundering) protocols.

Similarly, Panda Remit is fully licensed and uses bank-level encryption to ensure secure transactions.

Wise vs Remitly: Global Coverage

-

Wise: Supports transfers from 40+ currencies to 160+ countries. Delivery is bank-to-bank only.

-

Remitly: Available in 170+ countries, with more payout flexibility (cash pick-up, mobile wallets, and bank accounts).

For broader data, check the World Bank’s remittance coverage report.

👉 For bank transfers, Wise excels. For cash-based corridors, Remitly has the edge. Panda Remit balances both by covering 40+ currencies with digital convenience.

Wise vs Remitly: Which One is Better?

-

Wise is best for:

-

Transparent mid-market rates

-

Lower fees for bank-to-bank transfers

-

Digital-savvy customers and businesses

-

-

Remitly is best for:

-

Customers who need cash pick-up options

-

Those who value Express transfers despite higher fees

-

Expats sending remittances home regularly

-

For users seeking a combination of low fees, competitive rates, and fast digital service, Panda Remit stands out as a strong alternative.

Conclusion

When comparing Wise vs Remitly, the right choice depends on your needs. Wise offers mid-market exchange rates, transparent fees, and digital efficiency, making it ideal for individuals and businesses focused on affordability. Remitly, however, provides more flexibility with Express and Economy transfers as well as cash pick-up options, which can be critical in regions with limited banking access.

That said, if you’re looking for a modern alternative, Panda Remit (https://www.pandaremit.com/) combines the best of both worlds:

-

High exchange rates & low fees

-

Flexible payment options (POLi, PayID, bank card, e-transfer, etc.)

-

Coverage of 40+ currencies

-

Fast, all-online transfers

For 2025 and beyond, comparing Wise vs Remitly helps identify the right fit—but don’t overlook innovative services like Panda Remit that bring transparency, speed, and convenience together. For additional research, you can explore NerdWallet’s transfer reviews or Investopedia’s money transfer guide.